Aspire with Osha: art, nature, humanity

Osha interviews people who are dedicated to working to create a better future for us all in the fields of art, nature and humanity. We explore stories and discover people on a quest to deepen our connection to life and to our common humanity. On Aspire with Osha you’ll meet people who are passionate about creating a more positive future. There will be music, poetry and inspiring stories. Come hang out with us and if you like what you hear, like us and help spread the word. Thank you!

Aspire with Osha: art, nature, humanity

Investing for the Future and the Planet with Dale Wannen

Have you ever wondered if your investments could pack a powerful punch for both your wallet and the world? Dale Wannen, veteran wealth manager and founder of Sustainvest Asset Management LLC, takes us on a deep dive into the transformative realm of sustainable investing. With over two decades of experience, Dale illuminates the journey of sustainable investing, debunking the myth that prioritizing ESG (Environmental, Social, and Governance) factors means sacrificing financial gains. From using ESG ratings to avoid the pitfalls of greenwashing to highlighting the growing influence of electric and hydrogen vehicles, Dale provides a comprehensive and insightful exploration of the rapidly evolving investment landscape.

Let’s not stop there. We turn the spotlight onto the power of small investors to effect meaningful change through shareholder activism, a compelling topic that often gets overshadowed. Dale unravels how, with the right tools and knowledge, even the smallest investor can influence the trajectories of publicly traded companies. We navigate through the process of compiling shareholder proposals, the role of regulatory bodies, and the crucial importance of casting informed votes.

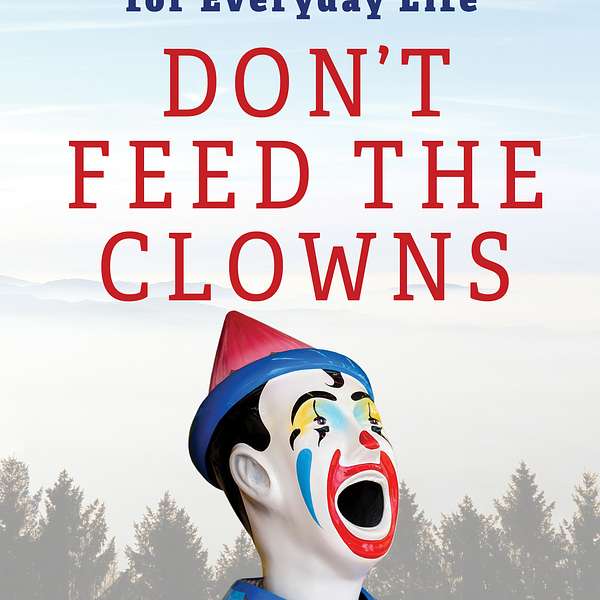

Lastly, we delve into the vast and exciting possibilities that the future holds for sustainable investing. From the burgeoning popularity of robo advisors and AI-driven investing, to the intriguing potentials of cryptocurrency and the metaverse, Dale shares his predictions and insights. His recent book, 'Don't Feed the Clowns: Sustainable Investing for Everyday Life,' serves as a beacon for those looking to align their investments with their values. Join us for this empowering and thought-provoking conversation that will inspire you to contribute positively to our planet's future, through informed and responsible investment choices.

Sustainvest Asset Management LLC

If you enjoyed this show, please leave a positive review and share with your friends. Thank you! Osha

When it comes to your investments, would you like to align your money with your values and put your money into companies that are actually making a difference? Today, my guest, dale Wanin, will show you how you can use your money to influence positive change and helps steer our world toward a more sustainable future. And if you're thinking right now, oh no, this is going to be boring, think again. Dale Wanin can make investing seem sexy. Dale Wanin is the founder of SustainVest Asset Management LLC, an independent registered investment advisory firm focused on sustainable investing. He has over 20 years of experience in wealth management with a commitment to sustainability. In his new book Don't Feed the Clowns Sustainable Investing for Everyday Life, dale Wanin gives you an insider's view of the world of sustainable investing. Welcome to the show, dale.

Speaker 2:Thanks very much for having me. Wow, what an introduction.

Speaker 1:So you've been involved with wealth management for decades. What prompted you to focus exclusively on the world of sustainable investing?

Speaker 2:Wow, let's sit back and grab a drink and really get into it here. That's a long time ago and actually one key moment happened when I wasn't an advisor and I wasn't doing sustainable investing. This is 20 years ago and somebody from a fun company called Calvert gave a speech, gave a talk to all us suit and tie Back when I used to wear a suit and tie and I was amazed that, oh, I can actually be in this business and make a difference. I was actually OSHA on the way out of the business and I was kind of like I don't know if this is for me, pushing municipal bonds to people all day long and I really didn't see a meaning behind it. But then, amazingly enough, I learned about sustainable investing, like I said, early 2000s, and I was like, if I'm going to be in this business, this seems like the way to do it. So here I am, 20 years later.

Speaker 1:Like. You've learned a few things in that time.

Speaker 2:Yeah, a lot. I've seen so much change and I sound like I am in my 40s, still that I sound like an old guy, but it's amazing how much growth this industry has seen, especially over just kind of like the last five years, I would say. But it's definitely changed from 20 years ago for sure.

Speaker 1:How would you respond to those people who say, yeah, sure, I'd like to invest in sustainable and socially responsible companies, but I want to make money on my investments. They have this idea that the two are mutually exclusive. What do you want them to know?

