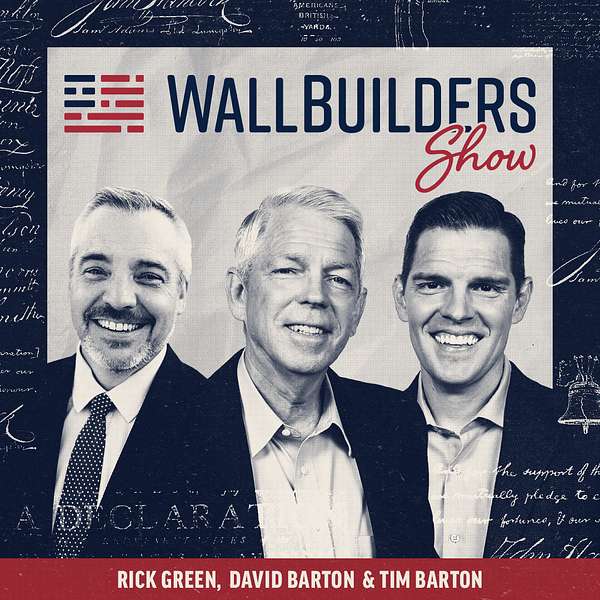

The WallBuilders Show

The WallBuilders Show is a daily journey to examine today's issues from a Biblical, Historical and Constitutional perspective. Featured guests include elected officials, experts, activists, authors, and commentators.

The WallBuilders Show

Founders, Faith, And The Fight To Protect Private Property

What if the surest way to protect every right you love is to start with the front door on its hinges and the deed in your drawer? We dig into the founders’ most overlooked insight: secure property is the spine of liberty. Tim Barton walks through original sources—Adams, Madison, Dickinson, Lee—and shows how they linked private ownership to freedom, moral order, and social trust. Then we test those principles against today’s realities: swelling assessments, layered taxes, and seniors losing fully paid-off homes. The question isn’t whether taxation can exist; it’s how to keep ownership from becoming a revocable privilege.

We contrast the founders’ consent-based, purpose-tied approach with modern practice. Daniel Webster’s case for funding education from property was narrow and civic-minded, not a blank check. John Marshall acknowledged the taxing power while pointing to constitutional structure as our only safeguard against abuse. Joseph Story’s warning feels prophetic now: when laws make the enjoyment of property precarious, liberty erodes whether the decree comes from a despot or an eager legislature. That’s more than rhetoric when families watch generational homes slip away for want of taxes their budgets can’t meet.

We also ground the conversation in Scripture. Chronicles, Proverbs, and Ezekiel present land and inheritance as gifts to be stewarded and defended from unjust seizure. Those texts don’t write a tax code, but they draw moral lines: rulers must not use power to evict people from their inheritance or frustrate parents and grandparents who provide for the next generations. When policy crosses those lines, patriotism wanes, trust collapses, and communities fracture.

Together we sketch a path forward: tighter assessment caps, strong homestead protections, transparent consent, targeted relief for fixed-income owners, and a reset toward simple, restrained, voter-accountable funding. If property truly guards every other right, then safeguarding ownership is not a niche cause—it is the practical defense of liberty itself. If this resonates, share the episode, subscribe for more constitutional deep dives, and leave a review with your best idea for fair, freedom-respecting reform.

Rick Green [00:00:07] You found your way to the intersection of faith and culture. Thanks for joining us today on The WallBuilders Show. I'm Rick Green here with David Barton and Tim Barton, taking on the hot topics of the day from a biblical, historical, and constitutional perspective. Check us out at wallbuilders.com and wallbuilder.show. Of course, wallbuilders.com, our main site. That's where you can get the swag and the coffee mugs and the shirts and all the books and the different materials to help educate yourself and your family. Also want to certainly at that website, look at the events we have coming up, pastors’ briefings, legislators’ conferences, teachers’ conferences, all the different things we're gonna be doing in 2026 with not only for the 250th, but a lot of the activities we do every year, all of that available at aallbuilders.com and then wallbuilders.show that's the radio site, super easy to use. You can scroll down any of the shows you missed over the last few weeks and months. You can listen right there on the website or you can download, you can go to some of the, well, pretty much every podcast app out there you can get WallBuilders as well, but I do encourage you to go to the website today, because if you're tuning in today and you hadn't been listening all week, we're wrapping up today, a series, that is a presentation Tim Barton did at the Pro Family Legislators Conference a few weeks back, I do want you to the website cause I encourage you go wallbuilders.show to share the program. Super easy to click on the links there, share it with your friends and family, post it on your social media outlets. We need to get the word out there. These are the principles that made America great in the first place. So as we celebrate the 250th all throughout this year, we've got to get back to those principles so we know what we're celebrating so that we know how to preserve and pass it to the next generation. So check that out at wallbuilders.show today. Let's jump in. We'll pick up where we left off yesterday. Going to take a quick break. When we come back, we'll jump in with Tim Barton for the conclusion. Stay with us. You're listening to the WallBuilders Show.

