InsurTech Business Series

The No. 1 InsurTech Podcast in Africa, for Africa, by Africans. Join us as we share thoughts, ideas about how technology and innovation can change the insurance industry on the African continent specifically in Nigeria. We would be having interviews & discussions with top industry C-Suites, innovators, InsurTech Founders, Investors from around the world. #IBSPodcast #InsurTechinAfrica

InsurTech Business Series

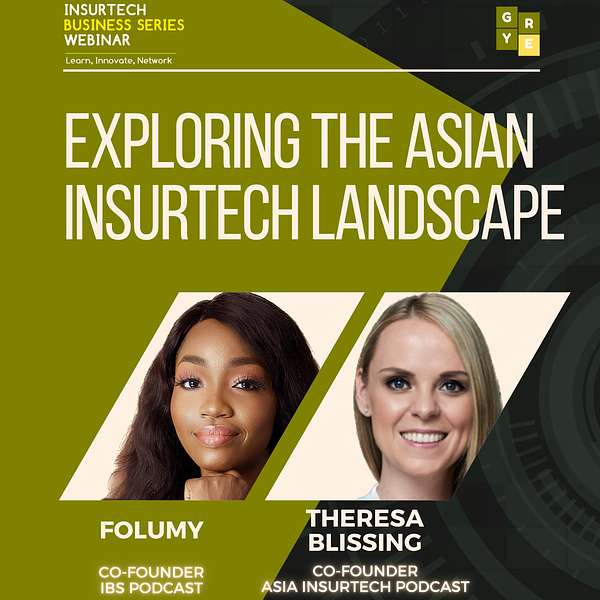

Exploring the Asian InsurTech Landscape

Use Left/Right to seek, Home/End to jump to start or end. Hold shift to jump forward or backward.

Do you ever wonder how the world of insurance is shaking up in Asia? You're in for a treat! This episode offers a deep dive into the evolving landscape of Asia's insurance industry, with insightful conversations with Theresa Blissing, Founder of the Asia InsurTech Podcast.

Theresa Blissing, a seasoned insurance professional who cut her teeth at Generali, takes us on a journey through her career, which has been steeped in insurance from childhood to adulthood and across both mature and emerging markets.

On the episode, we delve into the journey of One Degree, a Hong Kong-based InsurTech, and their innovative foray into pet insurance. We also navigate the fascinating world of Ping An, the second-largest insurer globally, and dissect its successful ventures and unique ecosystem strategy.

For all insurance or tech enthusiasts out there, this episode is a gold mine of insights and stories that promises to enrich your understanding of the industry. Its also amazing to see the uncanny similarities between the Asian and African market.

Get the Future of Insurance: Asia Rising here

Check out our free resources on InsurTech ecosystem and innovation in the African Insurance space here https://linktr.ee/insurtechbusinessseries

Join our IBS community on LinkedIn, Twitter, Instagram

Theresa, would you be happy to introduce yourself to Oliver.

Theresa Blissing:Yes, sure, thank you. Thank you for having me. Thank you so much for having me. Maybe a little bit of contact. My name is Theresa Blissing. I'm originally from Germany, but I have spent a decade living in Asia Pacific. The first time I moved to Asia was when I was working for Italian Insurer Generali. It was back in 2009,. So quite a few years ago, and that's when I really first got introduced to the insurance market in Asia and the different challenges, but also opportunities this continent is facing, compared to my home market, germany. Today I actually live in New York not necessarily my choice, but my husband is working for the United Nations, so we relocated to New York for three years. And, yeah, I'm really excited to be joining you here today and talk a little bit about my upcoming book Well, not upcoming, it's actually released today so really exciting day for me.

