Baobab Platform Podcasts

Baobab is the digital community for the Mastercard Foundation network. Baobab, a platform for young African leaders, helps you expand your network, collaborate with like-minded peers and mentors, share back knowledge and access resources and opportunities to help you reach your personal and professional goals. Podcasts are created by African Scholars and Alumni from the Mastercard Foundation network.

Baobab Platform Podcasts

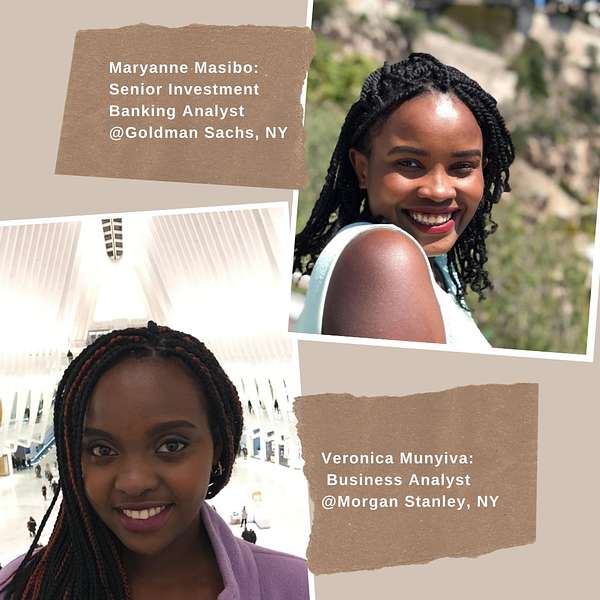

#TheHustle: Maryanne Masibo - Senior Investment Banking Analyst @Goldman Sachs & Veronica Munyiva - Business Analyst @Morgan Stanley

Maryanne and Veronica share career gems from their time as undergraduate students seeking internships and eventually, jobs. They are thoughtful, funny, reflective and this episode will resonate with students and professionals across different stages in their careers.

Share your comments on Baobab!

Join the Baobab Platform today.

Halle Rubera (00:03):

Hi and welcome to The Hustle, a professional development podcast series in partnership with the MasterCard Foundation Scholars Program. I'm your host, Halle Rubera Rubera, an alum of the MasterCard Foundation Scholars Program at Wellesley College. And with this series, I will share the stories of accomplished African professionals from different backgrounds currently working in investment banking, management consulting, big tech and more. Each episode discusses the wide array of career opportunities and provides listeners with advice about working at top firms such as Goldman Sachs, Facebook and Novartis. The title of this podcast, The Hustle, is an ode to my hometown of Nairobi, Kenya, which I love and where the spirit of the hustle, hard work and resilience shines bright.

Halle Rubera (00:52):

Today, I have the pleasure of hosting two of my really good friends also from Nairobi, Kenya. We have Veronica Munyiva who's a tech business analyst or just BA at Morgan Stanley in New York City. And we have Maryanne who's a second year investment banking analyst at Goldman Sachs, also in New York City. Vero studied physics at Barnard College and Maryanne studied economics and math at Williams College. Both of their past experiences were in the current fields that they work right now with Vero as a BA at Morgan Stanley and Maryanne as an investment banking analyst at Goldman and previously Credit Suisse. So, yeah, welcome to the podcast, guys. Thank you so much for doing this.

Veronica Munyiva (01:34):

Thank you for having us.

Maryanne Masibo (01:35):

Yeah, this is exciting [crosstalk 00:01:37].

Halle Rubera (01:39):

So I just want to start with kind of understanding what's the general understanding of investment banking here? And how would you describe investment banking to someone unfamiliar with this industry?

Maryanne Masibo (01:55):

Yeah, so the main thing we do in investment banking is financial advisory to our corporate clients. And so this includes a number of different things, we do mergers and acquisitions for our clients. We do IPOs, debt capital raises, which is just helping our clients raise capital via debt or equity capital raises, which is the same thing but raising equity instead. And then just general financial advice to our clients which comes in different forms and different capacities. Yeah, but it's basically financial advisory and underwriting for our clients.

Halle Rubera (02:28):

Nice. And you guys are not investors or... what's it called? Financial advisors, right? Because I know that's usually the confusion, is that you can advise people on the investments that they should make.

Maryanne Masibo (02:38):

Oh, yeah, exactly. Cooperate finance and personal finance entirely different things.

Veronica Munyiva (02:43):

Two different things.

Maryanne Masibo (02:44):

Veronica honestly knows more about personal finance [crosstalk 00:02:49] than I do. Yeah, we just do corporate finance for our cooperate clients so I am in the financial institutions group. So our clients are financial institutions and I specifically deal with insurance companies. So yeah, IPOs and MNAs for insurance companies and also any other financial advisory that comes up.

Halle Rubera (03:08):

What other groups could you consider in investment banking? What other groups are there in investment banking?