Rick Green [00:03:00] Welcome back to the WallBuilders Show. All right; it's time for the conclusion. Let's jump in with Tim Barton at the Pro-Family Legislators Conference.

Tim Barton [00:03:06] Why would Jefferson say... Pursuit of happiness and and not property? One of the things that Mason advocated for that actually historians believe Jefferson thought as well is there were some people that tried to use the argument that owning slaves was their property and they said that's not what we're talking about, right? The king is saying you don't own any land and it's all subject to me and we believe that God has given people the ability to own their own property, right, that you can be the king of your own castle. This is this is all that thought. So, George Mason's the guy laying this out now he's not the only Founding Father going through this exercise as well of property. You have guys like John Dickinson, he was known as the penman of the revolution. He wrote a lot of essays. This is even before the Sons of Liberty, like leading into this moment, helping stir the people up in Pennsylvania. He also was a governor. He was a member of the Continental Congress before. Then he was a Governor of Pennsylvania and Delaware. He was then a signer of the U.S. Constitution, so he's involved in virtually all of it. One of the early essays he wrote, trying to encourage Americans against tyranny dealt with property. It said, let these truths be indelibly impressed on our minds that we cannot be happy without being free. We cannot be free without being secure in our property. That we cannot be secure in our property if without our consent, others may by right take it away. You can't be free without property. You can be free if your property is not secure and your property's not secure if somebody can take it away from you. Well, that's interesting, right? Because this seems to be a reality that we are having to navigate in our culture. John Adams, in 1787, he was writing in defense of the Constitution, and he also, this was an essay dealing with private property. Here's what he said about private property, property is surely a right of mankind as really as liberty. The moment the idea is admitted into society that property is not as sacred as the laws of God and that there is not a source of law and public justice to protect it, anarchy and tyranny commence. If thou shalt not covet and thou shall not steal were not commandments of heaven, they must be made inviolable precepts in every society before it can be civilized and free. Now, again, this is John Adams. The Constitution is now being advocated for of why we need to pass this and ratify in our states. And he says, one of the things that's important about this is we need private property protections, which he believed the Constitution did. Arthur Lee was a diplomat during the American Revolution for the Americans. And he actually wrote to Great Britain, trying to explain to some of the people over there why we were having the problems and why we were leaving, here's part of what he wrote to the people of Great Britain. He said, the right of property is the guardian of every other right. And to deprive a people of this is in fact to deprive them of their liberty. If you don't have private property, right? If that's not secure, if that's not protected, you're that far away from losing everything else. Right? This was their idea to go further. James Madison. Wrote in 1792, he was in congress around this time, he said government is instituted to protect property of every sort as well that which lies in various rights of individuals as that which the term they particularly express or expresses. This being the end of government that alone is a just government which impartially secures to every man whatever is his own. Now it's interesting, he says whatever is own. He goes further, more sparingly should this praise be allowed to a government where a man's religious rights are violated by penalties or fettered by test or taxed by hierarchy. Conscience is the most sacred of property. Now it's interesting because even the idea that we have of intellectual property rights. Founding Fathers argued for those. And this is just one example where they go through that. Now, again, part of why I want to point this out is one of the things that if you study the Founders’ writings and you don't have to go very far because almost all of them wrote about this, they were very, very clear that in America, we believe in protecting private property. Now, it's a different question if we say, what about property tax? And I say this because I, highly encourage we got to get this property tax thing figured out, it's out of control. And again, the fact that people that have bought a house, paid off the home on the mortgage, and you have these elderly people having homes taken away from them. Like this is, this is incredibly immoral. However, if you go back and read the founders writings, people would point out, yeah, but the founding fathers, they believed in property tax. Okay, it's true. But let me give you a little nuance in that conversation. Okay. Let me show you some of their quotes. And it's important that we get a little fuller picture of this. You have guys like John Jay, he was not only the original Chief Justice of the US Supreme Court, during the revolution, he wrote a letter in 1778 to the New York legislature, and here's what he told them. He said, it is the endowed right and inalienable privilege of a free man not to be divested or interrupted in the innocent use of life, liberty, and property. Now notice, again, it's life, liberty, property, as we're talking about. He said, but by laws to which he has assented either personally or by his representatives. So if we didn't agree to it, you don't get to do this. But he pointed out if your representatives did it, well, they're representing you and you agree because like you voted for them, right? So you're consenting to that. They actually were not against some kind of tax legislatively done. Now they still had moral functions and functions and thoughts about it. Right? It wasn't just whatever you want. However, they seem to acknowledge like they're not anti-property tax. Again, I'm going to give you some nuance on this. You can also point to things like John Marshall. Now, John Marshall, there might be some divided sentiments on him, rightfully so, as far as some of his constitutional standing on some of the issues. However he's a guy who very noted Supreme Court Justice, Chief Justice, and in 1819, he delivered a decision McCulloch versus Maryland, and I'm going to read just a couple lines from this. He said, it is admitted that the power of taxing the people and their property is essential to the very existence of government and may be legitimately exercised on the objects to which it is applicable to the utmost extent to which the government may choose to carry it. The only security against the abuse of this power is found in the structure of the government itself, meaning the legislative, the checks and balances, and imposing a tax the legislature acts upon its constituents. This is in general, a sufficient security against erroneous and oppressive taxation.