Folumy:Congratulations on that again, thank you, because that was a lot of work that we saw you put into that book. Again, like I mentioned earlier on, it was a good read. It was a side book, it was packed, and the learnings from that book that we've replicated across various insurance businesses across the globe. I know that your journey into the insurance piece started from if I'm correct, right Started from when you were young, because your parent already had exposure to the insurance space. So was there any point where you felt like I was just going to continue or pull that line? Or there was some point like no, I'm not doing insurance, my parents have been dead on that, and they just maybe found your way out and then came back into the industry?

Theresa Blissing:Yeah, that's a good question. So I was born into an insurance family. So when I was born, my parents were running an insurance agency from a house I grew up in. So we were living on the second floor and on the first floor there was the insurance agency. So inevitably, insurance was all around me Since the day I was born and I remember my parents talking about the challenges they were facing during lunch, during dinner not a very healthy work-life balance but somehow I still decided to go into insurance.

Theresa Blissing:But I decided against working in the sales area. My dad would have locked me to take over his insurance agency. He had built it with my mom and they were running it for 40 years. So there was certainly that hope from his side that I will take over the insurance agency. But it's not really my area. I don't think I'm a good salesperson. That's nothing I believe I am good at.

Theresa Blissing:So I decided to join Generali and it was back in 2004 in their like corporate life division and really had a great experience working for them.

Theresa Blissing:I worked 10 years for the Generali group and had a lot of great experiences, a lot of lessons learned in different positions I held with the company, but ultimately I came to this point where I asked myself, isn't there more in life than working for just one insurance carrier?

Theresa Blissing:And I was also a little bit disheartened, in a way, by the little change that was happening, and that was back in 2015.

Theresa Blissing:So before we had this whole insure tech wave and yeah, I just found myself questioning there must be more. And I also started reading about big data and insurance. And I remember there was Henri De Castries back then, the Chairman and CEO of AXA, and he said at a conference that big data is going to change everything in insurance. And I was really intrigued and I was working for one of the largest insurance companies in Europe and I knew that there was no big data. There was not even small data like any insurance incumbents, even today, facing issues with like siloed data, et cetera. And also from my own experience, I've worked on a major merger project between the German entity of Generali and a German insurer called Volksgesorge, and from that time, I still remembered how difficult it is for people to change their behavior, adopt new ways of working and especially if there's this fear of becoming redundant, right, and that's what we talk about when we talk about AI and data analytics.

Theresa Blissing:So, yeah, long, long story short, I decided to take a break. I went back into academia, did my MBA with a research component, so I did an academic research study on the adoption of big data in the Southeast Asian insurance industry and that was really my start into everything tech and later founded the Asia Insur Tech Podcast, worked with a bunch of great startups out of Asia and, yeah, I have kind of a second career in a way right Like first working for an incumbent and then working on the innovation side, and I definitely enjoy that and I believe the industry as a whole changed and also, like, generally, I left in 2015,. The company today is not the same anymore, and I think that's the case for many, many organizations. So what you found?

Folumy:out about the Asian insurance landscape. What was like the most? I mean, you talk about data analytics and then you talk about AI, but apart from the technology and innovation aspects you know, and the Asian insurance industry landscape, was there any other aspect of you know, that part of the continent that then drove your interest? Because, again, to say that you are not from the Asian space, and I know that because so generally you're introduced into the market space- yeah, it's a good question.

Theresa Blissing:So, you know, coming from a very mature and very saturated insurance market like Germany, right, and then when I was with with generally and also later, you know, looking in the Southeast Asian insurance industry, you find a lot of developing and emerging countries, right, if you're looking at Indonesia, if you're also looking at the Philippines, vietnam, etc. And that's also how my perception of insurance changed in a way, because in a lot of Western mature countries, insurance is just perceived as a necessary evil, it's like, you know, just something that you need to have. A lot of people are aware of the concept of insurance, but it's nothing that they really value. I guess it's just like that's what you do you have insurance, whereas in a lot of these emerging countries that, on the one hand, have a very low financial literacy but also insurance has a different importance because, after all, insurance is what allows us to take risks. That what is, you know, make economies and societies resilience right, because and I actually talked in the book with a company from Indonesia, koala, and they found a hardship and he also said, like there is no great risk, there is no great economy that got to this point without being well insured. So if there are bumps in the road, you are able to recover and you know losses and especially if we are looking at emerging markets, the value of insurance is different. Also, I feel like sometimes the perception is different and I believe there is a huge opportunity to reshape the narrative of insurance and not make it this you know necessary evil and something that you have to do, but really point out how important insurance is for the overall society and how it can help every individual, every company, to take risks and do the things they enjoy.