Maryanne Masibo (03:14):

Yeah, that's a good question Halle Rubera . So the way it's structured at Goldman and I think it's pretty similar to other places is you have product groups, in which case you cover a specific product or you have an industry group in education covering a specific industry. And so we have our product groups at Goldman are equity capital markets, debt capital markets. And so in those cases, you're covering the product, the product of equity capital markets or debt. If you're in an industry group then you're covering the industry that you're in. And the industries include healthcare, TMT which is technology, media and telecom, industrials, natural resources, real estate, fig, which is the group I'm in. I think I mentioned natural resources, I think that's all of it. But basically you're covering an industry and so all of what you do is within that industry. And so at Goldman we do our MNA in house in the industry group. And so we don't have an MNA group that does all the MNA for all industries like we do it in house in our group.

Halle Rubera (04:12):

So what I'm hearing is you essentially could study anything in undergrad and you could be a successful investment banker, right? Because there's so many different options that you can choose from.

Maryanne Masibo (04:22):

That's completely true. We have all different majors that come to investment banking. Whatever your major is or was, I think the important things are your ability to learn, the soft skills that can help you build the technical skills that you need which you will build on the job. But yeah, any major can come to investment banking.

Halle Rubera (04:41):

And Vero, you studied physics in college. You did some research for your sophomore year before you took on the business analyst internship at Morgan Stanley. What was the motivation to do physics in the first place and then end up as a tech analyst at a bulge bracket bank? And what exactly do you do as a tech analyst right now or a BA?

Veronica Munyiva (05:03):

Okay, which one do I start with? Why physics?

Halle Rubera (05:07):

Yeah, why physics?

Veronica Munyiva (05:12):

Well, I think the initial reason for doing physics was a bit of a naive kind of reason, just because I loved physics in high school. I say naive because physics high school and I mean, high school physics and college physics are two very different animals. But that was my first motivation. But then I also was playing around with the idea of maybe doing Econ or CS. But then honestly, Econ I didn't really love the departments, the Econ department, but the physics department was so nice. It was smaller. And I remember my freshman year professor, I asked her one question once and I went to her office hours and she remembered my name from class and I thought I was very a really, really touching thing. I was like, aw, you remember my name, blah, blah, blah and then we just got to talking.

Veronica Munyiva (06:06):

And so I was having a conversation with her about, so what can I do with a physics degree? Where can I work? And she was like, you can work anywhere with a physics degree. You don't have to do physics research, because that's what I thought that you do. Either you do research or you go into grad school and then you take the professor out. But she told me that you don't have to just do that. You can do anything with physics. And people usually overlook that most of the time. Because with physics what you get is a lot of skills and the perception that you're smart, right? So [crosstalk 00:06:43] people are like, wow, you know what I mean? It's like a math degree, you can do anything with a math degree because people will assume you must know some stuff, right? You learn quick.

Veronica Munyiva (06:56):

And so with that, I was like, okay, maybe I can do it. And then I looked into it, I guess maybe a couple of years down the line going into internships and companies were like any major is welcome. And a lot of them even listed physics as one of the majors. And I was like, oh, okay. Because even for things like investment banking that Maryanne is doing, physics was an acceptable major, for tech companies physics is an acceptable major. So it made sense and eventually, I was like, okay, I'm making the right decision with this because I do like the department. It's small, I learn and kind of have fun with it. And I knew everyone which was a comfortable thing, especially coming from Kenya. And you're new and all of that. So it gave me a sense of security in college and a sense of community which I feel like made my college experience nice or nicer, I guess.

Halle Rubera (08:02):

That's great, that's wonderful. So how did you even find out about the BA role at Morgan Stanley before you applied for your internship?

Veronica Munyiva (08:10):

Oh, this is a good question. I literally Googled it because I was going through one of those, and I guess maybe we'll get it, but when you are recruiting, sometimes you have one of those application sprees, and you just apply to a bunch of companies. So I was going through one of those and then I came across this Morgan Stanley role.

Veronica Munyiva (08:34):

I think I found the link probably through Bernard. I'm not sure where I got the link from, but I remember I looked at the description and I was like, this is would actually be perfect because at the time I wanted to do something in between finance and tech because I didn't want to go into investment banking. And I also did not want to be a software developer. So I wanted something in the middle. And so when I saw the description for a BA, it's you're literally in the middle of the business and software developers. And what you do as a business analyst is that you translate the business requirements into software requirements.

Veronica Munyiva (09:14):

So you have to work with both the developers and the business. So you need to know both so you can talk to both sides and make sure that everybody's on the same page about the project. So I was like, this actually would be perfect. And that's how I ended up applying for it. And actually funny enough when I was applying, I was just like, this people are never going to get back to me? So I applied and I forgot about it and I was like, well, that's never going to happen. And then I got the interview and yeah.

Halle Rubera (09:46):

The lesson is to always shoot your shot.

