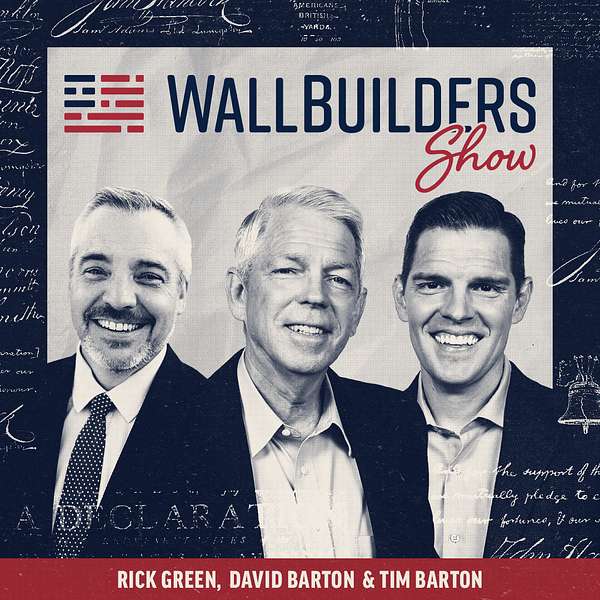

The WallBuilders Show

The WallBuilders Show is a daily journey to examine today's issues from a Biblical, Historical and Constitutional perspective. Featured guests include elected officials, experts, activists, authors, and commentators.

The WallBuilders Show

The Surprising Constitutional History of Tariffs and How They Shaped American Prosperity- with Bill Federer

The forgotten economic foundation of America lies hidden in plain sight - tariffs. For over 150 years, these import taxes funded 90-95% of the federal government while simultaneously protecting American industry and workers. This eye-opening exploration of tariff history challenges everything we've been taught about international trade and taxation.

Bill Federer takes us on a constitutional journey beginning with George Washington's Tariff Act of 1789 and the creation of the Coast Guard specifically to enforce these vital revenue mechanisms. The narrative weaves through America's industrial revolution, where tariffs enabled northern factories to flourish, creating the fastest rise in living standards humanity had ever witnessed. Women were liberated from menial tasks as factory-made products transformed daily life with ready-made clothing, indoor plumbing, and modern conveniences.

The prosperity of America's Gilded Age stands as testament to the effectiveness of tariff policies, with ornate public buildings and infrastructure developments showcasing the nation's wealth. Everything changed with Woodrow Wilson's introduction of income tax on the wealthiest 1%, later expanded by FDR during World War II through paycheck withholding - a clever mechanism that obscured the true tax burden from workers.

Most surprising are John F. Kennedy's economic insights, which mirror today's tariff debates. Kennedy recognized that high taxation drove American capital overseas and advocated for tax cuts to stimulate economic activity. His assertion that "tax rates are too high, tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut tax rates" offers a profound perspective on current economic policy discussions.

Ready to challenge your assumptions about tariffs and discover how they shaped American prosperity? Dive into this provocative historical journey that reveals how returning to constitutional funding mechanisms might address today's economic challenges.

Rick Green [00:00:07] Welcome to the intersection of faith and culture. This is the WallBuilder show taking on the hot topics of the day from a biblical, historical and constitutional perspective. And we're going to get some history today on a topic. I never thought I'd be able to get the history on that is tariffs. Hot topic in the culture right now. And Bill Federer is with us to give us some of that background. I'm Rick Green. We'll have David Barton and Tim Barton with us a little later in the program. But Bill Federer joining us now to talk about the history of tariffs. Love you, brother. Appreciate your time today, man. Thanks for coming on.

Bill Federer [00:00:34] Well, hey, Rick, great to be with you. Oh man, I'm telling you, this can be a fun topic today because normally when we're talking economics or taxes, everybody's falling asleep. But right now, tariffs has everybody's attention. And so David dibs that, man, we got to get bill Federer on. They'd seen some of the things you had already given some of the history on a tariffs and all that said, man let's get bill on and, and get an education. So I bro, I'll just going to throw it at you a real easy one. I mean, tariffs, are they constitutional and are they good or bad economically and take it away, bro.

