That’s Delivered Podcast

Welcome to “That’s Delivered Podcast” (TDP) your ultimate destination for all things trucking and beyond! Here, we take you behind the wheel and dive deep into the world of trucking, delivering stories, insights, and experiences designed to inspire, educate, and entertain.

Our podcast isn’t just about transportation; it’s about reliability, accomplishment, and fulfillment. “That’s Delivered Podcast” reflects the sense of completion that comes with meeting promises and exceeding expectations, whether on the road or in life.

Whether you’re a seasoned trucker, a logistics enthusiast, or just curious about the backbone of our economy, this is the place for you. We’ll explore life on the road, uncover how technology is reshaping the industry, and break down the latest regulations impacting drivers and businesses alike.

So buckle up, hit the road with us, and join a community that understands the journey is just as important as the destination. From personal stories to industry insights, “That’s Delivered Podcast” brings the best of trucking straight to your ears, promising every mile together will be worth the ride!

That’s Delivered Podcast

Your Franchise is Waiting with Jane Stein: How to Make the Leap from Trucking to Business Owner

Tired of the 9-to-5 and wondering if there’s something more out there? Jane Stein, founder of Your Franchise is Waiting, joins the show to share how she traded in her high-powered Wall Street job for a life of purpose and flexibility through franchising. With decades of business experience and real talk about the highs and lows of entrepreneurship, Jane opens your eyes to franchise opportunities far beyond burgers and fries. From pet cremation to dental equipment repair, the world of franchising is bigger—and more accessible—than you think. Whether you're a trucker dreaming of more freedom or someone looking for a fresh start, this episode delivers real advice, honest reflections, and practical tools to help you decide if owning a business is your next big move.

Key Takeaways:

✅ Jane left a successful stockbroker career after realizing she had money but no time or fulfillment

✅ Franchising isn’t just fast food—there are unique options in industries like pet cremation, crime scene cleanup, and more

✅ Most franchise opportunities require $60,000–$80,000 in liquid capital to start

✅ Creative funding is available, including penalty-free 401(k) rollovers for business startups

✅ Jane emphasizes self-assessment to see if entrepreneurship fits your personality and lifestyle

✅ Business ownership is tough—grit and resilience are key

✅ Her free tool at YourFranchiseIsWaiting.com helps you figure out if you’re ready for the leap

✅ Visit YourFranchiseIsWaiting.com and take the free Zoracle assessment to determine if you have the traits needed for business ownership

✅ Especially helpful for truckers exploring the shift from driver to business owner

Interested in being a guest on the podcast? Click here to join the conversation!

Fuel your grind. Own the road. Strong, Steady, and 3-Axle Ready.

Get some at 3AxleCoffee.com.

What's up everyone, welcome back to that's Delivered another episode with your host, Trucking Ray, and today we've got a conversation that all of us entrepreneur mindset individuals when. I love this episode, something that a lot of you out there are thinking about wanting to know what you want to do, whether you're behind the wheel, dreaming of having your own trucking company or owning your own business, just looking out for what's the next step in your career and possibly, well, today's episode is for you. My guest is Jane Stein. She's an expert in the franchise and founder of your Franchise is Waiting. She spent years helping people take a leap into the business ownership and finding opportunities that fit their skills and goals.

Speaker 2:A lot of truckers out there already have the independent spirit. As to what else we can possibly do, maybe becoming an owner-operator, or also starting something of your own that supports the trucking industry or something else so she has that advice for us. But what does it take to actually make that possible? What rewards are out there? What mindset do you need to succeed? Jane is going to share her journey and what drives her, and she's going to be her journey and what drives her.

Speaker 1:And she's going to be helping others learn about becoming business owners.

Speaker 2:Jane, welcome to the show. All right, appreciate you coming on Dance Delivered. I'm excited to have you here and share your journey and what led you into the world of financing and getting your own business going. I mean, tell us a little about your journey. Let's help the listeners see what it's like to be an entrepreneur.

Speaker 1:Sure. Well, my journey was circuitous. I became a stockbroker, you know, in my 20s and did that until my 50s, essentially, and late 40s really, and I loved it for about the first 15 years and I really didn't love it for about the last 15 years, you know. It was one of those things where I woke up in the morning and went, is this a weekend? And then like, oh, it's Friday, I gotta talk to people. It wasn't, you know, I enjoyed a lot of it, right? I loved helping people, I love the relationships, but the but it wasn't learning anything anymore. It was the same conversations literally all day long with the same people, and we'll talk about this in a minute.

