Climate Money Watchdog

Climate Money Watchdog

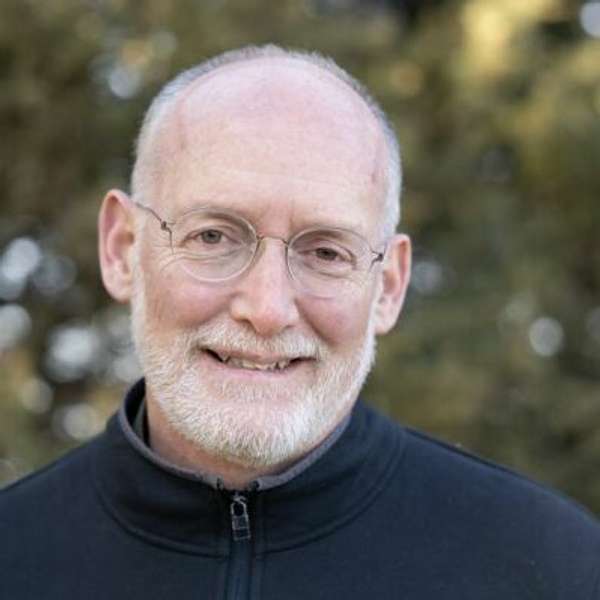

Problems with Q45 Tax Credits for Carbon – Paul Blackburn

Our guest tonight is Paul Blackburn of Pipeline Fighters’ Hub. Paul provides legal services on pipeline and renewable energy matters. He has worked on crude oil pipeline issues since 2008, and has experience in renewable energy policy and development. Paul represented nonprofit clients in the South Dakota Public Utilities Commission hearing on the Keystone XL Pipeline, and in the Minnesota Public Utilities Commission hearing on expansion of Line 67, another Enbridge pipeline. He has provided policy analysis and strategic advice on a variety of pipeline matters and authored reports on pipeline safety and oil spill response.

Paul started his legal career in Washington, DC, at the law firm of Van Ness Feldman, where he assisted clients in renewable energy and coal-fired power plant development, a variety of regulatory, legislative, and litigation matters, and Native American commercial law. After leaving private practice, he began a career in the nonprofit sector, including employment by the Sierra Club, the National Environmental Trust, and Oceana in organizing and media. He also has experience in community wind and solar energy development. Paul holds a B.A. in Biology from Macalester College and a J.D. from Boston College Law School.

In this episode we discuss topics including:

· An overview of the Q45 Carbon sequestration tax credit program

· Who benefits from the Q45 Tax Credit Program?

· How Fossil Fuel companies take advantage of the Q45 program and use it to continue to justify producing more fossil fuel

· Problems with the reporting system for 45Q to the EPA and IRS

For more information, see:

· The Pipeline Fighters Hub web site

· The Congressional Research Service’s page on the Q45 program

Visit us at climatemoneywatchdog.org!

Thanks for joining us for another episode of climate money watchdog where we investigate and report on how federal dollars are being spent on mitigating climate change and protecting the environment. We are a private, nonpartisan nonprofit organization that does not accept advertisers or sponsors. So we can only do this work with your support. Please visit us at climate money watchdog.org To learn more about us and consider making a donation. My name is Greg Williams and I learned to investigate and report on waste, fraud and abuse in federal spending. While working at the project on government oversight, or Pogo 30 years ago, I learned to do independent research as well as to work with confidential informants or whistleblowers to uncover things like overpriced spare parts, like the infamous $435 hammers, and expensive military weapons systems that didn't work as advertised. I was taught by my co host Dean eraser, who founded Pogo in 1981, and founded climate money watchdog with me in 2022. has spent 40 years investigating and sometimes recovering millions of dollars wasted by the Defense Department and other branches of government at Pogo, as an independent journalist, as an author and as a professional investigator. Our guest tonight is Paul blackbirds of pipeline fighters hub, provides legal services on pipeline and renewable energy matters. He's worked on crude oil pipelines since 2008, and also has experience in renewable energy policy and development. Paul represented nonprofit clients in the South Dakota Public Utilities Commission hearing in the Keystone XL pipeline, and in the Minnesota Public Utilities Commission hearing on expansion of lines 67. Another Enbridge pipeline is provided policy analysis and strategic advice on a variety of pipeline matters, and authored reports on pipeline safety and oil spill response. Paul started his career in Washington DC at the law firm of Vanness Feldman, where he assisted clients in renewable energy and coal fired power plant development, a variety of regulatory legislative and litigation matters, and Native American commercial law. After leaving private practice, he began a career in the nonprofit sector, including employment by the Sierra Club, the National Environment, trust, and Oceania In organizing, meeting in organizing and mediate. He also has experience in community wind and solar energy development. And Paul holds a BA in Biology from Alec Hester College and a JD from Boston College Law School. Is there anything else you'd like to share about why we're excited to have Paul with us tonight? Yeah, well, but