Speaker 2:Yeah, you just jump right into the hard stuff, by the way. But yeah, that's sort of an old, old wise tale. You can't make money being a sustainable investor, and I think what happened is 15 years ago 20, sustainable investing was really quite a bit different than it is today. Back then it was like I just want to invest in solar startups or wind energy companies and I think what happened was some of those entities or funds really didn't do so well. Nowadays it's completely changed. This term ESG, which I'm sure we'll get into.

Speaker 2:Nowadays, sustainable investing is really about finding the companies that are addressing issues that help them in the long run. What is Dell computers doing with water usage? There's actually a financial benefit to knowing what they're doing when it comes to sustainability. So I just kind of gave you two ends of the spectrum. But yeah that I could give numerous examples of how sustainable investors they don't see any difference in performance than traditional. And, if anything, I could show that there's an outperformance starting to happen and it's been happening for five years because of the fact that companies with high sustainability scores are sort of rising, the cream rises to the top and their peers are like oh, maybe we should be doing that. Maybe we should care about how much alternative energy we use for our own corporate needs. So it's pretty clear. And there's funds like it.

Speaker 2:Give you like DSI and not to start throwing out stock symbols. But DSI is an old Dominic index fund. It's been around for a long time. I always say to people if you're not sure, go look at DSI and compare that to the S&P 500 and you'll see. And that's sort of the baby step I never lead in with oh, buy these solar companies or wind turbine companies. It's more about just take a little step away from traditional investing and DSI. What DSI does? It actually gets rid of 100 of the worst companies in the S&P 500. So you own 400 companies that are actually doing a bit better than the 500 by weeding out the 100. So it's very easy to understand.

Speaker 1:So weeding out the bad players.

Speaker 2:Yeah, and that's a big phrase there. But yes, that's what the index does and there's so much data behind it now it's amazing. And that's definitely one of the things you've sort of mentioned is what have you seen change? And really the data that we didn't have 10 years ago is now available, like we know what Apple is doing when it comes to how much aluminum they're recycling in their laptops. I mean, you have it down to the number, so the data's out there.

Speaker 1:It's great because that leads me into this idea of greenwashing. I'm sure all of you out there have heard of the practice of greenwashing, but you might not know how to dig into the companies that are actually doing the work and those that are hiding their dirty laundry behind a veneer of feel-good advertising. So, dale, can you give us some ideas for how to screen out those companies that are doing greenwashing, or maybe some examples of some companies that have done a really big job of greenwashing and people have probably seen some of the advertisements?

Speaker 2:Yeah, you're full of all the hard questions right up the gecko. So I think most people are listening, probably, to greenwashing. It's sort of the go-to term for companies that are just pretending they're doing something and making it look like they are but in reality they're not In the book and I haven't looked at the book lately. But I think I mentioned Volkswagen. You know, volkswagen is actually a very sustainably minded company but, believe me, their ESG score really dropped quite a bit because they went through this huge mess up with emissions. And if you had a Volkswagen, you kind of know what happened, because they either paid you to get rid of the car or they just gave you cash because they were saying sorry, but we lied, because we said that our cars were not as polluting as others. But they actually weren't. They actually had a digital technique of showing that the cars were spewing less energy than they actually were. So that's one they cheated in line they cheated.

Speaker 2:Yeah, yeah, yeah I was trying to get around there. They did cheat and they're digging themselves out of it after billions of dollars. And that's what's funny is that's ESG? That's sort of hey, the data's there. Volkswagen's just bumped down from an A to a D. Now investors are going to look at that and say, maybe because their ESG score is not as high, I'm not going to buy them. If they were in an A, I would consider buying them, but now the 30. And of course, there's financial reasons to buy the stock or not.

Speaker 2:But yeah, and then to your point, which is, for maybe some of your listeners, we're like well, what about investing? Well, this is where you have to be careful. This is where, maybe, hiring an advisor and I'm not pushing myself, but sometimes or just ask friends there's some funds out there that say they're doing sustainable investing. But if you dig into the holdings, it's a different story and I'll give you a few examples. For instance, my clients. They don't buy a Goldman Sachs ESG fund.

Speaker 2:Every big money manager out there now has their own sustainable fund, clearly because they want the assets to stay with them or they don't want young investors to leave.

Speaker 2:The problem is Goldman Sachs itself as an entity maybe isn't the most sustainable bank in the world, whereas you could buy a similar fund from a company like Parnassus, who has been doing sustainable investing for 25, 30 years, and there's no outperformance from buying Goldman versus Parnassus. So you just have to be careful, because certain fund families really believe in sustainable investing and activism, whereas the vanguards and the Goldman Sachs is of the world. Just because they have a sustainable fund doesn't mean and I'll be the first to say that's actually a better step to buy an ESG fund at Goldman, but you're still doing business with the devil. So be careful when you start to look at what funds should I buy, and you could always ask people like me what are three or four fund families that you like that are putting themselves behind what they're doing, as opposed to just putting a fund out there? Vanguard has numerous sustainable funds. Now I'm not poo-pooing Vanguard, but they've never come out and say they believe in sustainable investing like some of the other firms have.

Speaker 1:Like you say, there are some corporations that do have an ESG fund but at the same time they do a lot of business with fossil fuel industry and polluters, so their hands are pretty dirty. So I guess it's really up to the individual to think about. What do I really want to support with my money? Can I make a difference? And if I do want to use my investments to shape a more livable future, then what are the most influential investments that I can make?