Speaker 1:What I discovered about myself is that I have a need for variety in my day, in my work day, and at the time I didn't really think about it. So, to make a long story short, after 9-11, I had a reawakening of life is short. I hate where I'm living, which was Houston. I had two little boys who were basically being raised by nannies because I had money but no time, my nannies because I had money but no time and I decided that's not the way I wanted the rest of my life to go. So I turned to my husband and said I want to move, I want to quit my job. You can imagine how this went down and it took a while to do it right. It took about three years of planning and we finally did it and we moved to a little town in Colorado that you know was my dream town. It had four seasons. You know I have a son on the spectrum and they have a lot of quirky kids in this town. It's Boulder. There's a lot of scientists and a lot of you know, kids that are on the spectrum just because that's who scientists have, because most scientists are on the spectrum. So it was just a dream scenario. And my kids we bought a little house that was two blocks from their elementary school. I'd walk out the door and watch them walk to school in the morning no more carpool business and it was really, really lovely.

Speaker 1:And then what happened was when they sort of got into middle school and high school there's really not much more that a mom can do in terms of getting involved in the school. So I was bored out of my mind and I realized I missed business. I missed smart conversations, you know talking to people about their money and their future and all those aspirational conversations. So what happened was I thought I would buy a franchise. So I start clicking around on the internet and I am inundated with franchise brokers.

Speaker 1:A light bulb sort of went off, because back then the business was not super sophisticated and the franchise brokers were not super sophisticated Frankly, they were kind of used car salesmen. And so I went through the process that they, you know, did and realized this is an area that I would absolutely kill at. You know, it's my kind of thing. It's talking to people about business, it's research, it's problem solving, it's helping people see their way forward in something that they really, really want to do, and I just felt I could do it better than 80% of the people out there doing it, and so that's actually how I got into the business.

Speaker 2:I like that Can. That spirit, that competitive spirit, you know it's also seeing something better for yourself and the industry. I mean that's huge. I mean not just, uh, accepting for what it is, you want it to elevate it, you want it to make it better. So, man, that's, that's great work. Um, was there a specific moment where you realized that franchising was your calling? I mean, you're in it to win it here. Was there a moment that you kind of realized that?

Speaker 1:I was working with and she had gone through a divorce and she really hated her job. She had to work nights and weekends. She was in catering. She was now a single mom and her daughter was at that critical period where you kind of want to be around middle school. And so when I placed her, she said to me I don't want you to ever think you're bothering people and if you're reaching out to try and get business, she said I feel like you were a gift from God to me. It was like I still get chills thinking about it. I mean, when it's right and when it's right for the right person, it's kind of a magical matchmaking experience and the fact that I have the privilege of steering these people into their next phase of their life, their careers, it's, you know, it's awesome.

Speaker 2:That's cool. I mean people can look at it like just an acquisition, but you're looking at it as guidance and also helping people see how they can find happiness in a world that you know sometimes can be monotonous. You know, just like you say, it could be just in that rat race trying to wait for the day that you get free to do something you are passionate about. I mean that's great, that's really good.

Speaker 1:And I feel like I'll add this it's not, you know, I'm I'm super passionate about it, but I'm also very, very aware of the risks and that it's not for everybody, and so I consider my role in the process to also be the one to tell people this isn't the right time for you, you don't have enough runway, you don't have the grit. Whatever I do a series of assessments and it is not right for everybody, and that's part of it too is educating people about what it is that they're going to have to be doing, because a lot of people really don't have a clue and really should not be business owners. To be honest, it's not for everybody. I'll just stop there, but we're going to talk about that some more, I know.

Speaker 2:There you go. What were some of the biggest challenges you face when starting your franchise as waiting? Maybe some challenges that you think people relate to.

Speaker 1:Yeah, I mean, I was 58 years old and had been out of the world of business for 10 years, had been out of the world of technology had really changed and it was a time when you had to embrace technology. I had to learn a CRM. I had to learn social media presence. I had to learn a CRM. I had to learn social media presence, marketing. I had to learn Google ads. I mean, really, it was that technology piece that totally kicked my butt.

Speaker 1:But you know you power through it. Failure wasn't an option. I got to figure this out and you just laugh about it. I mean, that's the other thing. At my age it was sort of like, okay, what's the worst thing that will happen? I'll screw up you know what I mean and I won't figure out how to have the Zoom on at the right time. You know it's that kind of a thing, but technology really was challenging. You know I should get older and you know it's probably true. Today. Now it's all AI. I don't think I could start over today in the world of AI could start over.