Dina Rasor:Paul and I met about maybe six months ago and with a group that's working and sometimes people think that things like you know, tax credits and things like that, make your eyes glaze over, let somebody else deal with that I want to deal with the environment, but they don't realize that wash it's the lifeblood interpreting the laws that have been passed is the lifeblood of, of Washington, DC. And what can happen is you can pass something with good intentions, but then it gets usurped by bad actors. And yeah, there are bad actors. Anytime you have this amount of money, you're gonna have bad actors. And if you don't believe that, then you're you're naive. And second of all, it it it is billions and billions of dollars that may be misused, wasted, and targeted correctly and will only hurt the climate issue of carbon sequestration, or whatever, you know, lack of having not much carbon because they want to the the these tax credits encourage carbon capture and pipelines and things like that, that we have found that just economically doesn't make sense. But the these new tax credits that are under 45 Q, there's all kinds of letters after various ones for various parts of programs. So Paul was written a series of blogs which we will have on our website that are written for the average person and fantastic because normally when you start to read this stuff, your eyes glaze over. You can't if you have to read it in the in its original bureaucratic accent in really dialect you can't really figure it out. So that's why I want to pile on because I know how good he is at explaining this stuff. And this is something that the every climate advocates should be concerned about. because it's it's a it's a highway of misspending for, and endorsed by fossil fuel. So with that note, editorial note, I'll let, Greg. I mean, Paul, I'm sorry, it's a long day. So I know tax issues are complex. But if you've heard about a series of blogs, so let's start out by you outline the history of this tax credit, how it affects climate and why it's important for climate advocates to understand its impact. So I'll turn it over to you all, and let him finally talk.

Paul Blackburn:Yeah, Dina, and Gregory, thanks for really, thanks a lot for having me tonight. And, yeah, it is a credibly important issue. It as Dina said, the, you know, climate policy and tax policy have lots of fine print. But it's really the fine print where the, you know, sort of attorney legal at the company attorneys and all the folks that scheme for the companies to earn a lot of profit, you know, everybody else's expense, really, really operate in the dark of these regulatory programs. And so the point of my blogs, which you can find it in bold wise.org, also, you know, is to try to help people understand how these schemes work. And, you know, they really are quite remarkable schemes and very audacious schemes that have been developed by the fossil fuel industry in conjunction with certain members of Congress and, and, you know, they're on their face, they're supposed to help the climate. But when you look at them closely, it's really important to understand that there's massive potential for what I call climate fraud. In other words, an effort to claim that this is going to help, you know, mitigate climate change, but really weld but also financial fraud, economic fraud, because there's also a massive potential for, for not only not helping the environment, but really ripping off the public to a massive extent. So we should really look at both of those issues, both climate fraud and economic fraud. So let's talk about the 45 Q tax credit, its history a little bit was originally passed in 2008. And back then, for every tonne of carbon dioxide that was captured at a facility and admitted at a polluter, the federal government would pay up to 20 bucks per tonne of carbon dioxide. So and that would be for carbon dioxide that sequestered meaning that it's just injected underground. But it would also pay $10 per metric ton for the carbon dioxide to use for other purposes. And the most important most significant those uses is called enhanced oil recovery. So carbon dioxide is a very is when it's made into 100. High pressure into a liquid is a very good solvent, it works really well to dissolve oil out of rock layers. So carbon dioxide can be used to get more oil out of the ground. And so again, the original amount was 20 bucks for sequester carbon, just stick it underground and dispose of it, and 10 bucks for carbon dioxide used to enhanced oil recovery. Well, that really wasn't enough to make any money. Anybody excited helped the oil industry on the margin. Only one project was developed in Decatur, Illinois, a demonstration project for sequestration, but it really didn't do much. So in 2018, Congress increased the amounts to $50 per metric ton for sequestration and $35 per metric ton for for hassle recovery. And at that level, it started to get folks attention, we started seeing some big projects proposed the Midwest, mostly related to the ethanol industry. You know, because that was enough money to make it worth it for them to do this. And, and so that these carbon sequestration project started, but then in 2022, Congress passed the inflation Reduction Act, and it made it did a 70% increase. So now, the tax credit amount is $85 metric ton for sequestration is $60 per metric ton for hassle recovery. And you know, these numbers don't really mean a whole lot to everyday people. But they mean an awful lot to the industry, because essentially, this is how much profit they're going to make. And that's one of the things about the 4545 IQ tax credit that is bad. And that is that the cost of capturing carbon dioxide is not uniform among industries, that natural gas processing plants and ethanol plants, called plants is a cost caching the carbon can be from 15 to $30 metric ton, well, they're gonna get $85 per ton for the federal government, that means that they're going to potentially turn, you know, 100% profit or more than 100% profit on that project. On the other hand, capturing at a coal plant may cost $50 $60, or $70 per metric ton. So they might still be able to do it, but it's not going to be wildly profitable, they should still make a profit in many of those plants. And the other added natural gas plants, the cost can be 8090 $100 $210 per ton. And those kinds of plants is not going to work. But the thing is that it's a highly variable interest cost industry. And the 45 Q tax credit is one price fits all, you know, and it just doesn't make any policy sense to to have some projects, you know, get massive windfall profits. And then other projects simply be on Economic, based based on you know, factors that are that can't be altered. So Yep. Great. You have a