Veronica Munyiva (09:48):

Yeah, exactly, that's literally what happened. I was just like, you know what? I'm just going to shoot my shot. And then this would be a perfect role. And then I was just like, I'm not going to even get my hopes up or anything.

Halle Rubera (10:01):

So did you have to take any computer science classes to understand the tech side? So because you'd done physics and that's stem but it's not necessarily software engineering, it's not coding. So once you realized that you probably had a good shot at getting this role, did you try and bridge the gap between the skills that you already had and the skills that were needed for the role in order for you to set yourself up for success in your internship?

Veronica Munyiva (10:29):

Well, actually, first of all, for a BA role, you don't need any coding skills. You don't have to be a software developer. Granted, it does help to have an understanding of the ins and outs of coding just because you'll be working with developers. And it makes sense if you understand what they're saying. So I didn't necessarily have to, although I did have the skills already because I had taken as part of the physics major, I had taken some CS classes. And actually by the time I was applying, I had only taken Java. So I didn't have a lot of classes for... a lot of coding classes background. So I didn't have... it wasn't an active thing that, okay, now I'm applying for this role, so I have to take a CS class, no. It just so happened that I had the experience when I was applying, but I didn't need it.

Halle Rubera (11:28):

Oh, that's good to know for prospective applicants.

Veronica Munyiva (11:33):

But I will say though, you have to have interest in the area because you don't just out of the blue be like, oh, I want to apply for this role, but I don't know anything about the software world, you know what I mean?

Halle Rubera (11:50):

Yeah, that definitely makes sense. Maryanne, why did you choose investment banking? Because you did due to summer internships before you took on your full time role at Goldman Sachs, did you always know you wanted to go into IB? What pushed you in that direction?

Maryanne Masibo (12:05):

Yeah, that's a good question. Definitely did not know I wanted IB, especially going into Williams, I didn't even know Goldman Sachs was possible. I didn't know this whole world of finance was even a possibility. And so my freshman year, the friends I made my freshman I think were very formative in my college experience, but also in my professional experience. Because I made a couple of friends. So my friend [Krushi 00:12:34] came in knowing she wanted to work in finance, she wanted to work in investment banking.

Maryanne Masibo (12:38):

And so that was my first intro into that world. And so at the end of freshman year, Williams does a Wall Street trek. So they bring a bunch of students down to New York, we visit different banks, talk to the alumni at different firms. And you just get a sense of this is a possibility, this is a job that you can go into and here are people who've come from Williams who were in your shoes a few years ago and this is what they're doing now. And so I started seriously thinking about this as a possibility career wise. And so my sophomore year, I came across the application for Credit Suisse's sophomore internship program.

Maryanne Masibo (13:13):

I feel like as I was applying it felt a little bit farfetched. As much as I'd seen people, seen Williams alums in those positions, it still felt a little far fetched just because I'm from Nairobi, right? Working at a bulge bracket worldwide bank like that, that felt a little bit too far to be a reality. So I applied for it hard. And I got the interview and the interview, the recruiting process, I spent a lot of time at the career center just preparing for that interview because it felt like a very formative interview at that point. And so I applied for Credit Suisse, I got in, I got the internship. And I think that's so actually doing the job is when I started figuring out, do I actually want to do this or do I not?

Maryanne Masibo (13:59):

Because I think before I was just like this is a huge opportunity. I didn't even know what exactly investment banking was, if I'm being honest. I knew a little bit about it and I obviously learned a lot about it during the interview process, but I couldn't exactly tell you what my job would be until I was actually doing it that sophomore summer. But yeah, I realized I really enjoyed it. I love finance, I love numbers, I love quantitative roles, I love analysis. And so I realized that was all interesting and exciting for me. And I was in economics and mathematics majors and so it kind of married those two things, because the Econ I know, when you're working in finance, you have to keep up with what's going on in the macro economy, all the trends and all the changes that are happening. And that came into play as well as the analysis really made use of my maths degree and so that came into play as well.

Maryanne Masibo (14:49):

And so after that, that's when I became a little more intentional because I decided I wanted to change to Goldman Sachs. I mean, don't get me wrong, I loved my Credit Suisse experience. And I loved the people I was working with, the job, the place, there's a lot of good that came out of that summer. But I kind of decided I wanted to go to Goldman Sachs, I guess, just because it's Goldman Sachs.

Veronica Munyiva (15:13):

Like you're going to do [crosstalk 00:15:16] banking do it at Goldman.

Maryanne Masibo (15:19):

I mean, talking to everyone they're like, yeah, Goldman is the place to be and just some specific things, I guess I was looking for that Goldman was able to offer. But again, taking nothing away from CS, I loved that internship and I loved the place. So I interviewed for Goldman Sachs and I switched to Goldman Sachs my junior summer which was different. I think going into Goldman was scary just because you hear cut throat environment, oh, my God, it's going to be so competitive. All those scary things about Goldman Sachs. And one of the reasons I actually wanted to [inaudible 00:15:53] I wanted to challenge myself and just because Goldman is challenging, it's not in the ways that I thought I would be. It's an extremely collaborative space, it's an extremely collaborative environment.