Rick Green [00:10:05] One more break today, folks. Stay with us. You're listening to The WallBuilders Show.

Rick Green [00:11:16] Welcome back to The WallBuilders Show, now for the final, final conclusion of Tim Barton's presentation at the Pro Family Legislators Conference just a few weeks back.

Tim Barton [00:11:24] So they're acknowledging like, well, the legislature does it. The legislature is representing the people soon as the will of the people. So then they're not doing it against the people, let me give you one more for a little context, Daniel Webster, very noted attorney argued before the U S Supreme court often was in the house and Senate for nearly 30 years, incredible political leader, one of the most brilliant minds in American history. He said for the purpose. Oh, actually let me back up. This was a speech he gave in 1820 in Plymouth, so 200th anniversary of the Pilgrims. So there's more to the speech that is really great, but this deals with property. He said, for the purpose of public instruction, we hold every man subject to taxation and proportion to his property. And we look not to the question whether he himself have or have not children to be benefited by the education of what he pays. Now they're acknowledging a property tax was to pay for education. And he said, we're not just looking going. Well, do you have kids or not? Like that's not how we're justifying this. He continued and said we regard it as a wise and liberal system of police by which property and life and the peace of society are secured. Now it is interesting, I can go further and some of this because the Founding Fathers definitely seem to say things we're like, what sounds like they're in favor, not just of private property, but property tax. And I will tell you; they were in favor of property tax but, what they were in favor of is not what we are doing today for lots of reasons. And let me give you a little more context to this. And I'm saying this because I want you to see the full picture. Because sometimes we look for things that both biblically and historically were like, silver bullet! That's all I needed. Right? Like that's I got the quote from Washington. I got to quote from Franklin. I got a quote from the Bible. Like it's all I need the Bible gives you really good clarity on morality of this. And I'll come to that in a minute. Historically..we do have really, really good examples of private property ownership and the preservation of that ownership, which is where I'm going now, but they weren't against property tax necessarily. However, one of the things Joseph Story said, now, Joseph Story was a justice on the U.S. Supreme Court over 30 years. He was appointed by James Madison, one of most noted Supreme Court justices in our history. And in 1829, he was giving a speech at Harvard. Again, you can read the whole speech. This is just a portion of what he said to the students at Harvard. He said the sacred rights of property are to be guarded at every point. I call them sacred because if they're unprotected, all other rights become worthless or visionary. So private property, you can take this. He continued. What remains to nourish notice what he says a spirit of independence or love of country if the very soil on which we tread is ours only at the beck of the village tyrant. If the home of our parents which nursed our infancy and protected our manhood may be torn from us without recompense or remorse. Notice what he tied there, he said if you start taking people's property, none of them are going to love this