Theresa Blissing:So I think that was really when I moved to Asia for the first time with Generali and that was the time when Generali started like Generali Filipinas, Generali Indonesia, and like seeing these different challenges and how insurance is really a force for good and that's what these companies were working towards. I found that very inspiring and completely different to what I have experienced in Germany. But, with this being said, asia is not all emerging markets. You find Japan, which is one of the oldest insurance markets in the world. It's also one of the largest insurance markets and in the book I really tried to have a balance between the emerging countries and the challenges and opportunities they are facing, but also looking at mature markets like Hong Kong, like Singapore, like Japan, and also I have Ping An in the book, which is one of the largest insurance companies, and China actually has a higher insurance penetration than the US today. So I really tried to have this balance because I think there's lessons in all of these different stories, all of these different markets, all of these different type of companies.

Folumy:I mean it's sort of similar to what we currently have in the African continent, where you have like a larger trunk of insurance progress in South Africa. You then have, like the developing markets, which we call the emerging markets, which you have countries like Nigeria, for instance, kenya, or beginning to see a lot of innovation on that space, and that's what people are, I mean, despite being just, you know, bite-sized, but then it's growing. People are beginning to understand like the different cultural aspects. People are also beginning to engage regulators more often to say that there has to be like change in the way we've always carried out or done insurance in the past. So I sort of enjoy, or like, the similarities that we have. This would then bring me into discussions around your book. Like I said, I couldn't get enough of it, and then we have, you know, listeners that are willing to hear about it. First of all, I want you to talk about the book itself and then we can, you know, talk about three studies from the book.

Theresa Blissing:Yeah, sure, let me maybe start how this book come to exist. I mentioned briefly I started the Asia Insure Tech podcast. That was together with Michael Waetz, who was the podcast post, and we launched in 2019. And one of the reasons we started that podcast was because at that time it was like the height of the insurer tech wave. You heard a lot about what was happening in the West, like in, you know, in the US, with lemonade and a metro mile, or in, you know, in Europe, but there was very little on what was happening in Asia. And, for reasons you also mentioned, like in low insurance penetration, et cetera, you can't take a concept that works in a market like the US and apply the same concept in an emerging market Right. So Asia really needed its own solutions and there were a lot of great companies and I really wanted to give a platform for these companies to tell their stories and, to you know, discuss how insurance is changing.

Theresa Blissing:And when I started the Asia Insure Tech podcast, I connected with Brian Falchuk, who was the original mastermind behind the Future of Insurance series. So Brian and I connected. We had him on our show, I was on his podcast show and he then reached out and said like hey, would you be interested to write a book about the Asian market and you know the experience you had there and some of the amazing players we find in this market and publish it in my series? So that's what we did. So, for those who know Brian's first three books so his first book was on insurance incumbents or insurance carriers, the second one was on startup and the third one, which only came out earlier this year, is on partnerships. So for my book on Asia, I did not want to focus on either carriers or startups. I really wanted to tell what I believe makes Asia special, and that is what I feel at least around how they market products and how they design products.

Theresa Blissing:You find a lot of like bite-sized insurance products. You also find a lot of initiatives marketing insurance to the younger generation, because if you look at the country like Indonesia, where you have 50% of the population being under the age of 30. So these are all people growing up as digital natives, right, and at the same time, you have very low insurance penetration. So I find this very interesting how some of the players are market to a young and tech savvy population, but maybe with low financial literacy. So what I did.