Maryanne Masibo (16:07):

And I've learned so much and grown so much so all the scary things I had weren't true. I mean, obviously, the hours [inaudible 00:16:14] across investment banking. So those late nights are going to be... they're going to be there anyway across investment banking [inaudible 00:16:21]. But everything else, Goldman's a very collaborative place and very entrepreneurial. So I ended up getting my internship, I got the full-time offer, ended up signing to join Goldman and it's been a great first year.

Halle Rubera (16:37):

That's great. I love that you both looked at these opportunities and thought to yourself, oh my goodness, this is almost out of reach for me. But still decided to put your applications out there and put yourselves out there, because I think sometimes the default is to kind of convince yourself of why you wouldn't get it and come up with all these reasons and end up not taking those chances. And so for me it's really encouraging to hear that you yourselves never thought that you would have these opportunities that you have now. And look at you guys now on this podcast talking about your experiences one year in. It's so inspiring.

Halle Rubera (17:10):

Maryanne you mentioned a little bit about the fact that your friend group kind of pushed you in the direction of investment banking, which you're obviously grateful for. And in speaking with you and Veronica, we've had conversations about how even just your own core friendship, the two of you and the people around you have also encouraged you to seek out challenging opportunities, have encouraged you with the recruitment process. Can you speak individually about how the benefit of just having that kind of friend circle, of having that kind of environment has influenced and helped you out in your career decisions?

Maryanne Masibo (17:51):

Yeah, definitely. Just the introduction into the world of finance, just knowing that this world exists was as a result of friend groups. So there's this friend of ours, you know him, Justin, who was ahead of us, a year ahead of us. And he worked at JP Morgan his sophomore internship and then Goldman Sachs, his junior internship. And so seeing someone you know, someone who's come from exactly where you've come from doing this, I think that's one of the ways it becomes even more tangible as a reality. Okay, this is actually possible. I mean, Justin went to...

Veronica Munyiva (18:26):

Wharton.

Maryanne Masibo (18:26):

At the time, was going to Wharton and [inaudible 00:18:27] that's kind of what Wharton does, it literally feeds into Wall Street. There's, yes, but he also... he went to Wharton. But still just seeing it as a possibility, for one of your own I think that's sort of a ways to make it the most tangible. Also, just because you can talk to him, right? You can talk to the people who are already in this industry. You talk to your friends who can tell you the truth, not that other people are lying to you. But they're just going to be censored, I guess. And so it was really helpful to talk to people who are your friends but in this roles. And to actually be like this is kind of what the job is, this is kind of... Just given information that you're not going to get online or from other places.

Maryanne Masibo (19:09):

And yeah, so for me, I think just knowing that this was a possibility was a result of my friends. Even going through the recruiting, this kind of touching on networking, but going through the recruiting process, alums, granted alums aren't my friends exactly. But the alums that I talked to, Williams alums are amazing. Williams alums are honestly incredible, they're so helpful. They will take the time to reach out to you, to give you mock interviews, to give you tips. They will spend time with you, trying to help you be successful in the interview process. And I'm so grateful for that because 100% I wouldn't have gotten to Goldman without all the support and the help I got from the Williams alums helped me during recruiting.

Maryanne Masibo (19:49):

But yeah, just this recruiting is... it's a lot, right? It's not possible... I mean, it's possible, but it's really hard to do it on your own. It's really hard to do it on an island because you need people to tell you if your resume looks good. You need people to tell you what exactly to prepare for. You need someone to tell you that the interview is going to have valuation questions, it's going to have financial settlement question, you're going to have the behavioral questions. And you need people... it's obviously on you to take the advice you're given and then really go and run with it and put in the time and put it to work. But you do need someone to give you the advice and to give you the guidance. And I think yeah, all that, just people were instrumental during the whole recruiting process.

Veronica Munyiva (20:31):

I think in addition to what Maryanne has said, just having people to talk to, it really really just helps to have a support system. And friends are that, right? So as you're going through the recruitment process, you are going to lose it. And it really just helps to have people that can put things into perspective and just help guide you through the stressful parts of recruitment. And also, I will say, not only just the introduction to the finance world. It was helpful for me specifically to know that it's not just investment banking that you can do in an investment bank and it was helpful to have people that are there and can tell you, oh, you don't just have to do this, right? Because even I said I didn't want to do investment banking just because I had gone through the recruitment process for investment banking. And I knew I was just like, I know this is not for me.