nation, you’re going to remove the spirit of patriotism right that the love of country he said this is not the direction we want to go. It's interesting, because he was very clear, and I'm going to show you more of this, because it's very clear that the idea that, okay, private property is so clear by God, property tax, okay. But there was, there was some boundaries with this. Let me finish what he told the students. He said there can be no freedom where there is no safety to property or personal rights. Whenever legislation render the possession or enjoyment of property precarious. Now I want to think about this for a second. He's saying if laws are passed, where people are now like, I'm not sure if I can afford this. Cause that's precarious, right? My enjoyment is now precarious because I'm having to question what's gonna happen. If I retire and I don't have, cause all I’ll have is Social Security now and I'll don't the money I need to keep paying property tax because every two years there's a new assessment of the value of my property and my social security is not like, I don't have enjoyment cause my ownership is precarious. That this is what he's talking about. He said whenever it cuts down the obligation and security of contracts, whenever it breaks upon personal liberty or compels a surrender of personal privileges, upon any pretext, plausible or otherwise, it matters little whether it be the act of many, the legislature, or few, the individual and authority, of the solitary despot or the assembled multitude, it is in essence tyranny. Now, this is the caution on that saying, guys, you can't get to the point where you are threatening people where they're not sure they can even afford and keep the property, right? They're not going to love their country. I mean, it's really interesting the way he lays this out, and the reason I want to point this out that there is an honest conversation that should be had about property tax. And I understand what people would say, the Founding Fathers supported property tax. I understand your argument. They add very different limitations. As what they put boundaries around than what we would today. Now, I think also when you're arguing when the Founding Fathers tax this, yeah, but you're taxing a thousand things they never would have dreamed you could have taxed. Right? Like you have, you are misapplying some of this and taking it so far out of context. The Founding Fathers promoted in the stability of people's property ownership. The reason they supported a property tax, they said that's the most equal. Why? Because the ambition of every American was to own property, and this was now a capitation tax, it wasn't based on a income. And now we have a progressive income tax or whatever the case might be. They absolutely believed in levels of limitation. Now, with that being said, and there's more conversation. I just want you to know, as you navigate this, don't think that there's a single simple silver bullet like this is all we got to do like, so clear Founding Fathers. However, they did give really good perspective, but I want to go back, the two things I wanted to explore are from a biblical and historic perspective So I'm going to finish giving a few more thoughts where the Bible gives really good moral clarity on this,

Rick Green [00:17:52] One more break today folks, stay with us, you're listening to The WallBuilders Show.

Rick Green [00:20:03] We're back here on The WallBuilders Show jumping back in with Tim Barton speaking at the Pro Family Legislators Conference.