Theresa Blissing:I have eight different companies featured case studies in the book and they really range from developed markets like Hong Kong, singapore, japan, china, as well with Ping An, but I also have examples of more like emerging markets, with India, with Indonesia through degree Malaysia. So, yeah, really tried to give that diversity. And also for people who have never worked in Asia, my aim was to really, even if you have never worked in that region, if you have never done any research on the market, the case studies are designed in a way that you also get a feeling for the country. What is it that they are struggling with? And I hope for me, for you, it was also easy to understand and get a feeling for what is this country like in a nutshell, and why have these organizations decided to operate in a certain way and capture the market in the way they did? Asia, just like Africa, it's a huge continent. There are huge differences, culturally, regulatory differences, et cetera, but still there are some overarching lessons learned and regardless in which market you are operating, those apply.

Folumy:Let me know what case studies that you find interesting and which ones do you want to dive into Reading the book sort of found interesting one degree and this comes from the regulatory point of view and how they were able to collaborate with the regulators to then design and to help them understand better their market, like the Hong Kong market. They were also able to then get like a virtual insurance license, which for some markets African markets for instance and we don't have this sort of innovation and that sort of stood up for me to see how do we able to work on the end with the regulator and do we able to get that license, albeit difficult at the initial stage.

Theresa Blissing:Yes, yes, sure. No, it's a great story and it's just. It's an example of what is possible if you're really passionate about something and really see an opportunity. So Hong Kong is a very small market. They have, I think, around like six, seven million people comparatively small population if you are selling insurance and we all know insurance is a number game, right. But Hong Kong has don't know the exact number, but around like a hundred licensed insurers, which is a lot in a market that has such a small population. So what happened was that the regulator said okay, we are not issuing any more insurance licenses, like we have already enough insurance carriers in the country, we are not issuing any new licenses.

Theresa Blissing:And then there came along Alvin Kwok and Alex Leung, the founders of One Degree, and they were really inspired all the digitization and they took a lot of inspiration actually from the US market and thought there's a huge opportunity to digitize in the Hong Kong market. So initially they thought they would start an insured tech, maybe just on the distribution side, but really quickly. When talking about the vision they had, they realized they wanted to be in control of product design and they wanted to be able to react to market changes quickly, because that is something a lot of insurance incumbents are struggling with, like adapt to change and really embrace change and react to market changes and there are a lot of different reasons for that, but that was something that was very important to the founders of One Degree. So they came to the conclusion that they really wanted to have a license and operate as an insurance area instead of partnering with an insurer and then be reliant on them for making changes and not being in full control. So what they did? They started working with the regulator in Hong Kong and pointing out all the digitization efforts that were happening in Western countries and, at the same time, the regulator was also thinking about making changes to the Hong Kong market Because, despite it being a very advanced and saturated market, online distribution of insurance is still really, really low. So, after the conversations they had and the inspiration the regulator took from the team at One Degree and the stories they're shared and again a reminder of how powerful storytelling can be Like sharing these examples and inspiring not only the founding team of One Degree but also the regulator in Hong Kong to say like hey, there's actually an opportunity in this market and we have to make that happen.

Theresa Blissing:So the regulator and other companies were pushing for that as well established a new insurance license, a virtual insurance license. What does that mean? Holders of a virtual insurance license are only allowed to distribute insurance using digital channels. So they can't have an agency force, they can't work with brokers that are selling their products, they really can only go direct to consumers through their digital channels, and that was something that one degree was also very passionate about. I guess if they had the choice, they probably would appreciate if they can also use agency force and other distribution channels, but that was what they were focusing on. So, yeah, when the regulator announced that there's going to be this virtual insurance license, they applied for that.