Gregory A. Williams:question. Yeah, just my understanding is that carbon sequestration or enhanced oil recovery, or I've forgotten what the term is, but pumping carbon dioxide out of the ground to increase the the oil that you can drill is a profitable undertaking in most cases anyway. And so for the for the people who are trying to extract oil from the ground, this is icing on top of the cake, you know that this is a profitable business anyway, without these, these subsidies? Well, it's

Paul Blackburn:not it's only profitable in certain places, the historical recovery industry has been the technology is developed in the 1970s, in the first co2 pipelines was developed back then to and that they use natural co2, in other words, co2 that was naturally trapped into ground and they would drill wells down to it and pull the co2 out of the ground. And, you know, the cost of getting out of the ground was relatively cheap. So some, your projects work, but it never got to be a huge industry for different limitations. And the two major limitations was that there's only a certain amount of natural co2 in the ground. And, and so that means that they need anthropogenic or human produced co2 in large amounts to do this. And the other thing is that it wasn't really cost effective to use anthropogenic co2 because it costs a lot to capture this carbon dioxide in most facilities. So so that means that the two hold ups on massive rollout of enhanced oil recovery were limited amounts of co2, and anthropogenic co2 is too expensive. Well, the the 445 Q tax credit is intended to to eliminate both of those barriers, it's intended to produce large amounts of anthropogenic co2 at federal government taxpayer costs. So essentially, it massively subsidizes the oil industry, by, you know, essentially paying for all their costs of producing co2 and they produce co2 at for example, an ethanol plant, then they can earn a lot of profit at the capture facility plus, then use that co2 and enhanced oil recovery and earn profit on the oil. And, you know, some people might be thinking, well, getting more on the ground is great, but you know, folks should have him take a pause here and realize that if the oil industry is needing massive, federal government subsidies to be profitable, that's a that's a problem. You know, you know, should we really be subsidizing the oil industry in order to get oil out of the ground. And the reason the oil industry wants to do this is because right now fracking in most of the fracking fields has peaked, and is starting to go into decline. It's really just the Permian Basin, we're or fracking is continuing to grow, but it's not going to be infinite there, either. The oil industry has to look and plan, you know, years into advance. So they're looking 1015 years down the line, and they're looking at fracking, just simply peeking out and then going into decline. And all the oil industry, guys, the geologists, the field workers, the, you know, the consultants and everybody else, the drillers all want their jobs to continue. So they're looking for the next big thing. And for number of physical reasons, the next big thing is likely limited to be going to be co2 ER or nothing. But again, what does it mean if the oil industry needs massive federal subsidies to do the next big wave and I'm talking subsidies beyond anything that's ever happened in the past? So you know, This is this is a sea change in the way we're talking about oil development the United States.

Dina Rasor:Yeah, I mean, I, you get all doubled up with carbon capture and sequester? And is that going to mean that they can pump more gas out in our oil out, you know and keep doing that keeps their industries going. And when you there's a group of people in the climate community think this is the good a good transitional thing like they think nuclear is good transitional. This is a good transitional. And I always go back to what Bill McKibben of three bad guys started three fifty.org He put it down very succinctly because everyone goes and talks about, well, how much carbon can you capture? And how much will this help than this and that and this and that. And he just wrote an Atlantic magazine, the title was The Earth is on fire stop burning things. This is a very good bumper sticker for people who try to for people who come in from fossil fuel or other other Wellman's meaning people who get all hung up on this carbon sequester, and the building of pipelines that are, you know, they need to build more pipelines to do this. There are oil pipelines, and you know, how popular popular lines are these days? So I'd like you to comment on that, that how this is. This is kind of a fig leaf to keep burning things.

Paul Blackburn:Yeah, I mean, the oil industry is, you know, likes to talk about enhanced oil recovery with co2 Reduce making low carbon oil is the terms they use. And the thing is that the co2 is really the only substance that's going to work in large quantity for enhanced oil recovery. Because remember, anything, you can use other things for enhanced oil, recovery, anything, it's a good solid, you can pump on the ground, and it will get help to soak the oil out of the rock. But whatever you pump underground has got a lot of it's going to stay there. And so you want something you can pump underground in large amounts that you can just, you can just afford to leave there, your your pay to leave there. And co2 is the only thing that's really going to work for that. So, you know, if we didn't use this enhanced oil recovery using co2, that oil would stay in the ground. You know, that's the point, it doesn't, you know, if we didn't you do this, we wouldn't get that off the ground. And typically, you're going to see two to three times more carbon released from burning oil that's produced, that is captured that is pumped underground to get it out in the first place. So you know, this is likely to be a huge net carbon increase to use co2 for enhanced oil recovery. And I'll also say the 45 Q tax credit, does not require that companies commit to sequestration or enhanced oil recovery. They decide themselves, you know, on an ongoing basis, how much of the co2 is going to be used for enhanced oil recovery, how much is going to be used just go for sequestration. And you know, the oil industry even says they need both, they want to have a large amount of co2 running through the system. So they can use a France to recovery, but they don't need it all. And they need to have the rest of the co2, they don't need to go someplace else. So they're going to send that to a sequestration. So that all those three studies say that sequestration is a necessary commercial element of enhanced oil recovery, you need to have the co2 that you don't need go someplace, and then the people that capture it need to be paid. So these are not competing interests, they are coordinated uses of co2, both necessary for enhanced oil recovery.