Bill Federer [00:01:05] Yeah, well they are constitutional. Article 1, Section 8, authorizes the federal government to collect duties and imposts to pay the debts provided for the common defense and the general welfare of the United States. Duties and imposes is another name for tariffs. And this was the number one way the federal government raised its money for a century and a half. Matter of fact, the second bill George Washington signed was the Tariff Act of 1789, which imposed a 5% tariff on all imports. And Alexander Hamilton, the Secretary of Treasury, and what's he supposed to do? Raise revenue for the federal government. And since revenue came from tariffs and you had foreign governments wanting to avoid the tariffs, they would smuggle stuff into America by taking their ship to another place instead of going into a port. And so Alexander Hamilton started the Coast Guard to catch these smugglers. And since the fastest ship of the day was called a cutter, these were called revenue cutters because they were chasing down revenue to support the federal government. Now, industrial revolution. England used coal. Coal mines would fill up with water. In 1769, James Watt, discovered or invented a steam pump to pump water out of coal mines. It quickly turned into the steam engine and it ran factories where they made textiles like cloth and shoes and leather items. So the factories were in England and the British discouraged manufacturing in the colonies because they wanted to market for these goods that are manufactured. And once we became free from Britain, we wanted to have factories here. And so Thomas Jefferson in 1816 said, it may be the duty of all to submit to this sacrifice to pay for a time and imposed on importation of certain articles in order to encourage their manufacture at home. So I was like, okay, we're gonna have to- You know, we may have to suffer paying a little bit extra for a while, but it'll give our country a chance to catch up, we'll build our own factories, and then we won't need to import stuff. And so it worked. We saw this mushroom, this explosion of factories. Now, admittedly, most of them were in the North, but they had steam powered spinning jennies. What's that? Well, they would take wool, like from sheep, If you put it under a microscope, it has these little barbs and hooks, and they would hook together, and the more you pull it, the tighter it gets, and it gets thinner, and it turns into thread. And so instead of a woman sitting at one of those wheels spinning the thread, the spinning jennys would do this really fast, and then they would weave with looms, L-O-O M-S, and they could make the bolts of cloth. And this had the effect of freeing women up. From menial tasks like sitting there spinning thread, weaving cloth, sewing clothes. Now you could buy an entire bolt of cloth really cheap or you could even buy ready-to-wear clothes. Imagine that and then instead of washing clothes in a wash tub and hanging them on clothes lines, the women could have a washer machine and a dryer and instead of carrying water in buckets from a well you could have pipes manufactured in factories. Bring in the water right into your house. So instead of going to an outhouse, you could have indoor plumbing. These things basically freed women up from these menial tasks. And so America saw the fastest rise in the standard of living in human history. And it worked. And so by the 1812, the tariffs were on 12%. And then they went up to 25% after the war of 1812. We had the war.

Rick Green [00:05:21] Hey, Bill, let me ask you a question. Do you remember if those were across the board? Was it a straight-up tariff across the board for anything coming in, or did they pick certain products?

Bill Federer [00:05:32] Back then it was pretty much for everything. Yeah. Now they did have another small tax called an excise tax, and that was on specific items like salty tobacco, alcohol, and today we call them sin taxes, so you would do want to discourage people from buying alcohol or cigarettes. You tax them to make them more expensive. And, but, but the big bulk of income was from tariffs. And so it was 60% tariffs by the time just prior to the Civil War. So Ben Siegelman wrote in commentary magazine March 1962 an article, Tariffs, the Kennedy and Politics. He says, in the early years of the Republic, all but about $20,000 out of the $4.5 million of Treasury income stemmed from tariffs on levies, goods from other countries. Up to the Civil War, in fact, over 90 percent of the federal government's receipts came from tariffs. And then, of course, you have Alex...

Rick Green [00:06:35] Wait, wait, wait. Bill, you got to repeat that, man. That's huge. That's not just in the fat, not just like right after we got the constitution or, you know, 10 years in to be in a nation up until the civil war, 90% of the federal revenue came from tariffs. Did I hear you right on that?