Theresa Blissing:Then everyone who has looked into starting an insurance carrier will agree how difficult it is. Like you know, set aside the situation that one degree found itself in in Hong Kong, where, at the point when they had this idea, there was actually no possibility to obtain a license. The only way to get into the market would be to acquire an existing insurance carrier. But they still pushed for it. And then, when it became possible, you still have a lot of other challenges to overcome, right, the capital requirement, so you have to raise money as a startup, which there are statistics that 90% of startups fail. Yet you are looking to raise, you know, huge amounts of capital to fulfill the capital requirements to be registered as a license insurer.

Theresa Blissing:And what was also surprising, in a way, was that the requirements the insurance authority in Hong Kong so the regulator in Hong Kong established for this new license, even though they were only allowed to sell online, were the same requirements as they had before for, like a traditional carrier license, and on top of that, they required additional cybersecurity measurements because you know the company would operate solely online. So, even if it's not a full-fledged license, the requirements to get it are even higher than they used to be when they were still able to get traditional carrier licenses, and took the team several years and hundreds of meetings with investors and they worked really close with the regulator also to understand. You know what are these requirements, what is like the system readiness, what terms of experts they need to have on board for the regulator to grant that license. And there's a good reason why regulators are that careful and have these strict requirements because they want to make sure that the company will be sustainable in the long run and will not fall than people who relied on those companies where they say keeping and you know their insurances are not left in the dark in a way. So really difficult to get an insurance carrier license, really expensive.

Theresa Blissing:But still, I think the example of one degree shows if you're really seeing opportunity and if you work together with the regulator and if you are embracing change, embracing, pivoting to find that spot that works. And one degree today is doing really well. They have actually started with pet insurance in Hong Kong, a line of business that was in the market for several years yet already, and a lot of them, a lot of people working in that space told them, like you know, we don't see a lot of opportunity there, but one degree identified that it was not marketed right. So they were able to come in and disrupt the market and even grow the market for the overall insurance industry in Hong Kong by, you know, putting a focus on that and putting a new twist and, you know, also looking product design. You know the reason they decided to go down that difficult road of studying in license insurance carrier in the first place so that control on underwriting, on pricing etc. Is what made them really successful in that space. And then you know consequently they added other businesses as well.

Folumy:The reason why I wanted us to dive into one degree is also because, like you said, for the Hong Kong market, back in Nigeria as well, you are not able to purchase or obtain new licenses from the regulators. You either have to, you know, merge or acquire an existing insurance organization or company. This has been quite difficult for, like insha texts that are looking to innovate and to what it is is insha text, then would have to maybe get like an agency license or an aggregated license and then come on board or a macro insurance license, whichever are the cases, and then a partner with existing insurance organizations. So this, in a way, it's actually a new innovative approach to looking at insha text that are looking to underwrite their own insurance themselves and, you know, carry on that risk and distribute the way or, however they want to, you know, via, like you know, virtual channels. So, again, this is one way that you know keeps home.

Theresa Blissing:Want to emphasize something right. Just because regulation says something is not possible should not necessarily be a showstopper. If you really see value and if you, the most important thing is, is that something that the people would like and would? Because, at the end, the role of the regulator is to make sure that consumers are protected. But if this is something that consumers are benefiting from, you know you can still go. And I think a lot of issues around innovation and insurance has been that insurance companies have been hiding behind regulations that like, oh, we would love to do something, but we can't. You know it's a shame, but the regulator won't allow us. So you know we don't bother. But and that's, I think, how inshotex around the globe has really reshaped this narrative on you know, working with the regulator and you can. You have seen this in other areas as well. Right, like when Uber first came up If you can show the regulator that there's an opportunity and that consumers will benefit from it, then there's no reason why you can't change regulation.

Folumy:Absolutely, absolutely. We're just going to move on to Adita, because Adita really like deciding your book is like the future of insurance. I enjoyed, or I love, their business model, as well as the business strategy. And then customer sensitivity is one key factor that I think a lot of people miss out on, especially when they're entering a market. Innovation is amazing, technology is great. Once you miss that customer need and one for a product, that can change the entire cost of the business.