Speaker 2:It's hard. I mean, that's what the investment world is. There's a lot going on. Hopefully the book sort of helps guide people to go in the right direction and give them some examples. But yeah, to your point. I'm sure there's themes. Now the exciting part and I don't want to be negative here the exciting part is there's so many different vehicles that are specific, or what they're calling thematic. That's great. That wasn't around 10 years ago. You could say.

Speaker 2:I really want alternative energy to be 5% of my million-dollar portfolio. I really believe in solar and wind and geothermal. Hey Dale or anybody. Is there a fund that I can just direct that to? And there is not. Just it buys 50 of the largest solar and wind companies and there you go, you're now allocated. Or if water scarcity we all know water is an important element in the world and if you want to invest in infrastructure and companies that are addressing farming and scarcity of water, you can actually direct capital and those are environmental. There's social issues. Now that you can, would you rather invest in women-run businesses? You can absolutely and I'm not saying load up on your portfolio in these themes, but this is how I work with clients.

Speaker 1:A lot of us have money that's sitting in investments or banks and we would like to make sure that our investments are in alignment with our values while meeting at the same time, while meeting our financial goals.

Speaker 2:Yeah, and it's going beyond. Being free of fossil fuels is one thing, you know, divesting the fossil fuel companies. But I'm seeing people start to take interest in you know how can I invest in my local community? You know what are some more impactful ways to invest? Now I will say there. Sometimes the returns aren't as high. You know you can buy something like a Calvert Foundation note. You can do that through Charles Schwab that's my custodian but they may make three or 4% fixed. But people are like, ooh, I like that.

Speaker 2:It's good to know that my money is being invested towards communities in need, but I do want to see some kind of return. I don't want to give everything up. It's not like a donation to a nonprofit, which is very a great thing to do. Most of my clients are like if I can get two or 3%? So what I'm seeing is people start to direct just a little bit and I keep using a million dollars as an example. But hey, can we just direct 1% of my assets towards something like that?

Speaker 2:And you know it just takes time. We're creatures of habit and so even in the investment world this is going to take time, even though sustainable investing has been around for my Obi-Wan Kenobi, the guy who was one of my mentors, john Harrington. He's been doing it for probably 40 years, so even though I've been doing it for 20, it's just. It's cool to see the evolution. It just takes time. One of my clients out of Berkeley he's just like you're doing a great job, dale, keep it up, but it's going to take a whole, it's going to be a generational shift. Do we have enough time? I don't know, but things take time. People want their money to grow, so it's baby steps.

Speaker 1:There've been so many really bad players on the scene in terms of the banking industry, and everyone can think of some examples of some of the bad players. I mean what Volkswagen did when they cheated, or the whole crisis at 2008 and the meltdown of the housing and mortgage industry. There are just so many things like that that have happened that I think it's really important to look at what are we investing in and where's our money going. Is this really legit?

Speaker 2:And so one way is to be really invested in socially responsible investing right yeah you bring up 2008, which is, you know, I went through it as a manager managing money, not at sustained vest, it was the previous firm I was with. Wow, what a wild ride that was. And if you ever look up, people remember Tarp. But every once in a while I get like in one of my bitter moods and I'll Google Tarp. You know Wikipedia, tarp, and you'll see who the banks were that really brought the whole thing down. And I still have a bitter taste in my mouth from those banks and I don't want to again. I'm not here to point fingers, but many of my clients most of them, when I buy regional bank CDs they tell me don't stay away from the big banks. You know Viva and Citi and I'm all for it because they were one of the you know, if not the one of the big reasons that things really went sour back then and now, and you can Google anything these days. But Tarp is interesting.

Speaker 2:And now, of course, which companies are funding? Who are lending the most to the fossil fuel industry? Right, and again, I'm not saying Exxon is horrible. Right, you know Exxon and Chevron. They are horrible right now, but who's to say, you know, maybe in 10 years they'll be the most sustainable energy companies in the world, right? So again, I'm not saying it's like the classic McDonald's versus Chipotle McDonald's doesn't score very highly with overall ESG compared to Chipotle right now. But I'm saying let's give everybody a chance. It doesn't mean we're going to invest in you right now, but let's give you a chance. And maybe in 10 years McDonald's will be at my client's portfolio, but right now it's not and I don't know how that's going to turn out.

Speaker 2:But right now you know Exxon and Chevron are not doing much in the way of alternatives. You can look this up, everybody can see it. As far as a percentage of their overall revenue or how much they're spending on renewables, they rank very poorly compared to other peers in the energy sector. But in 10 years maybe that'll change. But right now we can see the data and it's just not there.

Speaker 1:So well, let's take a short break and we'll be back in just a minute with more from Dale Wannon, and we're going to get into some really good juicy stuff in this next segment, so stay tuned.

Speaker 1:In case you're just joining us, this is Aspire, with OSHA, art, nature, humanity, and I'm your host, osha Hayden. I'm here today with Dale Wannon of SustainVest in Petaluma, and we are talking about money how you can use your money to make more money while doing good for the planet at the same time. So I wanted to talk a little bit about the movement of people who've drunk the Kool-Aid from the fossil fuel companies and are right now fighting to keep the coal industry fired up. We're just reading a story about it the other day. In some states, they're doing everything they can to prop up the coal industry because they think that we just need to have more carbon in the atmosphere and save the coal industry, and so these people seem to be rejecting anything that they consider to be quote woke. So, considering the way things are going to be going in the future, are they missing out on some of the best performing investments, and how would you help them make more money by investing sustainably?