Speaker 2:Today in the world of AI, you sound like me starting a podcast and getting it going. It is a lot. I mean especially Google Ads algorithms. You're fighting. I'm like what's going on here?

Speaker 1:Yeah, absolutely.

Speaker 2:I don't mind artificial intelligence when it comes to asking questions and getting answers. But it's nice that you get a sounding board you can talk to, but then you've got to fat check it and make sure it's right.

Speaker 1:I started doing some of my newsletters with AI, but then of course it doesn't sound like me.

Speaker 2:So what.

Speaker 1:I do is I just go in and edit the heck out of it until it sounds like me, because my voice is unique. It's very forthright and less formal.

Speaker 2:you know, I don't have a formal voice and ai comes across so formal yeah, yeah, um, I was thinking um what was some personal experiences or struggles that motivate you to find this business, maybe something that people can relate to when it comes to your, your personal life. I know you mentioned you have a young one, so what were some of the experiences or struggles that you could share?

Speaker 1:I mean, I guess I would say that it's going to be hard. You have to really have a lot of grit, you have to really really want to do something. I mean, in my business there's two kinds of clients right. There's people that say I've always wanted to own my own business and there's people that say I'm 58, or you fill in the number 63. I can't do it anymore, my body can't take it. Or I just got laid off and I know I'll never get back in the world of working at the pay level.

Speaker 1:So those people are what I call forced entrepreneurs, are challenging because it's just not something they're super passionate about. It's more, they've got to do something and they see this kind of as a solution. And those people are a little bit harder to place. You know, obviously, because if somebody is saying I've always wanted to own my own business, I've dreamed about this moment since I was, you know, 18. I grew up in my family's business, those people are going to push themselves forward through the discovery process. They'll do the homework, they'll reach out and deal with all the challenges of funding and they're going to get it.

Speaker 2:So I mean, I guess I would say I forgot the question and I think I was just rambling, but so so, yeah, on those particular challenges, I know you were hitting the stock market and you you were able to like, say you had money, but not so much on the time aspect. I mean, what were some of the challenges that you saw or your struggles during that process that you can help people to relate to? Like you know? Hey, you know, I guess, yeah, there's two types of people, but how do we put this pieces together personally in our life?

Speaker 1:Well, my personal struggle is maybe not going to be the same, but for me I was bored and I felt I was dying every day and that has been sort of a theme throughout my life. I'll do something for a period of time and then it's time to move on. And when I know it's time to move on, I know it in my gut time to move on. And when I know it's time to move on, I know it in my gut and because I'm somewhat fearless, I mean I will just leap and try crazy ass things.

Speaker 1:I just signed up for a improv class out of the blue. I'm like, oh, life and something that I can bring to the table and help people that I had with switching careers at a ripe old age was everybody was younger than I am, and so you have to really try and communicate your expertise. You're still being, I guess I would say, relevant, and because I think when people sometimes saw me and see me today, they may think that I'm somehow not on the cutting edge. I don't know what's happening. I'm, you know, I'm not relevant, and so you know, and and everybody is going to experience that if they're going to try and reinvent themselves and they're, you know, in their fifties and sixties, and that's just something you're going to deal with and you're going to have to push yourself to stay relevant.

Speaker 1:I had to learn a lot. I had to stay up late reading books, I had to push myself way out of my comfort zone in terms of talking to people about an area that certainly, in the beginning, I wasn't an expert, but I had to act like I was. And you know, the only thing I kept saying to myself is well, I know more than they do. You know because I've read and I've learned and I've studied, and but I was certainly by no means an expert. So you got to fake it until you make it.

Speaker 2:That's a real thing, isn't it? People think, hey, man, you know, say mean things to yourself, Well, you're not faking it Good, You're talking yourself out of it. So the entrepreneurial mindset. There's a lot of my audience that's made up of truckers. Many of them are, you know, business minded already but hesitant to take the leap. What do you think stops most people from going into business for themselves?