Veronica Munyiva (21:39):

And at the time, I also found software development a little bit out of reach just because I had only taken one class, right? So I was like, I don't have the skills necessarily for software development, but I wanted to be in technology, but also in the finance world. And so I found out about the fact that you can do something in between from some of my college friends that we were recruiting together. So I knew about investment banking from Maryanne and Justin. I was like, there's actually Wall Street down here, you know what I mean? So just that in between, I found out through other friends. And so part of it is just helpful, it's helpful to have people that can tell you, oh, this is what is available for you. You can apply for this and this and this and this, you know what I mean?

Halle Rubera (22:35):

100%. And you've mentioned, I know how grueling your recruitment can be. And I know how even worse it can feel when you're by yourself. There's that camaraderie in complaining with friends, practicing with friends. I mean, it's really important. I 100% know what you guys are talking about. And obviously, you've touched upon the recruitment process and how tough that can be. But I think it's even tougher say your senior year if you don't have a job, because you guys went through it sophomore year, for sophomore internship to junior internship. Why is it important that you get an internship, if you can, before scrambling to get a job your senior year? What's the importance of internships?

Veronica Munyiva (23:24):

I think it's literally exactly what you've just said.

Maryanne Masibo (23:30):

It's critical.

Veronica Munyiva (23:31):

It's critical because employers recruit first and foremost from their interns, right? So your internship, and they tell us this day one of internship, they're like the job is yours to lose. So if you come in as an intern, you're basically guaranteed a full time. Unless you do something huge that makes you not get the offer for a full time job. So if you have an internship, you're basically a shoe in. All you have to do is show that you can learn, you are ready to do the job and you're eager to be there. So as long as you get the internship, you're basically guaranteed a full time. And even if you don't want to come back to the same company, the fact that you have an offer from that company is leverage for you to recruit to other companies for your senior year. So it takes the load off recruiting senior year from scratch. Just because you have some knowledge and you have some leverage going in as an intern.

Maryanne Masibo (24:33):

Yeah, and I think the unfortunate thing about the way the recruiting process is structured is you kind of have to figure out what you want early on especially for these corporate roles, more corporate roles, you have to figure out what you want early on or it's really easy to get left out of the process and of the system altogether. But yeah, I've seen... Halle Rubera you know part [one 00:24:55].

Veronica Munyiva (24:55):

Halle Rubera , you would know.

Maryanne Masibo (24:57):

But also [inaudible 00:24:58] try and recruit Maryanne. I mean, granted, that some people get jobs.

Veronica Munyiva (25:02):

It's possible.

Maryanne Masibo (25:03):

And it's possible, but it's just so much harder.

Veronica Munyiva (25:06):

So much harder.

Maryanne Masibo (25:07):

Especially for the investment banking recruiting process is very structured. It opens this time, it closes this time, interviews happen. And it happens a year in advance. So for your junior internship, you have to know by the end of your sophomore year, I want to work in investment banking, so I'm going to spend my summer recruiting. So, yeah, you kind of have to know that early, this is what you want. Especially if you want to come to Goldman Sachs or Morgan Stanley or any of these other [inaudible 00:25:32]. And I think maybe what we would need to do, something that we've been thinking about is how to tell, especially international, people coming from Africa, students coming from Africa, freshmen and sophomores, guys this is a possibility. This is a thing because if you've been raised here and your dad worked at JP Morgan or your brother worked at wherever as you're going into college-

Veronica Munyiva (25:54):

You know.

Maryanne Masibo (25:55):

... you know this is an option and you know to start thinking about it. But most of us, that's not the case, right? I mean, I think I was lucky to have friends who were interested in this and who got me interested in it.

Veronica Munyiva (26:06):

Same.

Maryanne Masibo (26:06):

And yeah, same for Veronica. But otherwise, if you just don't know that this is a possibility, it's not something that you'd come in thinking about, right? And then by the time you're applying in your professional life and by the time you're thinking, okay, so what do I want to do? I really like finance. Oh, this is a possibility. By the time you're getting to that it's junior year already and it's too late.

Veronica Munyiva (26:25):

And you're locked out.

Maryanne Masibo (26:26):

Yeah, you're already locked out because people had been recruited for those internships the summer before.

Veronica Munyiva (26:31):

Yeah, I will say also, I think the way I was thinking about it then when I was recruiting for the junior summer internship, I was just like, you know what? I just need a shoe in. I just need to be in the "system." So I think it had gotten to a point in recruiting where I was like, I just need to be in the company and then I will work my way up from there. So even if you don't... I feel as long as you don't want to do, I think investment banking or sales and trading, which are very structured, I think for the other roles, as long as you're in the company, you can always network your way into a specific role that you want, which is how I was thinking about it at the time.

Veronica Munyiva (27:22):

I was just like, I just need to be in. And then from there I'll figure the rest out. So even if you don't know, I say this to say even if you don't know what you want to do exactly, you can always just get in and then network your way into whatever role. Because also these companies are now trying to retain their talent because millennials apparently don't like staying in one job for too long. So they encourage you to recruit within the company to... what is it? Mobility.

Maryanne Masibo (27:55):

Mobility, yeah.