Speaker 2:That's another big one. You always come out with the whammy. So I think you hit a couple of things there. One is this anti-movement and the politicians are starting to get involved, which is really interesting. I think you may be referring to the recent news where it's one of the politicians I want to say from Kentucky, but definitely one of the coal mining states, who's saying that investors should not have ESG sustainable investing choices in their 401k plans.

Speaker 2:That was what he. I don't know why he did this and where he came from, but I think I've kind of tweeted about this. I was like he doesn't know what he's talking about. I was like this jabroni, like this clown doesn't even know what he's talking about. And I know this only from experience that I've managed a few 401k plans. When somebody works at a job and they say, okay, I'm going to put some money away into this plan that my employers asked me to do, it's actually required that they have not only sustainable choices but also non-sustainable choices. Right, and the ones that I manage. I'd say you're going to have employees who maybe don't want to do the sustainable, more fossil fuel free things, so you have to give them that choice.

Speaker 2:So where this person this politician was coming from. I don't even know. I don't even want to waste time, because I really feel like he just is being an advocate because his lobbying that's occurring is pushing him to say stuff like that. So I always mentioned in my tweets when I'm going to bed if anybody ever wants to sit down and have coffee with me, these politicians included, let's do it, because I don't think you understand. What we're doing is not like I'm not out there hugging trees, and I'm doing this because, I believe, for my client's benefit, you're just taking an extra step to weed out companies that just aren't addressing these issues, and I mentioned a few of them. But it's pretty clear that if I don't know if a data storage company has their warehouses or their storage facilities next to a flood prone area in Miami, I hope that they're addressing this issue and considering moving away from that area, and that's an ESG consideration. So yeah, I thought that was part of your question, which I can't remember. If that answered it.

Speaker 1:But yeah, because the future, most of the companies, a lot of the big car manufacturers, et cetera. They're shifting big time towards electric or possibly hydrogen, but the fossil fuel spewing cars are going to be a thing of the past.

Speaker 2:Absolutely.

Speaker 1:But so if they don't want to invest in anything that's woke, aren't they going to miss the bandwagon there and be invested in things like fossil fuel companies that are going to go down?

Speaker 2:Yeah, I mean you're kind of answering the question, but clearly Ford and GM, they're all getting involved in EVs. I mean, ford is pretty amazing. I'm still waiting for that stock to do something. It's sort of quite a few of my clients own it because the Ford F-150 is the number one selling vehicle over the last 25 years every year the pickup truck, and now they're committed to go 100% EV in their Ford F-150 as of next year and so if we're sort of waiting to see how that plays out for them.

Speaker 2:But absolutely and you mentioned coal mining I remember I was doing something called shorting coal mining. This was like seven or eight years ago and I won't get into options trading or anything like that. But companies and they still are folding like Peabody. These are coal manufacturing companies that are publicly traded and shorting is a way to make money.

Speaker 2:I had a few clients who were like if we really don't believe in what they're doing, not only do we not own them, let's short them, because we feel like the stock price is going to go down in value. I'm not recommending options trading to any clients, but it was kind of a fun time because you watched your investment shoot up in value in Peabody Energy as they were going out of business and so and if you can Google and I do have this in the book where I talk about electric vehicles and the shift and the metaverse and there's so many cool things happening right now that they all have a play in sustainability, whether it's EVs, robots the robots are coming and maybe they'll help us be more sustainable with our lives, or maybe they'll just get rid of all of us, who knows?

Speaker 1:They might say well, you guys are illogical. You're polluting the planet that you depend on in order to live. So what do we need you for?

Speaker 2:Maybe they'll come up with a better answer than Elon Musk has or whoever else has so far, so let's not count about you. They might have the answer.

Speaker 1:They might, they might.

Speaker 2:And definitely solar and wind companies. I won't get into it, but you can see the difference in performance of companies like First Solar or Enphase. These are companies that have to do with solar panels and installation and et cetera, et cetera. And you can put them up against Exxon or Chevron. Anybody can. You'll see the difference.

Speaker 2:Now, two different industries. One's been around for 100 years, one's been around for 20. Solar is still trying to find its way and prices have come down so much you're going to get me in my stock valuation problem. Right now. It's really difficult to decipher what's happening with solar because prices have come down. You put years ago it cost $50,000 to put solar panels in move and now it's 15. Well, the market doesn't really like to see that because they want to see companies making money and not making less. So that's still working its way out. And then you have Exxon and Chevron that they've had a good run, especially when we go to war with a huge country, a communist country, that controls most of the oil and that's why the price of oil went up above $100. But remember, exxon and Chevron are 100% reliant on the price of one thing and any good investor knows it's one thing that they're reliant on, and that's oil, and that's not a very diversified company to be invested in.

Speaker 1:Right, and do you want to be perpetuating that? You know that's the other question. I mean, I love the idea that I can use my money to help create positive change in the world and make money at the same time, so that's kind of a real win-win.