Bill Federer [00:06:53] Right, right. Now, it gets a little bit into the weeds that the North benefited from the tariffs and they had factories. Every little town and village in Massachusetts had some factories, but the South didn't. South was agricultural. So the South was having to either buy stuff from Europe more expensive or stuff from the Northern factories. And at one point, most of the income was paid for by tariffs collected at southern ports. And so from time to time, they would threaten not to collect it. And that's when Lincoln sent the troops to Fort Sumter to say, no, you're going to continue to collect these tariffs. And it started the Civil War. So once the South broke away, the North didn't have any income. And so Abraham Lincoln pushed through an emergency income tax to raise $750 million to pay for the war. After the war... The South is now part of the Union. We're collecting tariffs. And by the early 1900s, 95% of the federal government was financed through tariffs. It was a 95% tariff. And it was called the Gilded Age. It worked. We were producing stuff. If you've ever been, I'm sure you have, to the Capitol in Harrisburg, Pennsylvania. It was built during this time in the early 1900s right after the, you know, World's Fair and so forth and Chicago and the it's it's gilded everything it's like so ornate there was a opulence and wealth that the country had and so this was great but then you have Woodrow Wilson pushes through the first income tax as right one percent tax on the top one richest people he actually tacked it onto a tariff bill and the problem was German immigrants were coming over and they had been infected with Marxism and they would work in factories and unionize and they say redistribution of wealth. And the government tried to stop it, stop it stop it and then finally says, okay, look, we'll push through this income tax on the wealthy. It would be today only taxing the George Soros, the Bezos, the Zuckerbergs, Larry Fink with BlackRock, it wasn't gonna tax the people, just those rich, what they would call robber barons. But they weren't rich because they're stupid, they're rich because know how to handle money. So as soon as the income tax passed, they created tax-free foundations, educational foundations, Carnegie Foundation, Ford Foundation, Rockefeller Foundation. So they didn't pay the tax anyway, but the tariffs were still the main source of income. 1921, you have George Washington Carver, the peanut farmer from Tuskegee. And on January 21st, 1921 he goes to Washington DC at the request of the United Peanut Growers Association to lobby the US House Ways and Means Committee for what? A tariff on peanuts imported from China. They were bringing them in from China so cheap it was undercutting the Southern farmers. George Washington Carver lobbies, and he's successful. And they passed the Fordney-McCumber tariff bill of 1922. And then a short time later, the Smoot-Hawley tariff Bill 1930. But tariffs were the main source of income for the federal government for the first century and a half. Then Woodrow Wilson-

Rick Green [00:10:35] And that just, just to review on those numbers, because it really is hard to get your head around 90% roughly the civil war and then up to 95% in that, in that early 1900s and then like, like everything else, all bad things come from Woodrow Wilson, I think. So, so then he brings in the, the progressive income tax and, and, and then it was it a little while before they started really reducing the amount that would come from. Terrorist because of, like you said, the, the little, you know, the few that they were trying to tax with the income tax at that time, found ways to evade it so that it just didn't bring in much money. Oh, right.

Bill Federer [00:11:12] So, it was. Franklin Roosevelt. So Franklin Roosevelt expanded the income tax to the entire country. And it even, it was during World War II. So we have an income tax during the emergency of the Civil War. Woodrow Wilson had an income's tax during the emergency of World War I. And here's FDR having an income text during World war II. It was part of the by war bonds, Uncle Sam need you. And pay your taxes, fight the axis. So this was this government campaign. And John F. Kennedy in 1961, April 20th says, in meeting the demands of war finance, the individual income tax moved from a selective tax imposed on the wealthy to the means by which the great majority of our citizens participate in paying. So there's Kennedy saying, it used to just be a selective tax imposed on a wealthy, but during the war, the majority of the citizens, but people made about $5,000 a year and they did not save up money to pay an income tax at the end of the year. And so nobody's paying. And so Beardsley Rummel is the chairman of Macy's department store. You know, the Thanksgiving day parade, he's the, becomes the director of the New York federal reserve. And he gives FDR an idea called paycheck withholding. Oh no, we'll just take a little bit out of the paycheck and nobody will notice and it worked. Kennedy says, April 20th, 1961, withholding on wages and salaries was introduced during the war when the income tax was extended to millions of new taxpayers. It's like, so whenever you see your paycheck and there's something withheld, you can thank Franklin Roosevelt.

Rick Green [00:13:04] And Bill, we were just talking, my family and I were just sitting around over the weekend, talking about it as everybody's, you know, filing their taxes, getting ready to go. And, and my oldest son, Trey, that was exactly his point. It was like, if everybody else had to do what his siblings were having to do, which is file, you 10 99. So they're paying it all at the end of the year. He said, if anybody else had, to do this, we wouldn't put up with the amount of money that the government takes from us, but because it's hidden in the check every month, they actually think they get a refund at the end of year. Oh, I didn't realize that that came from the guy at Macy's. Now, now I have a new target for my, uh, not my love. Let's put it that way. Anyway, go ahead, brother.