Veronica Munyiva (27:55):

Yeah, so they encourage mobility within the company. So if you are in the company, you can always find a specific role that you're like, oh, I would like to try this, I would like to... And they will encourage, and they will probably guide you through that internal mobility process. So I feel like as long as you don't want those very, very structured. And I feel like if you want those very, very structured roles, you have to know early on. So if you want IB you have to know early on, if you want sales and trading, you have to know early on. That's the only caveat.

Maryanne Masibo (28:20):

Yeah, that's the only caveat to what you said [crosstalk 00:28:20]. Because investment banking, if you're at Goldman in another division and you want to switch into investment banking, I think it could take at least a couple of years to probably make that switch.

Veronica Munyiva (28:35):

Maybe two.

Maryanne Masibo (28:37):

Yeah, at least two, maybe more. I've seen one or two people who've done it. But it's because you kind of go into the interview process, but yeah, it will definitely take at least a couple of years. And then you come into investment, I think if IB is what you want, which I know is sometimes hard to know early. But if it's an option, maybe try recruiting for it in the end. As you're recruiting, you're also now figure out are you actually interested in things you're learning [inaudible 00:29:02].

Veronica Munyiva (29:02):

Which is what I did.

Maryanne Masibo (29:03):

Which is how Veronica found out this is [crosstalk 00:29:04].

Veronica Munyiva (29:04):

And that's how I was like, no, this is not for me.

Halle Rubera (29:08):

I really like that you pointed out that even if you're not sure, just the fact of preparing and reading through the documents. Because for me too, I was trying to look at, say, I looked at management consulting and IB and I was like, okay, I know what I like and what I don't like. I know what makes sense for me and what doesn't. And I think that's something that is also not emphasized enough, is it's almost like oh, the goal is just to get the internship and to get in. But it also gives you clarity about whether or not you'd enjoy the job and whether or not you should be recruiting for something else.

Halle Rubera (29:42):

And as you were speaking, I was just thinking even for you Maryanne, you didn't think you could get into investment banking. And then when you finally did and you went to Credit Suisse, even though you loved your experience at Credit Suisse, you wanted a different one and you wouldn't have known the difference had you not taken the internship at Credit Suisse. And now at Goldman, you can speak to both places. And now you're giving us insider information, both of you are giving us insider information on how you can study and Goldman Sachs. So also the benefit itself of just trying, I think is not emphasized enough.

Maryanne Masibo (30:16):

Yeah, no, that's something [for sure 00:30:18]. I think you have to give it a shot. Something that I had to actively work first is if you're questioning it, give it a shot. If you don't get it, you don't get it.

Veronica Munyiva (30:27):

Right, exactly.

Maryanne Masibo (30:29):

If you're out, you're out [crosstalk 00:30:29]-

Veronica Munyiva (30:29):

But you tried.

Maryanne Masibo (30:29):

... you will actually get in so actually just give it a shot.

Veronica Munyiva (30:29):

Yeah, and I have... Sorry, were you done?

Maryanne Masibo (30:29):

Go ahead.

Veronica Munyiva (30:38):

I was going to say, I actually recruited for everything. This is painful, and I don't think I would recommend this to [inaudible 00:30:48], the process was really painful but because I didn't know what I wanted to do. And that's something that people don't necessarily talk about is... we were what? 19. I didn't know what I wanted to do. So recruited for consulting, I recruited for tech, I even recruited for software engineering actually [crosstalk 00:31:07]. Don't do it.

Veronica Munyiva (31:16):

But because I think with the skill set that I had, I had a shoe in, but that's how I figured out that I wanted something in the middle, right? Because I recruited for everything and I was like, no, software development, that's not it for me. Investment banking, that's not it for me. Consulting also, I mean, the thing with consulting, it seemed very... it was sexy, you know what I mean? Because you travel and they tell you, especially if you're recruiting for the big ones like McKinsey, EY, Deloitte, they tell you you'll be traveling, you'll be working with... They only sell the really, really good parts. So I also recruited for that, granted that one... then it came to the case studies and I was like-

Maryanne Masibo (32:06):

On second thought.

Veronica Munyiva (32:10):

... so on second thought.

Maryanne Masibo (32:13):

And one first of all, plug for IB is after IB you can switch to anything.

Veronica Munyiva (32:17):

Oh yes, I meant to say that.

Maryanne Masibo (32:20):

Literally anything, if you want to go... I don't know. Non-profit, private equity, venture capital.

Veronica Munyiva (32:24):

You can do anything after investment banking

Maryanne Masibo (32:24):

You can do just about anything after. Even if you want to go to software developing, especially having any of these big names in your resume, it's going to be so helpful trying to recruit for anything else. And a lot of people do come into IB knowing that they're not trying to stay. So if you're not sure where you want life to take you, give IB a shot, give it your all-

Veronica Munyiva (32:40):

Give it your all.