Speaker 2:It is yeah, and you know it's great when you get the emails that are three or four months later that say you know what? I'm looking at my quarterly report and I feel like there's a weight that's been lifted off my shoulders. And I'm not just saying that to be cheesy, it's just that's. You don't get those very often, but it is nice to hear that because of taking them away from the, you know the vanguards and then they see the newsletter, like okay, this makes me feel better. I'm still invested, I got to save money, I want to take vacations every year, but it's good to know that they've shifted away.

Speaker 1:Let's talk about something you've done, a lot of which is shareholder advocacy. So can you talk about why it's important and how any investor can, as you say, take on the man through simple actions? And so how can someone who's not a millionaire, who doesn't have all that power, how can they actually have an impact with these companies?

Speaker 2:Yeah, shareholder activism. I'm surprised it doesn't get more press and because I find it really interesting and people don't realize the power we have so well. I have to give a shout out to again John Harrington, who's like my. I keep saying my Obi-Wan Kenobi. But there are certain people in this industry that have been doing it for a long time and I always say, any industry you're in, it's good to have a mentor. They may not know they're a mentor, but somebody to kind of watch what they're doing, because they're really helpful and they can inspire others. But so, yeah, so shareholder activism is a way to sort of, instead of just owning the company, you can do something else. You can own the company, but then you can also sort of poke them a little bit if you see something that they're doing that you may not agree with. Now I always say remember, these are publicly traded companies and you can't do this with a private company like sustain vest. I'm a private health company. You know these are public companies.

Speaker 2:Remember, like when Mark Zuckerberg decided to go public with his already huge company, he did it because he wanted to grow. He did it because he wanted to make more money. Once he decided to go public. He's now just as public as the public library, right? And people sometimes forget. Oh, elon Musk. He might be the richest guy in the world, but guess what? We own him like I don't know, not as a person, but he relinquished his ownership of his company. Now he has a big chunk of his company still, but because now the public owns it, we have a right to say something.

Speaker 2:So shareholder activism is that where you have the ability to write something to the company, it has to be 500 words or less, and of course I have a chapter about this in the book. I hope I don't make it very boring. I talk about being hungover with my dog, like licking my toes, and me filing one of these proposals. You don't have to be rocket-sized to do it. You do have to know the ins and outs a little bit, but and you can just say hey, company, in 500 words or less, I would really like it if you did such and such a little bit better. Right, and there's reasons behind this. Because I'm a stock owner. I feel like if you don't address this, it's going to negatively affect the value of my stock that I own in you. So there's a way to do it and you only need a few thousand dollars.

Speaker 2:It used to be you just had to hold two thousand dollars and that was it of the stock and had to hold it for one year. The SEC and the powers that be upped it to I think it's 30,000 for one year. Or you can just own three thousand dollars of the stock for three years. In other words you have to hold it for three years before you can commit. But three grand in this day and age with inflation and everything, it seems like a fair amount to have some beat the file. And I help clients do some of these because they get like oh, I can't believe Starbucks doesn't have the good milk they're using non-organic and they're like let's file a resolution against that. So it's exciting when you see clients are like do I own that stock? I'm like you do. You have 40,000 dollars in Starbucks or whatever it is, and then you can kind of get the wheel spinning on file. So it's fun.

Speaker 2:The client, the companies don't like them. You know the attorneys get the proposal from you and you have to send it a certain way that it's signed for and everything. And it's great to get those emails from the attorneys. Attorneys are great, we all need them. But the corporate attorneys at, like these big public companies, they're like wait, what is this? Because some of these companies maybe have never seen one before, and so it's just an interesting way to kind of say hey, you're public, I have a right to this. It's not me against you. It's literally me saying, hey, I can help you, if you just listen, I'm a public. And then the SEC has the final say and, as you can tell, I'll keep talking about this. It's not like the company or I have the final say on whether this gets on the proxy. The SEC decides like, oh, this person has a valid point. Or they'll say this person's crazy, this stockholder. They cut it off at that.

Speaker 1:So I mean, if you do get the approval and it goes on as a proxy vote, then everyone, all of the shareholders, can vote on it and say yes or no. Right?

Speaker 2:That's right.

Speaker 1:I guess that's another reason to read your shareholder.

Speaker 2:Yeah, maybe not every one of them.

Speaker 1:But yeah, you know yeah.

Speaker 2:Yeah, as an advisor, you know I vote on behalf of my clients and if you do have somebody that helps you, let ask them. You know when a client comes on, there's a yes or no and I open the client's like you do it, because I can vote in favor of shareholder proposals and I have a system that I pay for to do it to make it easier for me, as opposed to a client having to get 50 of these things every year, or 20 or whatever it is, and have to check the boxes. But definitely anybody can see the proxy statement. They're online because it's a public traded company and they're pretty juicy. You know they're black and white and they're 50 pages. They don't make them very interesting, but you can dive in. It's really interesting. Not only are the shareholder proposals on there, but also like compensation I go. I didn't know that the board members were getting paid $60,000 each quarter to go to a board meeting. So it's there's juicy stuff inside of those things that you just look and yeah, yeah, that gives you a lot more information.

Speaker 2:Yeah.