Gregory A. Williams:And how are how reliably is that co2 That is theoretically sequestered? How reliably does that actually stay sequestered?

Paul Blackburn:That's a hard thing to say there. No, there's there hasn't been a huge amount of knowledge about this mean that yet the industry geologists will say it'll stay there for 1000s of years. But the thing is that when you put co2 Underground, it can come back up either through fissures or, you know, natural cracks in the rock, or it can come up through old wells. So you know, if you have like an old oil field, like there's in the Gulf Coast with 10s, of 1000s of oil, wells, pokin, all over the place. And you're gonna pump co2 around underground, the industry needs to confirm that all those old water wells are first known and identified in second, tight and that kind of rupture. Because if the co2 gets into a well that has been improperly kept, or simply not kept, or is old, and they didn't discover it, they're gonna pop the co2 Underground under extremely high pressure, and if there's any way for it to leak out, it will. So you know, in some sequestration, places where there's no other wells, there may be greater, some greater ability to predict that it's not going to leak out again, but even there, there could be earthquakes, natural fissures, or other mechanisms that are not sure about, but you know, in places where they're gonna use it for enhanced oil recovery Really, there's all kinds of wells, typically that's poked all through the earth all over the place. And if any of those wells are defective, and they weren't kept properly, you know, or they degrade under the co2 pressure, that co2 could come bubbling up. Also, if you have multiple operating oil wells in an area, the co2 can migrate from one field to another. And that's happened before where the co2 will be injected by one company, it will go through cracks in the ground, they didn't anticipate, and all of a sudden hits the oil wells or somebody else, it is not equipped to handle that much pressure, and it blows out the top of the there, you know, the neighboring oil wells. So, you know, they like to think they know everything that's going to happen and control it all. But the truth is that there's you know, that they make mistakes, there's things they don't understand, they don't know. And the soil the co2 has to make to be effective on climate change perspective needs to stand your ground for 1000s of years, you know, and what infrastructure we have 1000s of years old, that's not made out of stone.

Dina Rasor:Right. Well, then, let me ask you this question. What do you see these tax credits helping legitimate? No, I don't want to say that these this stuff is illegitimate, because they passed it for that. But clearly, there's a there's not a whole lot of excitement about subsidizing the fossil fuel to continue to do what it's doing. And so it had the 45 Q tax credit, help anybody who's actually doing true clean energy production?

Paul Blackburn:Well, the whole point of the 45 Q tax credit is to is to pay companies to convert co2 or fossil fuels, you know, hydrocarbons into carbon dioxide. You know, it's the dead opposite of a carbon tax. So the carbon tax, you charge the emitter the polluter per ton amount for how much for every tonne of co2 they emit. And it's a liability they have to pay to pollute. Well, with a 4050 tax credit, it's the dead opposite. We're paying polluters to produce co2. That has some pretty profound effects on climate policy in many different ways. And you know, this, this enhancement of the Florida who tax or through inflation Reduction Act, you know, it was the language was provided to the public about 10 days before the this very long, complicated bill was enacted by Congress. So we really didn't have a chance to go through and think about the policy implications of doing this for effective tax credit. But it's, you know, the tax credit is the dead opposite of a policy of a tax, carbon tax. And it really wasn't discussed that much, you know, but for example, if if a company wanted to do efficiency or conservation, or other means of just reduce or substitution of reducing their carbon emissions, if they have, if they have carbon capture facility, could have installed the facility for every tonne of co2 that they reduce through through efficiency, conservation or substitution, they will be paid less later earn less money from the federal government. So you know, this works if you tax credit will discourage conservation, discourage efficiency, and discourage substitution for cleaner energy sources. You know, if you were literally paying the polluters to pollute, we're turning carbon dioxide into a valuable commodity. You know, it's we're gonna kind of then we're going to create a national private sewer system of pipelines to take the co2 that they're being paid to make and put it underground. You know, this is just a radically different policy and it really wasn't discussed, but it has profound implications for climate change efforts in the future. But you know, again, carbon tax would say we're going to charge you$50 per ton for every tonne of carbon you get on the ground and then for FAQ tax credit says we'll pay you $50 for every tonne of the ground you put on the ground you know there's they're just simply completely incompatible with each other. So you know, the 14th Few tax credit and the inflation Reduction Act should be seen as a complete you know, it just killed the carbon tax and the carbon tax is no longer a viable policy as long as the 45 new tax credit is in place

Dina Rasor:well then I'm then that's one of the things that I wanted to try to to get at is that this is like the what would they call a Washington freight train hard to get started but once it gets started almost impossible to stop. Now that people aren't planning and making this helmet how much money is it estimated that might be available for this out of in this will be two taken directly out of the out of the federal employment money. Yep.