Maryanne Masibo (32:40):

... because that recruiting process is not a joke. If you come half hearted, I might not get it but just really give it your all. And also it's early enough in the year such that if you want to recruit for other things and IB doesn't work out, you can still then recruit for other things because IB is going to happen... it's been happening over summer, right? Ib recruiting, people have gotten offers on the summer. I think some offers are still being extended and are going to continue to be extended for the beginning of the fall. And this is for next year summer, right? For junior summer internships. So it's early enough that if you really give it your all and get an internship, excellent. If you don't, then you can also start looking at these other things that are a possibility that you might be interested in.

Halle Rubera (33:23):

Maryanne, I really like that you talked about the exit opportunities, because I think you did mention early on about the grueling hours in investment banking. They work you guys so hard. But the thing that Maryanne has that a lot of us might not have, which could or could not be a good thing. But Maryanne you tell us. Maryanne has people in her inbox asking hey, do you want this job, do you want this job, do you want this job? Because that's the kind of street cred that investment banking gives you and a couple of other roles as well. But investment banking for a fact gives you a lot of exit opportunities. So if, in fact, you really do not know where you want to end up and you kind of want to give yourself a good shot at one financial safety net. And great exit opportunities, investment banking is really known to set you up well for that path.

Maryanne Masibo (34:18):

Yeah, that's true.

Halle Rubera (34:19):

The hours are long though but yeah, Maryanne.

Maryanne Masibo (34:22):

That's really true. Yeah, people reach out and there's an email and there's so many structured [opportunities 00:34:28]. If you want to go into private equity, there is a structured admitting process out of investment banking. The minute you get in, there's the process for two years out. People are like, recruit for private equity. You can do that IB for two years and then you come join us. And then after your first year again, here's another process, you recruit. You can come now immediate switch after one year whenever you want to leave. And even within the firm you can switch to, especially Goldman has mobility in the sense that after your first two years then you can switch to anything else that you want to do and spend a year doing that. If you like it, you can stay. If you don't, you can come back to your original IB role. So it just gives you a chance to try something else within the firm.

Maryanne Masibo (35:08):

But yeah, there so many opportunities that IB is going to give you. But that said, after your internship, hopefully you get the internship to kind of figure out if you're interested because you have to not hate it. Otherwise you're going to be miserable for two years. I don't know that I'd say that you have to love it because I know people who are doing this job who don't love it.

Veronica Munyiva (35:27):

So don't hate your life.

Maryanne Masibo (35:29):

But don't hate it because you're still going to have to put in two years and you don't want to be miserable for two years. Hopefully, you want to be interested enough to actually do a good job, get a good bonus. Also, just get good recommendations built out, you don't want the first two years of your professional experience to just be horrible. That said, some people are like, I'm just going to sacrifice, right? It's going to be hard, it's going to be grueling but I'm just going to sacrifice myself for two years to set myself up for a future which is another way to go. That's completely fair. I think one of the reasons I actually came back full time was I don't know that I knew for sure, for sure, okay, this is what I want to do from now on. But I at least knew that I enjoyed it, I liked the people I was working with. And I liked most of the job, granted not everything. There going to be miserable days and I think this applies to any job.

Veronica Munyiva (36:13):

And that's all jobs.

Maryanne Masibo (36:16):

Right, just bad days and that's going to be true for any job you take.

Halle Rubera (36:21):

Do any of you have plans to walk but work back in Kenya or anywhere in Africa?

Veronica Munyiva (36:29):

Yes.

Maryanne Masibo (36:29):

Yeah, speaking of [inaudible 00:36:31] there's a time last year, early last year that I was like so I'm just going to do one year at Goldman and then I'm going to be on my way. And I was legit thinking I'd be recruiting for Private Equity by the end of the year. Private Equity Nairobi by the end of the year and I thought I'd be going back but things changed.

Veronica Munyiva (36:52):

The good days come back and you're like, okay, never mind.

Maryanne Masibo (36:59):

And you're like okay, never mind. I can actually do this. But yeah, for me, my goal is to go back to Kenya at some point. The question is just when when when.

Veronica Munyiva (37:05):

The question is when, that's true.

Maryanne Masibo (37:11):

And also now [foreign language 00:37:11] the question of grad school, MBA to get it, not to get it. There a lot of things are up in the air.

Veronica Munyiva (37:13):

To be or not to be.

Maryanne Masibo (37:14):

Yeah, exactly. But there's a finance industry that's buzzing in Nairobi-

Veronica Munyiva (37:18):

And also has finance.

Maryanne Masibo (37:21):

... and it also has opportunity to grow-

Veronica Munyiva (37:22):

Oh, for you. Sorry.

Maryanne Masibo (37:26):

... for me just because I want to go back to finance. And it's also there's a lot of room and opportunity for that industry to grow in Nairobi. [foreign language 00:37:29] it's already so developed.

Veronica Munyiva (37:31):

That's true.