Speaker 1:Actually, let's go to a short break and then we're going to talk about future stuff, so we'll be back in just a moment with more of Dale Wanin, and his book is Don't Feed the Clowns Sustainable Investing in Everyday Life. Stay tuned. In case you're just joining us, this is Aspire, with OSHA Art, nature, humanity, and I'm your host, osha Hayden. I am here with Dale Wanin of SustainVest, an investment firm in Petaluma, and we are talking about sustainable investing and also about his new book, which is quite a good read. Actually, you might think that, reading a book about investing sustainable or not you might think you know yawn. But it's actually a pretty good book and it's funny and it's fun and it's interesting and you learn a lot, and it's called Don't Feed the Clowns Sustainable Investing for Everyday Life. Before we talk about future stuff, I just want to ask you a quick question about the clowns. Who are the clowns and why don't we want to feed them?

Speaker 2:What a horrible title for a book. But I keep getting asked about the title. You know, actually I never even had a title throughout the book process and writing. If anybody ever wants to email me who wants to write a book themselves, please do, because I love talking about it because I learned so much about publishing and all this stuff. What happened was my book coach. You know she would help me. Every two weeks we'd have a discussion. It was great. Get a book coach if you can, as long as they're not too pricey and you like them and you get along.

Speaker 2:We were trying to come up with a title and I kept a document that said titles and I think I had 14 or 15 of them listed for the book and this one's not fun enough, but I want to say it was the book coach, if I remember, that came up with something. She said you keep talking about clowns and the buffoonery in the investment world, and that goes to my experience. When I was a young one, in my 20s, I kind of started going through the insurance companies and banks and broker houses and did the whole thing. So that's where it came from. I have seen and I've been in the carnival, as I referred to the book quite a bit and I just kept calling them clowns, which I know that's a horrible word to use, but it's my way of saying just be careful. I've seen things. I still see it to this day.

Speaker 2:I have clients who bring me statements and they're like I don't know what this person charged me for what, and it was for a trade. And it cost $800 to do a trade. And I was just like what is this? And this wasn't 10 years ago, this is two years ago and so there's still this stuff happening. That's where it comes from. A lot of references to clowns and I know I'm in this industry, but I'm really trying to let people know. This is how maybe you want to go, if you want to hire somebody to do it, or if you walk into a bank. Here's some issues to take note of and be careful of. Don't be swayed by the fancy chocolates and stuff, because stay away from certain games and the carnival.

Speaker 1:That's where the clowns came from and it's not because you dislike entertainment-type clowns, right.

Speaker 2:No, I love clowns by the way I've had a couple of people say to me I'm not going to buy your book because I'm scared of clowns. No, I love clowns. I find them pretty hilarious. I'm not scared of them at all.

Speaker 1:So we're talking about a different type of clown, not the clowns that entertain and that are fun and that are funny. Make you laugh. You're talking about the clowns, who are big-time jokers, taking your money and telling you something else.

Speaker 2:That's right, and there's so many parts of that, whether it's what type of fun to invest in, like class shares, whether it's insurance and annuities I'm using that term very vaguely You're talking to somebody who grew up East Coast, atlantic City, the boardwalk, and that picture of the clown that I have on the cover is. The publisher came up with three different pictures of clowns and I said, oh, it's that one, because I remember on the boardwalk in Atlantic City that's what the clowns sort of reminded me of.

Speaker 1:So let's talk about the future. Let's talk about where we're headed right now and some things that investors might want to be looking at and thinking about as we move forward. You have a whole chapter just on the future.

Speaker 2:Yeah, I think that gets a little weird. Not weird, but maybe I had a few drinks before I started writing this chapter. But no, and I think you're referencing the one chapter. It's called Asta La Vista Baby, which that's just the Terminator, which is a movie from the 80s, which that's when I was in the heart of my teenage years. But the Terminator was one of the original AI robots that I knew of because he was being programmed and constantly upgraded.

Speaker 2:I don't want to get into my real robotic stuff, but things have changed so much because what's happening is everything's wireless now. Remember when we had little furbies that were like these cool robots as kids and they talked. They only had one program inside of them and that was it. It could have never been updated, it wasn't learning, it was just there Now to say I think, just so people know that's what's amazing is you can have a robot now and it's constantly going to be learning. And not only is it learning, it's learning so much quicker that we are. That that's what's scared.

Speaker 2:But the books purposes back to investing Sometimes in the book. I got a little silly and I would go off on these funny little stories about. Japan has one of the lowest birthing rates in the world. It ranks like third from last. I didn't know this, but Japan's population is about to go from like 120 million to like 80 million, and that's because they really are into robots, even as partners, and it's funny. You'll have to read the book about that.

Speaker 2:But now what's happening with investing is there's things called robo advisors, and they came to the scene very quickly with big companies like Betterment and Wealthfront, and I think Robin Hood might be moved into that. But I even have one now. It's called Sustainfolio and I still have my core business, which is hey, meet for a cup of coffee. Human flesh is speaking to each other and that's really the core of what I do still. But I definitely see that in the next five, 10, 15 years, the young whippersnappers, which are people like in their 20 and 30s I make myself sound so old, but they may not need as much handholding as my parents did or even me. They're so prone to just go on their phones. So investing is now sort of sliding into this. Oh, you can be helped with a human, but I'd rather just go online and have the investing done for me through this thing called a robo advisor, and I only bring it up because I just wanted to let people know again for the betterment of the reader. Hey, just be on the lookout for these.