Theresa Blissing:So if you just walk us through Adita, focusing on this customer sensitivity as well as technology, Okay, sure, yeah, actually I was debating and I explained in the chapter why I was debating with myself if I should feature Habitto, because Habitto they just launched in June of this year in Japan. Like when I had the first interviews with them they were not even live yet. And then the question is do you feature such an early stage startup where you don't know if they will make it right? Like what I said earlier, 90% of startups fail. But I felt it was a really good addition to the book because it shows the cycle of innovation. So Samantha Jotti, the founder of Habitio and the CEO, she originally worked in Europe, originally from Italy, worked in the UK, worked in the US and then got the opportunity to come to Asia and work at the deputy CEO for SingLife. So SingLife was the first new life insurance company in Singapore and actually the founder of SingLife wrote the forward to my book, walter the Odor. So, sam, she worked with Walter at SingLife and what they have built was a whole product which is not an insurance component but basically a payment debit card like a banking stack, essentially to used this as a pull product and designed it as a digital first, mobile first. That's what really Sam was focusing on when she came to join SingLife. Singlife later acquired Aviva Singapore, which is just crazy in my opinion. So a company that started in 2017, I think it was in 2020, acquired Aviva Singapore, which was much larger than them, and they designed a very interesting way to be able to do that acquisition, and Walter speaks in the forward about that. So, after SingLife had acquired Aviva Singapore the biggest insurance deal in Singapore's history Sam and also Walter and some others from the team they left SingLife and Walter started a new company called Chocolate Finance in Singapore. But Sam took a lot of the lessons she learned from working at SingLife, but also throughout her career, and wanted to point that at a much bigger market, and that's when they came to Japan.

Theresa Blissing:Now, japan is also a really difficult market to tap into, especially if you are a foreigner, because it's very insulated. Language barrier is a thing, cultural differences is a thing, and also Japan is a very male dominated industry. So you know, number one amazing that Sam, as a foreigner, started this company in Japan and what they were aiming for is. So Japan is the country in the world with the highest median age. I believe it's 48,. They have a huge issue with the aging population, and what is also the case is that I think over 50% of the country's wealth is with people that are 65 years and older. So naturally, financial institutions have been focusing on this, like older demographic, and agency distribution is like the number one distribution channel in Japan. But they have lost sight of the younger generation, like millennials. And so what Havito did when they decided to go into the Japanese market, they did a lot of research and they also talked to psychologists, and what they discovered is that the younger generation in Japan has a lot of financial anxiety because, you know again, an aging population puts a lot of pressure on any society when it comes to retirement, etc. So a lot of people age 30, they are really worried if they can afford to retire, you know, if they will be able to take care of their aging parents, if they will be able to afford education for their kids, etc.

Theresa Blissing:So this is when Havito came in, and they are operating under a new license that was rolled out by the regulator. So in this case, it was really a regulatory opening that enabled them to start that business model in Japan. So what they are doing is they are able, under this new license, to distribute a range of financial products, so banking products, management products, but also insurance products. Now, their pull product very much to what they have experienced or built with SingLife in Singapore was that they have a bank account with a leading interest rate. So that is what is pulling customers in, because they want to get that bank account where they can get the most interest for their money. And, interestingly enough, the company is financing these high interest rates with their customer acquisition costs, which, in the long run, is not sustainable. But that is why they really need to evolve this model and start upselling, cross-selling other products, and that is when insurance comes in.

Theresa Blissing:Right, and they have built essentially a mobile-first digital experience, but they still have human financial advisors.