Speaker 1:Well, I think two things. One is they don't have the financial wherewithal, and that's a legit thing and you can't really do anything about that. I mean, you can look for opportunities. For example, you could try and find a business that you know the owner is close to retiring and try and get in there and convince him hey, let me work for you for free. I'd like to take over this business and I'd like to, you know, earn your trust and see if there's an opportunity in that way. So the money piece is there and it's legit, and in my world, honestly, I don't think people should even consider this unless they have 60 to 80,000 liquid capital sitting around. You know the banks will loan you the money. That's not the issue and it's. The issue is just, I know what it's going to take and I know what kind of a runway you'll need until you start earning. And I mean I feel like I can't find anything for you unless you have a minimum of that piece, and more is better.

Speaker 1:But the second thing that stops people from doing it is fear, and you know fear is healthy. Fear keeps us from being eaten by lions. We need fear, but at some point you have to calculate the risks. At some point you have to calculate the risks, understand the risks and push yourself through it with some sort of confidence that you'll be able to get to the other side. There's nothing I can say that's going to help you with that. There's nothing Tony Robbins can say. I mean, you yourself have to find it in yourself to overcome the fear that you will fail, and failure cannot be an option. You just have to reach that point where you say to yourself, as I did, I will do whatever it takes. I am not going to lose my money here. I am going to do what it takes to succeed. And, of course, backed up of that is a lot of research. And that's where I come in and blah, blah, blah. But you have to do a lot of homework to understand what that first year might look like, what that second year might look like. Line up your ducks, how you're going to do it, blah, blah, blah. Convince the wife, convince the whatever. And fear is really what stops people. And it's healthy.

Speaker 1:And again, not everybody's made to be an entrepreneur. Look, we'll talk about this. You got to do everything. You know, if you work for somebody, it's fantastic. They just you just get a paycheck once a week. You don't have to deal with anything but your job.

Speaker 1:You know, when you own a business, you're going to be doing the marketing, you're going to be doing the staffing, you're going to be doing the HR, you're going to be doing the payroll. You're going to be. You know it's a myth that a franchise does it all for you. They don't. There's a lot of structure. They're going to coach you heavily, assign you a business coach. They may have a resource for HR, they may have a resource for payroll, but bottom line is you're going to be wearing all these multiple hats every single day until the business gets to the point where you can hire out various pieces of these roles.

Speaker 1:So it's a lot, and fear is healthy, and it keeps you from doing stupid things. And there is a point, though, at which you just have to make an educated guess that this is a good option for you, and everybody has to be on board, and you have to have the financial runway, and the timing has to be right. You know there's certainly the time isn't right when you have little kids at home and you can't pay your bills. Right, the time is later. The kids have been educated. If that's your deal and you've got a little bit of money saved aside, and if you lose a little bit of money, worst case scenario, it's not going to bankrupt you, it's not going to be the end of the world for you.

Speaker 2:Yeah, nicely said. You talk about the mindset you need to have. You talk about the grit. Can you share a story with someone? You had a big shift in how they were thinking and they were able to find a way to succeed. Have you helped someone in an area like that?

Speaker 1:I mean literally everyone I place because I keep in touch with them. They are overwhelmed. The first year I just placed a lady in an outdoor lighting business she's not an electrician. She hired two key employees within three months of each other. They both quit and now she's got jobs to fill and no electrician. And she laughs about it. And she's at the home show right now in Denver trying to get more business. She's just figuring it out. She assumes that if the business comes she'll deal with the you know the install problem later and go hire a handyman if she has to until the next electrician comes along. And she's learning from her mistakes. And you know she tried one payroll provider. It wasn't great. She switched to another one. I she just texted me and said I want a new bookkeeper and I sent her a bookkeeper resource. All of that. A hundred little minor annoyances are going to happen every single day and the biggest one is going to be around staffing.

Speaker 2:Yeah, and finding talent to do that and to keep it pushing forward, you know, versus something else. Man, that's awesome. Helping each one of those that you've placed I mean that's huge. Starting their business and making those changes in their life I think that's great. I applaud the work you're doing this, thank you. Have you had any moments where you've doubted yourself during this process that you want to share? Maybe something like hey, man, you know, maybe that wasn't the right call.

Speaker 1:Well, I mean, this is a bad example, because I thought about this question and my situation really is kind of unique. I was financially secure when I started this. I started it out of wanting to find purpose again and wanting to find a reason to get up in the morning again, and there are times when maybe the lead acquisition gets old. I mean, that's the only piece I don't like is trying to find candidates who want to work with me, and you have to put yourself out on social media. You have to like toot your horn endlessly, which is not my style. You have to.