Maryanne Masibo (37:31):

There's not [inaudible 00:37:32] that's really going to change, right? It's very structured, really developed. But yeah, me I want to move into Nairobi and start a finance company and do all that. And spend some time maybe working there to really understand it before trying to do something on my own. But yes, the goal is to go back to Nairobi because that's home.

Veronica Munyiva (37:49):

Same.

Halle Rubera (37:51):

Yeah, because it's home.

Veronica Munyiva (37:54):

I mean for not necessarily finance. Actually, I think I would still want to be in the finance industry. Anyway, this is one of those it's still moving, a moving...

Maryanne Masibo (38:03):

It'll be a different response in two months.

Veronica Munyiva (38:08):

Yeah, ask me again in two months, I'll tell you a different industry but yes, the goal is... because I mean, what's the point of getting all these skills if you're not going to apply them at home, right? So at some point, hopefully... I don't know how many years, but at some point going back to to Nairobi would be ideal.

Halle Rubera (38:32):

That sounds lovely. And both of you have [crosstalk 00:38:34] built up... Yeah, you've built up great pedigrees as well with Morgan Stanley, Goldman Sachs and the experiences too. I think those set you up really well for any opportunities that you decide to pursue in the future, whether it be just the skillset that you've learned, even just the grit, the resilience at working at some of these places. I wish you guys all the best. And finally, I've been asking this question to every single one of my guests that has been on the podcast. For both of you, when you think about kind of your professional development and your career development, what's one thing you think you've done really well and one thing you wish you could have done better?

Maryanne Masibo (39:15):

Veronica, you want to go first?

Veronica Munyiva (39:23):

No. Okay, this answer might change, honestly, at some point again, but I think for me it has been just doing, just going for it, just doing it. So like I mentioned, I recruited for everything. It was a painful process, but I did it. And then when I was interning, I knew I wanted to change my team coming back full time. And when I had the opportunity to do that, I did it. And it has worked out well, honestly, so far because I love my team right now. My boss is an angel. So I think just going for it, if I have a question, just asking, kind of just trying to I guess, get over the imposter syndrome by just doing it. And not necessarily caring or not over thinking what people think about me. So I think just going for it, just doing it. And I hopefully, I'll keep the same attitude to just go for it.

Maryanne Masibo (40:39):

I think I can talk about something I have not done well. So when I started working last year and I don't know, something about the working environment that I am, made me introverted because I think everyone who knows me, knows me as a very extroverted person. But that wasn't [inaudible 00:41:00]. That's not the person that was coming through at work. And I don't know, maybe it's imposter syndrome, a combination of imposter syndrome and also just feeling very other in that environment. Also, just I think I felt that there's a lot that I didn't know and there's that I... and I was very used to being very comfortable information wise. Academically as much as I was always learning but I felt like [foreign language 00:41:29]. I think in most stages of my life I have felt not uncomfortable with what I'm supposed to know versus what I'm not supposed to know.

Maryanne Masibo (41:37):

But when starting at Goldman I felt like there's so much to the point that it was uncomfortable. There's so much I needed learn to the point that it was uncomfortable. And I think what I did wrong was I lot that really intimidate me and my interactions with people. And so I don't think my personality this first year really came out.

Veronica Munyiva (41:54):

Came through.

Maryanne Masibo (41:57):

And so that's something that I'm going to be actively working on. I mean, right now it's been remote for six months and so I guess there's that. But also, going back into the office. But yeah, going back into the office is something I'm going to have to be very, very conscious [about 00:42:09]. I didn't think it was going to be a big deal starting out. But in the professional environment, it actually is, it actually does matter. Being seen, being visible, voicing, speaking up, having your presence felt is really important. And that's something I'm going to be... it's going to be very active effort as I go back and throughout my second year.

Halle Rubera (42:36):

I really loved speaking to you guys. I love the both points that you gave. Vero, I think Nike needs to sponsor you. You've said just do it so many times.

Veronica Munyiva (42:45):

I know, [crosstalk 00:42:47] for my cheques.

Halle Rubera (42:51):

And just I think for both of you, the sense of just knowing yourselves, self awareness, I think is very evident on this podcast. And I think over and above everything you've said about recruiting and talking to people and networking, all of that stuff. I think it's also important for our listeners to know that you're also growing as a human being. And it's important to also figure out how your professional development fits into your own personal development. So I really loved that you've pointed out just sitting down and being introspective about the things that you've done better, things that you've done well and the things that you could do better to set you up for future successes. So thank you so much for sharing your experiences. This was a lovely episode. As always it's really nice chatting with the two of you.

Maryanne Masibo (43:37):

You too.

Veronica Munyiva (43:37):

Thanks Halle Rubera .

Maryanne Masibo (43:37):

Thanks Halle Rubera , thank you for having us.

Veronica Munyiva (43:42):

This was so much fun.

Halle Rubera (43:42):

It was.

Veronica Munyiva (43:44):

Please, just have us again.