Paul Blackburn:Well, originally, the 45, new tax credit had a cap on it about 750 to half a one and a half billion dollars total. But the inflation Reduction Act remove the cap altogether. So now there's no limit on how much federal tax credit dollars could be committed to this program. You know, the big projects that we're proposing Midwest, one of which has since been cancelled, would have together per year, pulled out about three and a half billion dollars in tax credits at most. But that's just the first three projects and there's been dozens and dozens and dozens of them proposed, the tax credit is only so you know, ultimately, it could be 10s of billions of dollars, or maybe even hundreds of billions of dollars a year and tax credit commitments from the federal government. But you know, the tax credit, the perfect new tax credit present only lasts for 12 years from the date that of a carbon capture facility starts operating. But we know that if they're going to spend billions of dollars building these carbon, these capture facilities that those owners are not kind of well, what held them just go out of business in 12 years. I mean, nobody builds a big industrial facility expecting it to last just 12 years. So we know that you know, we for the 12 years is up if they build all these facilities, just like you said, you gotta be hard to stop because those facility owners are going to come in and say we need extensions of the 40 Front View tax credit, oh, by the way, make it more generous while you're at it. So it's going to be you know, the gift that just keeps giving to the fossil fuel industry. And, you know, another thing I'll just mention is that, you know, in North Dakota there are three coal facilities that were planned to be retired the Senate fuels plant, Great Plains, foods and fuels plant near Beulah concrete plant, coal plant, power plant near also near real but and then the project tundra, the middle and our young coal plant, all these coal plants are expected to be retired because they were no longer economic. And particularly the send fuels plant was always always heavily subsidized loans cost with subsidizes loans were repaid by the government, it was a very heavily subsidized project. And none of them were really economic anymore, because clean energy was cheaper. And so what happened was that all three of them have, well, they all proposed carbon capture and storage projects, the sun fuels plants, probably an operation and working. And, you know, this carbon capture for FAQ tax credit, back to the envelope calculation suggests that that sin fuels converting coal to natural gas than to be sold, that's in fuels plant with more than double its profitability, you know, because of the new tax credit. So basically, this was going to be retired and now this coal Sun fuels plant is is is likely to be wildly profitable. And the same with a coal plants that they haven't got those projects running yet. But But essentially, what they're going to do is use the 45 Q tax credit to justify keeping these coal plants in operation even though they were considered to be on economic until before it's our cue credit was expanded and 2022. So, you know, that's the kind of effort we were going to see when you start entrusting the fossil fuel industry, which has fought climate change and climate change for over 30 years, and you're gonna give them 10s, if not hundreds of billions of dollars to mitigate climate change. I mean, what could go wrong? You know, I mean, billions of dollars to mitigate climate change, so they're gonna really do a good job at it, you know, are they just going to take the money and run?

Dina Rasor:Well, just knowing Washington DC, that there'll be so many jobs involved, because the thing will have these plants will keep going on be jobs. And so what they'll do is that is that tax credit gets down to the time it will close, they'll all come in and say oh, my gosh, then I lose, you're gonna have to lay off all these people and this state that state this state that say that it all becomes an issue. This is what happens in defense all the time. And they you know, if they if you've got to kind of weapon they actually put out a chart showing where all the subcontractors are and how many states. And so once this thing gets started, and the other part of it that just drives me nuts, but it's the it's the culture of the two agencies that are overseeing it. Explain the UK, how do you get this tax credit? Well, you report, you self report to the EPA, on how much you're think you're capturing. And it's also sometimes it's not, it's not from exact measurements. Sometimes it's by extrapolation, which just to me is crazy. And then so the EPA gets it the EPA doesn't really know you know, they're not thinking of tax credits or anything else. They just and they don't verify it. And then they send it over to the IRS. And the IRS says, well, the EPA says you self reported this amount of tons and here's your here's your tax credit. How do you know if we aren't able to stop 4045? Q? Completely? How would you change the reporting system? So that is not a massive fraud formula?

