Financial Wellness at Work

Financial Finesse Financial Coaches work with people from all walks of life and have literally seen it all! They’ve supported employees and participants (and their families) through debt, cash flow, and credit challenges, buying homes, growing their families, marriages and divorces, retirement planning, and more. Financial stress doesn’t exist in a silo – it influences everything, including mental and physical health, relationships, and productivity. We’ll dig into it all.

Financial Wellness at Work

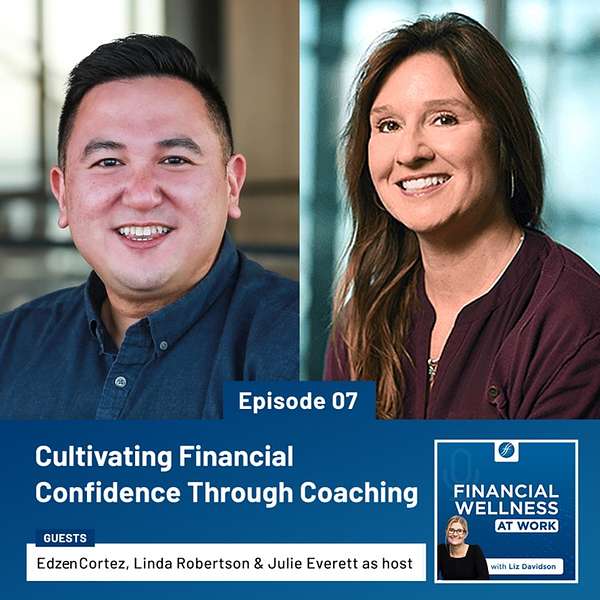

Cultivating Financial Confidence Through Coaching

Use Left/Right to seek, Home/End to jump to start or end. Hold shift to jump forward or backward.

Managing our finances is one of those things we all need to do, but we rarely are taught. While we all do the best we can, there are times when our lack of education can land us in challenging situations. Today’s guest, Edzen Cortez, was in a great deal of debt before he sought help from a Financial Coach. He was recently featured on a panel at the Employee Benefit Research Institute symposium in Washington DC where he spoke about how achieving financial wellness has increased his bandwidth, both at work and in his personal life. In this episode, he joins us with his Financial Coach Linda Robertson to share his story. Tuning in you’ll hear about the situation he found himself in, what prompted him to seek financial coaching, and how it has radically changed his life. He also talks about how he has managed to work his way out of debt while still being able to enjoy a vacation in Hawaii and adopt a dog. If you, like Edzen, want to live a little bit more carefree and increase your bandwidth, don’t miss this episode!

Key points from this episode:

- Edzen Cortez’s background and what prompted him to reach out to the financial coaching line.

- The homework Linda gave Edzen to research the amount of debt he was in.

- Where Edzen is today in terms of his finances.

- Edzen’s recent vacation and how he planned for this responsibly.

- How Edzen thought through the financial responsibilities of getting a dog.

- The importance of planning for some fun while still staying within the parameters of your budget.

- How things feel differently now for Edzen.

- How Linda and Edzen’s conversations have changed over time.

- How achieving financial wellness has increased Edzen’s bandwidth both personally and professionally.

- Linda’s thoughts on the first step for anyone considering financial coaching.

Quotes from this episode:

“I’ve become way more responsible and what Linda [my financial coach] has done for me is cultivate that confidence and given me a couple of steps to think about before just impulse buying.” — Edzen Cortez [08:47]

“I had a budget, I had saved up money, but it was the weirdest thing to go on a real vacation and not stress out about every single dollar being spent.” — Edzen Cortez [13:50]

“To have paid off the credit card debt and the private loans just created so much more space, bandwidth, capacity, and it freed a bunch of my mental strain. It allowed me to really focus in on work, the relationships, becoming a people manager and leader on the team, and turning the page to becoming a proactive problem-solver.” — Edzen Cortez [18:40]

“To have this benefit [of financial coaching] has led to a better quality of life, personally and professionally.” — Edzen Cortez [19:24]

“Just come as you are, bring your true self, be open to answering all the questions your financial coach is going to ask you because some of it is going to be personal.” — Linda Robertson [20:11]

Links mentioned in this episode:

Julie Everett, CFP® on LinkedIn

Linda Robertson, CFP® on LinkedIn

Employee Benefit Research Institute

Financial Finesse

%20-%20Founder%20&%20CEO%20of%20Financial%20Finesse%20-%20headshot.jpg)