Theresa Blissing:So people have the opportunity to talk to financial advisors, but in a digital manner. They have an app, they can text with their advisor, they can have video calls, etc. I think that is what is really powerful about Habito. They have the technology and they have a large emphasis on technology, because that's also what makes the business model scalable, but at the same time, they have that human component, that empathy, that talking to psychologists about what is it that people are fearing when it comes to financial freedom right and really combine this in a meaningful way. So, technology to make it easily accessible, efficient, great user journey, but still have that human component. Because at least when it comes to more complex insurance products like life insurance, health insurance, I think most of all still want to talk to a human person. But maybe the younger generation does not want to engage with an agent, arrange a meeting, having them come to your home, and it might not cater to the younger generation and that's really what Habito is doing.

Folumy:It was quite interesting because, looking at the aging population as well, for the shift in demographic, I think this is also one that is replicated as well in Africa. You have the more vibrant youths within the age range I think we have the youth vibrancy from about mid-20s to three, all the way to like 35. And this is like the larger trunk of the population size, right. And then we have the old money. We have understood financial literacy, the private group with financial literacy, since they're just starting out, probably be on the lookout for Habito and see how they are able to then upscale with this business model. I think it's all in compacting and, yeah, one of the very future of insurance. Yeah, correct, you just dipped that into Ping An, and the reason why we also wanted to have a view at Ping An is because I'm just going to give like sort of an insight into what we currently have for existing events. I mean, I work for AXA, my partner also works for AXA, so this just sort of touched on right.

Folumy:We've had financial institutions or we've had financial conglomerates back home where you have people dealing in the financial services, talking about securities, you're talking about banking, you're talking about insurance, and then you're talking about maybe wealth or pensions and all of that, but there is no synergy or there is no integration into that ecosystem. So you just have people. Yeah, we are like a group, so I like the group, but then you don't have that cross-selling, up-selling, you don't have a ecosystem that has been created over time and then technology also is a bigger part of it. I just want to use touch-based on how Pingan has been able to develop that ecosystem with scaling vertically, also establishing their own start-up like good doctor, for instance, and how they've been able to leverage on technology through them. You know, like I don't want to say distraught, but that's pretty much what they've done.

Theresa Blissing:I was really, really excited that I got the opportunity to talk to the Pingan team and completely to Jonathan Larson, who is the Chief Innovation Officer on Pingan and also the CEO of the Global Voyager Fund. So Pingan only started in 1988. And when Pingan started in China, they were hardly any privately owned cars. Today, pingan is the largest motor insurer in the world. So companies like AXA, who have been around for, you know, over a century and who are also operating in China right, like a lot of people say, yeah, but China is a big market yet. But AXA is also operating in China and in general, it is a lot of these big international companies, but Pingan is really a giant amongst giants. It's the second largest insurer in the world today. So how did they get to that? And I think one of the reasons they have been so successful is to, in a way, preserve their entrepreneurial spirit and to be able to connect different businesses in a meaningful way, like you mentioned, like you know how they grow horizontally. So some of you might have heard about the Pingan ecosystem strategy. So Pingan is not only an insurance company, but they have launched different ventures that are not necessarily directly connected to insurance. You just mentioned Pingan Good Doctor. So Pingan Good Doctor is a virtual clinic and health care service in China.

Theresa Blissing:When they first started it and that is, I think, what Pingan is doing really well like when they start a new venture, they really treat it as a start. So a lot of insurers who have embarked on corporate venture building what they do is they staff such companies or such ventures with people from within the organization, like the head of IT is now also running that tech venture, and that is often difficult because running a startup is very different to running an established insurance company. It has a different mindset, it has different challenges and also, to be able to attract the right talent, it is better to really have it separate, and that is what Pingan did Like. They created a separate venture, they got investors, they hired a team, not from the insurance incumbent, but a lot of them were actually coming from Alibaba, which had started in China as a digital platform, and initially Pingan was helping Pingan Good Doctor to scale by telling their insurance clients about this new digital health offering. But what has happened now over time and Pingan Good Doctor is just one example there's also AutoHome, which is like one stop shop for everything. So what is happening now is that Pingan gets 35% of its new business from its ecosystem partner. So people who are like on the Pingan Good Doctor platform or people who are users of the AutoHome company right, so they are able to use this as a funnel to then attract them to also buy insurance products.