Paul Blackburn:Yeah, well, let's talk about what the IRS does. Because you know, the IRS doesn't track physical shipments of carbon dioxide, they do dollar things, they don't do sciency things like having the equipment and pipelines and stuff. You know, they just care about the dollars. And to get the 45 Q tax credit, the official form with the IRS is only two pages long and making then some folks may only fill out a couple of lines, two or three lines and check a few boxes, and then they get their tax credits. That's the official form. Now, they also are supposed to do these model certificates, which report, you know, more detailed information, but those models don't have to be used. So they're going to reporting information about, you know, tax credit use on non standardized forms. And why is that significant? Well, for these big, the big US carbon capture projects proposal Midwest, you know, we knew that summit, for example, had over 400 investors, so each of those 400, investors might have a right to a tax credit share. So all of a sudden, you've got 400 different investors plus they had 32 ethanol plants signed up. So you're going to have in the carbon capture the fuel tax credit is is arises from the people that own and initially the car, whoever owns the carbon capture equipment. So you're going to have all these investors that all these different plants, and they're all going to claim tax credits. So the permutations and combinations of who gets to claim tax credits is pretty broad. So all these different individual claimants, not the companies that are capturing the co2, but the individual claimants are going to file claims to the IRS using these model forms which are not standardized. So they can, they can just put in a PDF, and however they want to report it, they can, that means the IRS isn't going to have a premade database of who's using these tax credits, they'd have to go back and look at all these customized form pick pieces of paper, try to enter the data into a unified database in order to figure out whether there's any fraud going on. But they're not going to do that. So, you know, the first part of it is that the IRS reporting is completely inadequate. It's just laughable. You know, and, and, clearly, Congress wanted seems to just they just wanted it to be as easy as possible for rich people to claim tax credit. You know, another thing about tax credits, we should just throw in your on the side is that they're most tax credits, and especially these are inherently regressive. You know, everyday people aren't going to don't have tax bills that require hundreds of millions of dollars of investment or tax credits. And so most of the people that are almost all the people are going to invest in these carbon capture and storage facilities are accredited investors, meaning people with over a million dollars or more of of investment funds, and people even richer than that. So, you know, this, these tax credits aren't going to help everyday people, they're going to help the oligarchs in our society, and that's really the only people that help. But then again, you know, they could do more detailed reporting, but they aren't. It's all just, you know, ad hoc reporting in non standardized ways. And, you know, the IRS doesn't even actually require that the EPA Sanlam, anything, anything, they just say that the the reports that the tax claims filed by the companies just simply need to be consistent with what they're saying to the EPA. But the EPA and the IRS don't talk to each other about this. So you know, they're two totally different agencies. And then the other hand, the PAs track co2 for a couple of reasons. One is to protect groundwater, what the heck does that have to do with the IRS? Well, nothing. And the other reason is, is for carbon emissions for how much you know, Herb is going the atmosphere. But they're not necessarily tracking where it comes from, how it goes through pipelines, who owns it, and that ownership can change. You know, how much of it goes to er, how much of it goes to sequestration. And even then they could pull it back out of the ground for a sequestration site or an ER so I can pump it to someplace else. It could go through multiple hubs through multiple pipelines. So it's a very complex system. And the EPA isn't tracking isn't prepared to track the complexity. So you have two agencies that do totally different things that don't talk to each other, and don't you know, actually track any data that's going to be useful to enforce the fourth IQ tax for hit. So the chances of fraud here are just, you know, almost seems like almost inevitable. Because it'd be basically an unenforceable tax credit. It's.

Gregory A. Williams:So I'm going to move here. And I understand something you mentioned a couple of minutes ago, which is you, you were describing all the different parties that might be involved in carbon sequestration, you know, sequestering the same, the same carbon. And if I understood you correctly, there's really nothing to stop all of them from claiming the same carbon to the EPA and the IRS.

Paul Blackburn:Well, they're not supposed to, but there's no reporting to say that they couldn't double dip massively. You know, how's the IRS going to figure out if they're double dipping? If, if, you know, and the other thing is that the first the carbon credits are created by whoever captures the carbon, and then they can transfer those credits to either anybody who owns an injection well, either for enhanced oil recovery or for sequestration. So you know, all those people that the ethanol on carbon capture over the ethanol plants for the big Midwestern projects could then transfer their co2, carbon cut their carbon credits, to enhanced oil recovery operations, or sequestration sites. And those can all be owned by multiple partnerships, you know, part joint ventures or corporations, which split up the tax credits. So these tax credits are gonna get missed and parsed, to go to whoever whichever rich people need them the most. And, you know, so that means that it's, it's, you know, it's going to be virtually impossible to track all that moving from through all these parties.

Gregory A. Williams:That sounds like you know, if somebody installed solar panels on somebody else's roof, and then that person rented that home to somebody else. There don't seem to be much in the way of guardrails that would prevent all three of those parties from claiming that, that tax credit.

Paul Blackburn:Right. And although it gets even worse, because it's sort of like, well, if you had, you know, two dozen people on the part, some share of the solar panels and, you know, on the roof, and then they could split them back and forth, and share them and trade them around, you know, like playing cards, like, you know, baseball cards or something. You know, that's, that's what that's the situation, there just really isn't any, any structure. And the tax credits Congress in the flesh Reduction Act specifically made them made up did amendments to make these tax credits very fungible or transferable between parties. And in fact, for nonprofit organizations such as public utilities, meaning Rural Electric Co Ops, and municipal utilities, they can actually just be paid directly for their tax credits, rather than claiming, because they don't have they don't pay any taxes. Since they're nonprofits, the federal government does pay them cash for the value of those tax credits. And other entities can do that as well. And so you know, then finally, I say, with the tax and not finally, with whatever the tax credits is that because these are all claimed on tax returns, and tax returns are by law confidential, all these tax credit claims will be confidential and unable, and citizens will not be able to know who's claiming these tax credits. So it could be corporations, it could be fossil fuel industry, it could be private investors, it could be members of Congress, there's nothing stopping members of Congress who are millionaires or billionaires and cashing in these tax credits. But because it's done via it's all claimed on tax returns, it's all secret, it's all confidential. So you know, it's impossible, it'll be impossible for anybody but the IRS to even attempt to terminate those fraud, and then prosecute those who are conducting fraud. And again, if the IRS is reporting requirements are so weak, that, you know, they the people have this report in an ad hoc way, using forms or whatever form they want, and we've got 10s of 1000s of people reporting the IRS, you know, the IRS isn't gonna be able to enforce it, that means nobody's gonna be able to enforce it in the industry is gonna be able to figure out that it's unenforceable, and even if they got caught. They could say, well, this is also complicated that we didn't really know what you will pay you back and it's okay. You know, and they'll and they'll just fake it and, you know, and, and not get and gets risk slapped, you know, by the IRS. So this is just completely set up to be to be a massive rip off from the very wealthiest in society of all the rest of us who are who, who then would be have to absorb the budget deficits that go up to pay for this program.