Speaker 2:And I do talk about how some of these robo advisors are being pushed by the evil banks of the world and they're saying that they're doing sustainable investing. But you're not going to help anybody because you're just putting your money back with that same entity who's lending it to fossil fuels. So I hope young investors see that. And so Sistine Folia was my way of saying hey, it's me here, I charge the same as the big guys, and at least you know that it's not being swayed towards Goldman Sachs or whatever like that. So that's what the chapter is sort of about is the robotic world is coming, and now AI, which that wasn't even on the scene chat, bt and all that stuff that wasn't on the scene when I wrote the book. And now there'll be another book about investing with AI and these chip companies like NVIDIA and AMD. It's a wild world. Right now we don't know where it's going to go.

Speaker 1:Right, but if you're continually thinking about and looking at what's down the road in terms of the future, it can begin to shape how you invest in things. And the second thing is that you can begin to influence which things are doing better by putting your money in them.

Speaker 2:Absolutely Like things like the metaverse, which I already mentioned, and even cryptocurrency, which, again, I'm not advocating to invest in that, but it seems to be sticking. You know, bitcoin and things like that and I do mention this in the book like meta at crypto. First of all, the easy one is crypto. Some cryptocurrency takes a lot of energy usage to develop these coins to mine for the coins. And there are certain coins again not advocating to invest in them that are using alternative energy to create the coins, so that's kind of nice. And there's two or three that I mentioned that if you're like, oh, if that really is important to you to be in crypto, you may want to look at those firms that are using alternative energy. And then the metaverse. This could be a topic that numerous martinis could go down over this, which is people say the metaverse and this apple just came out with their version of the metaverse, with these goggles that they're coming out, which are supposedly really amazing. You know we are people, we are humans, we need to interact, but there's a chance that the metaverse could actually help with sustainability and I don't want to get weird here, but you know there's a chance. Just like zoom, like we're doing right now. It could be limiting the amount of pollution we're putting out right, and the metaverse could be a way to do things that don't produce as much pollution.

Speaker 2:I think I'm trying to think of the example in the book which is, instead of going out buying those $300 pair of pants that were made in the middle of some third world country, the young kids maybe don't want to buy the pants now, but they will buy them for $5 in the metaverse and I know this is wild. And guess what happens? They don't even have the physical pants, although they can show their friends in the metaverse that they're wearing $5 cool pants. But they might have just saved a lot of waste and pollution because of the fact that they're not buying the physical thing Now. Our kids still going to be wearing pants, of course, but my mind is still spinning, and that's why I mentioned the martinis, because it takes a lot to think about and nobody knows the answer to this right now, which is there is this interesting future coming and you can invest in certain companies that I know for sure that are going to be benefiting from this. So, weird times, a weird time.

Speaker 1:Instead of flying across multiple oceans to go on a vacation, you could step in that metaverse and basically be walking down the street and and interacting with the monkeys in the monkey forest.

Speaker 2:Yeah, I mean, we all now, we all want to go to the beach and put our feet in the sand and feel the sun. But you definitely bring up an example of maybe. There's places that we could go together, like me and you, osha, if we want to go to I don't know, the Metropolitan Museum of Art right together and actually put our goggles on and say, hey, how about this Sunday, let's go, take an hour and go and we go there. It may cost us money because the Metropolitan is going to now be charging us to go there, but it's the same experience, except you're not there. It's going to be a weird dynamic because some places you still want to go, like you got to see the Eiffel Tower, maybe in person.

Speaker 1:Well, that's just because you need to have the, the cafe creme and that baguette with the cheese and that's right, you know certain things you have to do in Paris right.

Speaker 2:Yeah, that's right, new Orleans, like you can't you know you got to have a baguette in New Orleans. You can't just do it over over the Metaverse. But it's going to be interesting to see how this helps with really carbon emissions and things like that. But we're just in the early stage.

Speaker 1:It could also help tremendously in respect to parking spots, you know that just occurred to me. I was thinking OK, so very fun you got to park at the Metropolitan Museum or at the Opera or whatever, and you go in the Metaverse and you have to park.

Speaker 2:That's right. Oh, parking is. You know, I'm an East Coast originally, it's, it's the worst. And I'm not a hunker. I don't hunk my horn anymore. California has changed me. I no longer hunk my horn. But, yeah, and like you say, like a museum could be one thing, but I definitely want to let people know that also, we're going to physically still want to go places and feel things, but maybe a museum, if it's three dimensional and Mona Lisa's right there and I feel like I'm there, that's pretty good. And I'm not. Everybody should go to a good museum once in a while, but I do hope the museum folk are getting ready. They're, you know their business development. Folk are just like hmm, maybe we should be paying attention to this and make money doing. They could triple their, they could quadruple their emissions, still charging, maybe you know. So there's what a wild world.

Speaker 1:They were doing a lot actually during COVID. You know you could go to the art museum. I mean not go there, but you could see the art, you know they were making the art available so you could go visit the art you know on your screen. Nothing is ever going to take the place of walking among the trees and hearing the birds song and being at the beach and watching the waves and the seagulls and feeling the sand beneath your feet, of course, but it is interesting.

Speaker 1:And looking at the future and how things are going to be going. You know we also want to be investing in or at least I do investing in making sure that we do have a future for our next generations, that they have a place to live, that there is enough water, that there is air that's breathable, that they don't have to escape every year from the wildfires.