Theresa Blissing:But again, what is remarkable is not that they set it up with the idea of okay, this is going to be another funnel for insurance. I think that is where a lot of insurance companies are failing. Ping An really set it up as an independent business with independent revenue goals, et cetera. Ping An Good Doctor today is a listed company, but then connecting it in a meaningful way and that can go in different perspectives, right. Like when Pingan Good Doctor first started, it was Ping An Insurance that supported Ping An Good Doctor to get their first users, but then after a while the effect reversed. So now Ping An Good Doctor is operating as kind of a funnel for new insurance clients for Ping An. So that is really impressive.

Theresa Blissing:What is also impressive is that Ping An defines itself as a technology first company. So they have a huge emphasis on technology. But what they are also doing is they are not only keeping the technology to themselves, and that is again something a lot of the big insurance companies are doing Like they develop their own tech and they see it as their competitive advantage. But the reality is developing a state-of-the-art tax debt is really expensive because technology evolves so rapidly if you just look at the rise of chat GPT in this year alone. So you constantly need to update it so it doesn't become a legacy and it stays top of the art and what Pingan is doing. They are actually also exporting their technology.

Theresa Blissing:So in the book there is an example that through their global Voyager Fund, they have taken a stake in a US startup called Snapsheak. So they are working in the US market when it comes to motor. Now Snapsheak is working with, I believe, seven out of the top 10 motor insurers in the US. Now, with Pingan's investment in the company, they also started using some of their visual flames technology they have developed in China and deploy it with Snapsheak in the US. So arguably, through that partnership and through the strategic investment, they are working in the disguise of Snapsheak with some of the largest insurance players in the US market.

Theresa Blissing:This is not only great because they were able to monetize their tech stuff, which enables them to then spend more money on tech innovation, but it also helps them to improve the model, because everyone who is familiar with AI and machine learning the more data you feed into an algorithm, the better it gets.

Theresa Blissing:Then you can argue that you have maybe different cars in the US than compared to what you have in China. By adding more variety to the model, more data to the model, you improve it, which then Ping An in China is again benefiting from. It's really unique how Ping An has built this range of different companies that are operating in different areas, like Auto Home, good Doctor, but also the tech stack they have built. Wherever there is an opportunity to monetize their technology or just build a new business model in itself, they are jumping it, and it doesn't need to be directly related to insurance. It's not about guiding your own innovation and seeing it at a competitive advantage, but seeing the competitive advantage and expanding horizontally and also monetize different parts in different ways. That is what is really unique and probably at least one of the reasons why Ping An is today second largest insurer in the world.

Folumy:Amazing. I like the fact that, in the words of the CCO for AXA who, would say that we should be coopetitive rather than engaging competitions, and that's collaboration with competitions. I think that's what Ping An has been able to do with their technology infrastructure. I think that's just the way to go. If you just talk about where people can get the book and how they could access you, what media platforms you are really on for other discussions around the book?

Theresa Blissing:Yeah, sure, the book is actually called the Future of Insurance, volume 4, because it's a sports book in the Future of Insurance series and then Asia Rising. So if you go to Amazon, all the Amazon stores have the paperback and hardcover issue of the book. There's also an Amazon Audible audiobook which I recorded, which was, frankly, probably the most difficult in the whole bookwriting experience, but, yeah, and there's also a Kindle e-book version. Just search for the Future of Insurance, asia Rising, or just search for my name. It's actually a very unique name. That's also the reason why I did not take my husband's last name, theresa Blessing. There it seems to be only one in the world which is me. So, yeah, if you want to connect with me on LinkedIn, instagram, feel free to send a connection request. Thank you very much.

Folumy:Theresa for coming to this session.

Theresa Blissing:Thank you so Folumy for having me Also on the day of the release of my book. Thank you so much. I really love chatting with you.