Dina Rasor:Well, now that we are all thoroughly depressed, no England Where the billions of climate money may be going? And you know, when you and your the various groups are banding together to publicize this? What would you suggest? You know, what would you suggest to help stop the bleeding? And what would you suggest to stop the need to put guardrails into the situation? Or can you actually stop this credit? Is it too late?

Paul Blackburn:Well, I think that the environmental community first off should really take a hard look at this, I know that there were a lot of folks who bought into the original initial push for the inflation reduction, I thought it was the greatest thing since sliced bread. And, and you know, those who supported it should really take a second look at the 45 Q tax credit and look at it very carefully in terms of its actual regular statutory regulatory language to understand what it is and how it operates. Because the potential for climate fraud here is nificant. And it was passed with a lot of green environmental organization support. So first off, I think that the folks who are supporting the IRA in carbon capture and storage in the environmental community really need to take a second look at this. For everybody else, you know, we're planning a series of efforts to publicize these concerns and to propose congressional statutory fixes to put guardrails in this program, for example, requiring the IRS have uniform standardized reporting that's entered into a database so that they can hopefully track who gets carbon captures carbon credits, we also want what's called a cradle to grave tracking so that we know where the carbon is produced, who owns it, if it's sold to somebody else, because it's a commodity, who it's transferred to, and how those tax credits follow the carbon dioxide to a sequestration side or hassle recovery or some other facility. You know, there needs to be crale from where the carbon dioxide is first produced to grave where it ends up on the ground. And that tracking needs to be like invoices. And the same thing is done. Similar things are done for hazardous waste. So you know, it has this way to generate there's generated this cradle to grave tracking, the generator has to have paperwork, they can't have it to a shipper that ships it to a hazardous waste disposal facility, they all have paperwork has invoices, and and and manifests up manifests, and then certifications that it's properly disposed of. Well, the same kinds of cradle to grave tracking needs to happen for carbon dioxide, and it needs to both be usable by the IRS for IRS purposes, but it also needs to be used usable by the EPA so they can track carbon emissions. You know, another thing about the this carbon capture and storage is that capturing the carbon dioxide, compressing it pumping it through pipelines, compressing, pumping on the ground is very energy intensive and resource intensive. And yet the 45 year tax credit program does not have any net carbon doesn't doesn't give benefits based on net carbon sequestration. It only gives benefits based on gross carbon injected underground, either for enhanced oil recovery or or or sequestration. So you know, there really should be a net carbon sequestration net carbon benefit amendment to the Ford effect new tax credit, so that we aren't, you know, subsidy subsidizing projects that ultimately ended up emitting more carbon into the ground and they are into the air of the night supposedly underground. There's a lot of different guardrails that could be done for this program. And we're going to be proposing those and hope that people support that, you know, whether, you know, whatever side of the political spectrum you're on, we don't want to have massive fraud of public tax dollars. And you know, whether you support carbon, really believe climate change is real and support carbon mitigation. You know, we don't want to have this simply be a massive fraudulent ripoff that increases budget deficits and makes everybody poor at, you know, the oligarchs expense, that and the benefits the oligarchs.

Dina Rasor:Okay, well, that pretty much answers my questioning. Greg, do you? Is there anything that you would like to add or, or ask about,

Gregory A. Williams:but I just wanted to ask you so you've, you've said we're doing on a number of occasions, and I'm wondering if that's the pipeline fighters hub, the anti carbon sequestration community in general, or are there other organizations you'd like to point our listeners to for more information or ways to protest paid in the fight against this kind of fraud. Yeah,

Paul Blackburn:there are a variety of different organizations that are working on this both at a federal level and at a state level and project level for these carbon sequestration projects. And and, you know, rather than trying to name them all here, because I'm going to forget, what I would suggest you do is go to the, our website, pipeline fighters hub, and and look at look at where we have all the materials we have there and just search online and Google, there's the science, Environmental Health Network, the Center for Biological Diversity is working on this. There's Deena and Greg's organization. And a number of other, you know, policy experts that are working on this. So we think that there's, there needs to be a growing awareness of this effort, and we are growing that awareness, but it's going to take time to do it. Do you have any folks that you would suggesting that should be the people could be referred to here? No,