Bill Federer [00:13:39] So there is a fallout from taxes. It's called outsourcing. And so after World War II, we're rebuilding Germany and Japan Marshall Plan, and they had have brand new factories with really cheap labor. And so when FDR raises the taxes really high, the business owners are successful. They know financial stuff. They said, look, let's just open up a factory overseas and we will have cheaper labor. We won't have to worry about unions and wages, and we won't want to worry about lawsuits and government red tape, and we can produce stuff cheaper. And then with all of our profits, we can donate to politicians so that we can get them to vote to lower the tariffs even more. So we can bring more stuff into America, and this is called free trade. And so what happens is as the- foreign goods come in, it undercuts the American made goods and puts the factors out of business. And then we have unemployment. And then the foreign countries realize, hey, we can now pressure US foreign policy, because if they don't do what we want, we can threaten to withhold our products, or our rare earth metals, or something that computer chips from China that because we've had several generations of not manufactured. So John F. Kennedy says this. He says, I've asked the Secretary of Treasury, this is February 6th, 1961, I've ask the Secretary Treasury to report on whether the present tax laws may be stimulating an undue amount of flow of American capital to industrial countries abroad. It's like you squeeze the sponge, the water goes out. You raise the taxes on business owners, they're gonna move their business where there's the least resistance. Kennedy said April 20th, 1961, in those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. Tax by retaining income in subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the Unites States. So that was John F. Kennedy saying, okay. We got this problem, we're raising taxes and all the businesses are leaving, and then they're getting the profit, we're getting more unemployment, and then that can pressure us when it comes to negotiating foreign policy. And so Kennedy's answer was to cut taxes. And so Reagan basically adopted Kennedy's plan. Kennedy said this, September 18th, 1963, a tax cut means higher family income, higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new convenience, education, and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business. And as the national income grows, the federal government will ultimately end up with more revenue.

Rick Green [00:16:51] So it's like, what was it? What was this Republican's name again? What was, uh, oh, oh wait, Democrat John F. That's good stuff, man.

Bill Federer [00:17:00] Yeah, it's like cut taxes. People have more money. What are they going to do with the money? They're going to buy stuff. So the factories will have to hire more people to meet the increased demand. And then the business owners will have more money. They're gonna invest it in their business and to be able to hire more people. And so the caveat is you give the tax cut to the companies operating on American soil. It's not just for any business. It's the businesses that are operating on American soil. So it was effectively doing the same thing that Trump is doing now with the tariffs. Kennedy said this, January 17th, 1963, lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased flow of revenue to the federal government. So he says, it might take a couple of years, but we're gonna catch up. And then Kennedy said, November 20th, 1962, it's a paradoxical truth that tax rates are too high. Tax revenues are too low and the soundest way to raise the revenues in the long run is to cut tax rates now. Cutting taxes is not to incur a budget deficit but to achieve a more prosperous, expanding economy that can bring a budget surplus. So that's the situation for 150 years, tariffs were the main source of income and emergency one during the Civil War because the southern ports were not collecting tariffs and giving it to the north. After the war, we're back to tariffs. We have this gilded age, industrial revolution. We have the highest rise in the standard of living and then we have Woodrow Wilson and, he pushes through this 1% income tax, but it was just to soak the rich one. I mean, there is a question as to whether or not it was ratified correctly, but really the attitude of most of the people in the country was, yeah, go for it, tax those rich guys, you know, the Rockefellers and Canegies and Jay Paul Getty's and Astor's and Flagler's and Harryman's and Mellon's. But then it was FDR raised the taxes and that caused outsourcing and then this thing called free trade, but it's not really free trade. It's undercutting the American businesses. And so Trump's wanting to go back to what we had during the period where we had the fastest rise in the standard of living.

Rick Green [00:19:24] It's so interesting that they, when they, you know, they use the terminology free trade because they knew that would play on our free enterprise love, right? So we want free enterprise, but they, they used this, created this term free trade, and if it was actually free enterprise and free trade, it'd be different and, you know it's just, it's interesting to see the table being reset in such a powerful, powerful way, but if we don't know that history, then it's very easy to fall for some of the arguments and things that people are making right now. As they're criticizing what President Trump's doing. Bill Federer, God bless you, man. Thank you so much for coming on. Thank you for the history. I know you've got a book on the income tax, the history of the income, where can people get that?