Tim Barton [00:20:08] On 1st Chronicles 28, it says, now therefore in the sight of all Israel, the assembly of the Lord, and in the hearing of our God, be careful to seek out all the commandments of the LORD your God. Now, this is the Israelites being encouraged. It says that you may possess this good land. Now, already, they get a land. We're talking about property ownership. And notice how it concludes. And leave it as an inheritance for your children after you forever. What threat was there going to be on anybody losing their property? In God's economy, none. Okay, this is a big deal because from a moral perspective, if God gave you something, nobody else has the right to take it from you. That that's a big deal. Cause this is again, the Founding Fathers were more influenced by the Bible than any other source. We can track that for you historically if you want some information, we'll help connect those dots for you. The Founding Fathers were the most influenced by the Bible and the founding fathers understood these thoughts far better than most Christians do today. Let me give you another example. In Ezekiel 46 verse 18, it says, Moreover, the prince shall not take any of the people's inheritance by evicting them from their property. Now, the Prince is government, right? That's who we're talking about. The government can't come in and be like, hey, now we could actually get into eminent domain on this a little bit if we needed to, right? Because you also can talk about there was this king and queen Ahab and Jezebel. There was a dude named Naboth and he had a vineyard. And they're like, that vineyard looks good. And he goes and like, I want to buy it. And He says, I'm not going to sell it to you. And Jezebel's like, well, let's just kill the dude and take it. It's literally what they do, right? I just want to point out; the Bible actually gives some clarity on the limitations of the moral decisions of government. You actually can't go and take somebody else's property from them. Let me keep going in this verse. It says, he, this is the government, the king, the prince, he shall provide inheritance for his sons from his own property. Why? So that none of my people may be scattered from his property. So that nobody ever loses what God gave him. Because God said I gave it to him. Right? So the government can't come in and say, no, I want it, and they're gonna kick them off what God gave them. Okay, again, I'm just showing you a moral side. Let me give you one more moral thought on this from a biblical perspective. The Bible says in Proverbs 13:22, a good man leaves an inheritance to his children's children. We could get into estate tax and death tax and property tax. Things that are involved in taking some of the inheritance away that's supposed to go to the children and the children's children. We can get into that conversation. Not the point of right now, but I do want to say, if we're looking at things that threaten or endanger or challenge what the Bible says would make someone a good man, that's a bad law. If the Bible says, here's what a good man does, he gives some to his kids and his grandkids. And the government says, yeah, but only for so long, then we're taking it from you. When you are making it more difficult for a person to be what the Bible says, the good man, or you are actually taking away what the Bible said made them a good, man, that is an immoral position the government is taking. Okay, again, I'm just showing you from a moral perspective because we should be shaped by the thinking of what the Bible shows us as we navigate. Okay, so if we know we shouldn't do this and we know the Bible says it's like, well, so where is the line? Now, we don't have to work on that one because it might look different in different states, but the Bible is pretty clear. And I will also point out we have not even gotten into what the Bible says about don't remove the ancient boundaries, don't move the ancient landmarks, or even what the year of Jubilee looked like. Now, the year Jubilee we could talk about and people might say, well, that was really for like Israel on their land. Okay, I understand the argument, but let me just walk you through a thought for a second. The year of jubilee, if you were in a position where you had debts, paid off, you could sell your land to somebody, the year of Jubilee it was all returned to you. Why did God think their land should be returned to them? Because God said, I promised it to them and what I promised to them, they get a keep. Again the principle, if God has given us something, nobody can come and take it from us. And there's a lot of, and again, we're not getting into like the county and the local school districts and the tax assessor. We're not even there yet, but these are things that I can tell you as a Texan, the tax value on my home since COVID, my house didn't grow during COVID. Like it's the same square footage it was before COVID. What are you talking about? This is where we have to recognize a lot of what is happening is from an immoral position and when we are putting people in a place where we are now threatening something that for many of them, right, for many Americans, they inherited this from their parents. They're living in their grandparents' house, right? The place they grew up and now, well, if you don't give us this money, we're taking it from you. That is so immoral. As legislators, we want to do things where we stop what's immoral and we promote what is moral.

Rick Green [00:25:36] All right, everybody, we're out of time for today. That was Tim Barton speaking at the Pro-Family Legislators Conference. Once again, if you joined us halfway through from what Tim was sharing at the Legislators' Conference, all of that's available right now at wallbuilders.show, super easy to download it or listen to it one part at a time, however you prefer, but definitely take the opportunity to share it with your friends and family. And consider going to that website and making a contribution as well, you know, the only way we're able to reach as many people as we do and now, you know, something like 140 countries and all these different places, listening and learning these principles. It's those donations at wallbuilders.com that make that possible. So thank you to everyone out there that has been part of that. Thank you for helping us reach more people. Thank you for sending in your questions, Foundations of Freedom Thursday. So great opportunity for you to get some question about a founding principle, maybe a clause in the constitution, maybe some law's passed and you want to know how that stacks up with the Founders' view. Send any of that in to radio@wallbuilders.com, radio@wallbuilders.com. And then of course Friday, don't miss Good News Friday this week. We're gonna have a lot of good news to share with you. Appreciate you listening. You've been listening to The WallBuilders Show.