Dina Rasor:I would just highly, you know, what I would suggest, if anybody's, you know, in a lather about this, which I hope we've been able to do is one have the, you know, pass on this podcast, which helps because a lot of people don't have time to read a lot of tech stuff. But I also would say, if you really want to get a good grounding on it, go to go ahead and go to Paul sights and look at the series we'll have, we'll have connections to it on our on our blog, and go to the various blogs that he wrote upon this and articles he wrote on this, because he's gives you lots of good, solid information and passing that along to other people, is probably the most important thing. And one of the reasons we do these podcasts is that when somebody comes and you know, you think if there's a politician or a staffer in Congress that doesn't really understand this, you can send the link to this podcast, and they can just sit down and listen, because I, you know, I know that thing in Washington DC, if you keep adding on what people read, it doesn't get read. But this is the kind of thing that they can listen, on the car in the car on the way home, something like that. So that's why we're doing these kinds of things, with very highlighting various activists. And that's why I wanted Paul on because I knew that he he, he was able to explain a very Byzantine attempt at the government to do something that's actually turning out to be rather stupid.

Paul Blackburn:Yeah, I mean, campaigns to stop this kind of thing. You know, first, we need to do a lot of public education, we're still in that phase. Ultimately, we'll start to develop political power as more more people understand what's going on. And, and then we'll have specific actions that people can take to stop this. But remember, and this is potentially hundreds of billions of dollars that the fossil fuel industry wants are up against some very powerful players. And it's gonna take a while to build power to push back on this. And also, there's been a lot of I think, misrepresentation about the potential benefits of carbon capture and storage and the potential risks. And the more that that the people who care about climate change are aware of these risks, the better. Because, you know, frankly, this is being pushed to a significant degree by the Biden administration by Democrats. So we frankly, need to start pushing back democratic representatives and senators and also President Biden to say, hey, you know, there may be some role for carbon capture and storage, which, you know, is was is mostly understood to be industries like coal, and like the steel industry and the cement industry, but this tax credit doesn't prioritize them. But you know, there needs to be guardrails on this. Otherwise, it's just going to be one big, huge, massive ripoff. And it's kind of, you know, we're gonna look back and see that the fourth hukou tax credit, didn't do anything for climate change, and instead, really hurt our country's economy, you know, and then built all these potentially built all these pipe dangerous pipelines all over the United States. And we already talked about that. Just how dangerous a major pipe co2 plan is, if eruptions. You know, the potential for mass casualty events from these pipelines is real. You know, so there's just a huge amount to understand and no here. But again, you know, the industry hires tons and tons of attorneys and policy people, lobbyists, and they all scheme about how to do this. And so their scheme here is to pretend to be helping the climate while ripping off the public to the tune of hundreds of billions of dollars and continuing the fossil fuel industry indefinitely. It's quite a devious and remarkable scheme and audacious scheme, but it also has some very obvious vulnerabilities and slaws and as time goes on, I think we're going to see the truth about the 43 new tax credit coming out more and more.

Gregory A. Williams:So we will do is, Dina said, Put these links on our blog. But they will also be included in the description of these podcasts, as they're represented in all of our different syndicating partners. So whether you consume this on Apple podcasts, or Amazon, or any of any of the popular podcasts indicating platforms, you'll get all of these links. And if you pass on the podcast, you will be passed on all of those links as well.

Paul Blackburn:Just add real quick, the blogs didn't were all written before the inflation reduction that came up. So I haven't gone back and updated them, I should really do that. But they assume that the 2018 bills in place. So the thing is, this situation is the worst, it's much worse now than it was when those blogs were written in terms of the potential financial liabilities faced by taxpayers, but most of the basic structure is still there. And those blogs, I think will help folks understand this relatively complex situation, in common sense terms.

Dina Rasor:And you do have articles to in the same place where you list the blogs where you have updates in different different publications like The the hill and other places where you update the blogs. And so it's it's easy to find that information.

Gregory A. Williams:And so we encourage our listeners to read from as many different sources as they can. But regardless of what source you're consuming, always ask the question, you know, where's the money going to, you know, who is benefiting from this? You know, it's the classic advice to follow the money. And if it's not clear from the article where the money's going, then, you know, I encourage you to question the integrity of the source. So with that said, Is there anything you'd like to add as final remarks?

Paul Blackburn:No, I just thank you for having me on tonight. And again, people should really look into this because it's a huge issue for climate change. It's a huge issue for our health department, financial health of our government, is a huge issue for equity in how we're spending our tax dollars. So, you know, we all need to work together, we're trying to take back our government from the people who are just simply ripping all of us off.

Dina Rasor:And we're gonna keep following this. We're gonna keep sorry, right? We're gonna keep following this so that when you get to the point where you're actually starting to present it to various members of Congress and things like that, that we'll have another podcast on maybe if you and another person talking about Okay, now we're trying to do something about it, and this is how you can help.

Gregory A. Williams:All right. Well, thank you very much for joining us tonight, Paul. Thank you.