Bill Federer [00:20:03] Yeah. Yeah. It's called the interesting history of income tax. And, um,.

Rick Green [00:20:07] Do you cover tariffs in that as well.

Bill Federer [00:20:09] Yes. Yes. And there, there's a whole, there the debt stimulated economy that John Maynard Keynes came up with, where if the government goes in debt, spends money in the private sector to create jobs, the jobs will pay taxes. The taxes will pay the debt, but it never worked because every politician funnels money to their district, you know, goes more in debt. But they never want to raise the taxes to pay for it. And so now we've got a $36 trillion debt. With no way of paying it off. And so Trump's doing emergency surgery. Debt is fat to the body politic. You know, you have a body, you eat stuff you shouldn't, and it turns into fat, and you gotta carry it around. It's not brain tissue or muscle tissue. It doesn't add anything to you, but you gotta to carry it round. Well, what's debt? You spend money you don't have, and then you gotta pay interest on it. I mean, here we are giving billions to foreign countries that we don't, we're just creating, we're putting this debt under our kids. So this debt-stimulated economy is something that I talk about in the book. And then the last part is, I did a book called Endangered Speeches. It's a play on words, endangered speeches, how the ACLU, IRS, and LBJ threaten extinction of free speech. And you think, what's that? Well, LBG is the one who pressured the, the 501 C3 status. So I get into the whole thing of Bolshevik revolution. So the the the Carnegies and so forth when they raised that 1% tax, they funneled their money into tax-free foundations so they could avoid paying the tax. When FDR raised the taxes, they sent their factories overseas. But when Woodrow Wilson raised the tax, as they just put their profits into tax free so they could still control it. But then the Bolshevik Revolution and communists were forming the 501c3s educational foundations to overthrow America. And that's when the government says, oh, we're going to limit these 501 c3s. And as I get into that whole history, but maybe that's an interview for another time.

Rick Green [00:22:08] Yeah, we will we will cover that another time and and I'm going to remember the whole cutters the revenue cutters Which Elon Musk is is hopefully going to be the charge on that one Bill Federer God bless you, man Thanks for coming on.

Bill Federer [00:22:19] Thank you Rick.

Rick Green [00:22:20] Stay with us folks. We'll be right back with david and tim barton

Rick Green [00:24:30] Welcome back to the WallBuilders show. Thanks for staying with us. David and Tim Barton with us for the final part of the program. And guys, I know y'all got to hear what Bill was talking about on the tariff. So much there that I know you guys could comment on, but only a couple of minutes, so go for it.

Tim Barton [00:24:43] Well, as he pointed out, I guess you asked him, is there a book on this? And he has a book, The Interesting History of the Income Tax. And I told him while we were on break and he was saying bye, he's the only one that could take something like this and make it interesting. But learning the story behind it is fascinating. Learning the history, not just of the income tax, but literally of the tariff, recognizing how much of the government used to be funded by tariffs, which we, have studied enough to know that there definitely was some that was funded by tariffs. But I don't think we had any idea the extent of what tariffs were used for and how far they went. And hearing Bill lay that out, it was quite impressive and makes me even think a little bit differently about we've already seen success from some of what Trump has done, but it makes me feel even more confident in some of he is doing with this, even if it is just leverage for negotiation. The history of this is remarkable.

David Barton [00:25:42] Yeah, it may be leveraged as long as it's working. I don't think I realized that early even to 20th century, 95% of federal income came from tariffs. Man, I keep thinking of income tax at the time of Lincoln. I know that's temporary, but I didn't realize that it was really just from FDR that that income tax became what it is. That's amazing.

Rick Green [00:26:01] I was really shocked by the Jefferson quote because, you know, I was, throughout all of this been thinking, okay, if you're using it for negotiation tactics, but for the, for Jefferson to actually advocate for literally doing it to protect our merchants here in the country, either to be able to get established or just in terms of competition or whatever, that was remarkable to me. So a lot of great information there. Incredible. And like you said, Tim, this is one of those, you got to get the book. You got to dive in a lot deeper, but we'll get Bill back to to cover some of those other things that we just got a little hint of in today's program. And of course, there's a lot more at our website wallbuilders.show for all of our other radio programs and then wallbuilder.com for all the other information. Appreciate you listening today. You've been listening to The WallBuilder Show.