Speaker 2:Yeah, that's where sustainable investing comes in and you know we're all trying. There's so many new amazing things Like I think of I don't know why I thought of this like green bonds, and now there's a thing called blue bonds. We're focused on the stock market a lot, with my clients and you know buying funds that are getting rid of things that are leading to climate change and everything. But don't forget about the bond market, which a lot of retirees. They have half their portfolio in something called a bond and I won't go into the thing, but usually when you invest in a bond, you don't know what it's for. If Starbucks issues a bond, you don't know what it's being used for. But now these have grown so much in popularity In fact, they get bought up so quickly that they're hard to buy.

Speaker 2:A green bond is where Starbucks comes out. It has to get a third party stamp, but the proceeds of them issuing the bond say it's $100 million. They say this 100% of this is going towards solar panels on all of our offices or 100% of it is going to compostable cups. So they're issuing the bond because they need to raise money and then the investors gobble them up because people are like, oh, if I'm going to buy a bond, I'm going to do that, and then that's a green bond. So maybe your listeners can Google that. When we hang up, they go this guy was talking about that. And now I'm hearing and I've been hearing this for years and they haven't taken off yet. But blue bonds for water have to do with the oceans, health and things like that.

Speaker 2:It's really cool that the investing world is trying to do its thing. I mean, there's definitely the evil clowns that are still out there, but how cool is it. And it all comes from your listeners and you, osh, it's not me, I'm just a messenger. The change is going to happen when the investors know about these things, and I might have a client that's a surfer in Santa Barbara and they may come to me and say what's this blue bond thing, dale, can we put 50 grand into these blue bonds? Well, my job is I haven't seen them yet, they haven't been issued, like on Charles Schwab's platform, but it's the more of the investors are asking for that stuff. You know, I mean that's why ESG has grown exponentially, not because of me, it's because of the investors who are saying, hey, dale, find this for me, and then I have to. So it's happening, let's just hope we're not. We're not too late.

Speaker 1:Right, we do what we can. We're as much as we can and letting that money not sit passively while it's hopefully growing, but actually have it doing something good. That's a huge thing, and it's when you have somebody who is committed to sustainable investment that you're working with. That just makes it a lot easier, because they've done the homework for you. But we can also do the homework ourselves. That's the other way to go.

Speaker 2:Yeah.

Speaker 1:And I know that not everybody does. I know a lot of women give up their sort of sovereignty over their investments because it's complicated. I did for a long time and finally I just. I said wait a minute, you know wait a minute I'm going to empower myself around how my money is being used and what I'm doing with it.

Speaker 2:Yeah, good for you. Most of my clients are women, by the way, which is interesting, but they're generally the ones that sort of initiate, you know, because they believe. You know they have stronger beliefs, maybe, than us guys do, and you know. But and it's not young clients I mean, I definitely have my head full of young tech workers, but a lot of retired people who've done well and saved money and now they're like okay, I'm doing fine, I can pay my bills and enjoy my life and my retirement, but something sort of scratching at them with sustain. You know they're trying to, and maybe they've read something, but yeah, and to your point, definitely, my job is so much easier.

Speaker 2:It's not, it's not an easy job, but people come to me already convinced that sustainable investing is what they want to do, which is great, because that's what I do. And so, as a person, you have to believe in it first. You know I'm not here to convince people. You first have to be like okay, it's time for me to get rid of these evil Doers in my portfolio because it's keeping people up at night and that there's no reason for that. You should be enjoying other things and not worrying about a gun manufacturer, an assault rifle manufacturer sitting in your IRA.

Speaker 1:Right, right.

Speaker 2:Yeah, baby steps, baby steps.

Speaker 1:And one step would be to get this book. Where can they get it? Do they just go online, or can they get it at the local bookstore?

Speaker 2:Yeah, it is at the local Copperfields in Sebastopol and Santa Rosa and Penaluma, so it's there. Other than that, it's Amazon.

Speaker 1:So again, the book is called Don't Feed the Clowns Sustainable Investing for Everyday Life by Dale Wanin, and you will learn a lot in the book. I was surprised by how much information is in the book, Dale. I mean, you know and you have appendices in the back that go through all kinds of information and give you like, okay, if you're interested in this, go here, If you're interested in that, go there. So you give a lot of really good information. That's like immediately usable information.

Speaker 2:I love it. It sounds like you read it, Oshia. That makes me feel so happy. Yeah, Like I outlined every decade of your life. Don't, don't pay attention, but I help people like okay what do I? Do in my 20s? What do I do in my 70s?

Speaker 1:Yeah, Well, as I read the book, I thought, oh so he's going to make investing sexy.

Speaker 2:Yeah, that's right. I try, We'll see. One of the chapters is titled. You know, investing is just like sex, so I don't know. I was definitely trying to catch eyes.

Speaker 1:Right. Well, I think that'll grab people's attention and keep them engaged, because if they're laughing while they're reading, then that sort of changes the dynamic that they might have about. Oh, investing is difficult, like you know, but if you're laughing while you're reading and learning about it, it shifts your attitude towards investing, I think opens it up.

Speaker 2:Yeah, that's, exactly it so thank you so much.

Speaker 1:And now you have, your website is sustainvestcom. So sustain like sustainable, sustain vest VST.

Speaker 2:That's right yeah.

Speaker 1:So you can go there and learn more about Dale Wannon and get some information there. You can read his book and it just has been a pleasure talking with you today.

Speaker 2:Thanks, Ocean.

Speaker 1:I hope all of you listening have really enjoyed this and find it inspiring and stimulating. Thank you all for listening today. As you go about your week, have an inspired week and live your joy. See you next time.