Speaker 1:In my business we actually buy leads and it's a weird process, but anyway, you have to kind of cold call and chase people down that have expressed interest, which I don't love. And there have been times when I ramp it down because it's just like, nah, something's going on in my life. My mother died, my father died in short order, my sister unexpectedly died. That all happened between 19 and 21. And so I didn't really work much during that period. I just my heart wasn't in it and I had just had a lot to do. But so I don't have a good example for you of really pushing through.

Speaker 1:Pushing through because, first of all, I love helping others and I'm super stubborn. If I don't get something, I will just figure it out. I will just. You know my husband's like. You have one focus and you will not get off the focus and, it's true, I just will chip away at it. But also there are times that I don't work very much just because I don't feel like chasing people down. And somebody comes to me, great, I work with them, but I'm not going out there aggressively chasing leads. Right now. I ramped up. This 25 is going to be a huge year for me. I'm running a million different marketing campaigns and going to be very busy and am very busy, so I'm into it right now. Yeah.

Speaker 2:I can see it. Eye of the tiger, huh.

Speaker 1:Yeah.

Speaker 2:Hey man, thank you for coming on the show and and also sharing your vision. Uh, understanding franchising can be, you know, a misunderstanding. You know a lot of misconceptions out there. People fear, you know they. You know, like I said, fear is a real thing. Well, people hear franchise and immediately think you know mcdonald's subway, but uh, there's so much more to it than that, isn't it? Can you break down what franchising really is?

Speaker 1:Yeah, I mean any mom and pop business that has a successful five-year operating history can franchise their business. So you know, if you drive down the street, ray, two thirds of the businesses that are on strip malls on either side of the street. Those are all franchises. So I mean some of the crazy ones that people don't realize. You know you can be a franchise broker. You can buy a franchise to be a franchise broker. I did not, but there's two huge players in the space. You can buy a franchise to be a franchise broker. I did not, but there's two huge players in the space. You can buy a franchise to be a dog trainer and be a dog walker. Have a dog walking business.

Speaker 1:Keeping in mind, the franchise model is taking any business that is not professional and nobody owns more than 2% of the market in their lot of chuck in a truck type businesses. Traditionally the franchise model was taking those industries, making them professional having people show up on time with iPads, making on the spot estimates, having the software to track your drivers to optimize the route. That is the traditional franchise model and they went into those industries, whether it was plumbing, carpet cleaning, house painting, landscaping and just dominating against those Chuck and a truck, mom and pop type businesses, because their presence is so much better, their execution is so much better. So just about everything you can think of you can find it in a franchise. But some of the crazy ones lately are pet cremations and I think that's killer idea because people love their pets and well, if you've ever gone through it, the whole cremation process is gross and your dog's ashes get mixed with everyone else's ashes. It's a disgusting business.

Speaker 1:Crime cleanup is a franchise very, very uber profitable. Margins are enormous because when somebody commits suicide in their apartment, the HOA cannot clean it up. There's biohazards. You have to be professionally trained to do that and these crime cleanup companies it's you know they. Basically it's easy to get the labor. You can pay your people $55 an hour for these jobs, which are two times a month. You hire firefighters oftentimes and train them in biohazard cleanup. So that's a killer business. If you can stand it, you have to be very good at communicating with people on the worst day of their lives, so you have to be extremely sensitive to what's been going on. Often it's a parent. Think about it's not just crime cleanup. Think about somebody's got to go in and clean up the home of what's his name? Who just died? Who's the actor that they just found he'd been in his home? Yeah, gene acme.

Speaker 1:Yeah, and his wife so, um, there's a lot of things like that that happen. There's hoarding those are all biohazards that have to be cleaned up professionally anyway. There's, uh, downsizing in estate sales. There's's the dental you know the guys that you know those dentists have to have that equipment serviced and fixed like immediately. So there's entire franchises for dental repair of the equipment, stuff like that. So all kinds of stuff. There's hydraulic pump replacement parts and servicing. Most restaurants pay one of two franchises to have their restrooms cleaned every week because their employees don't want to go in there and do it and they have to be done professionally, and so it's a route. You have your techs and they go in. Same thing with repairing, I mean cleaning the oil out of the fryers that has to be professionally disposed of and replaced and cleaned, and those are all franchises that do all that work.

Speaker 2:Wow, I mean I keep to keep everything going and we don't even know it.

Speaker 2:That's amazing A lot of detailed, finite things that need to be taken care of on a delicate issues that, like you said, most people on a day to day won't be able to do that because they don't have the skill set or the training that, like you said, most people on a day-to-day won't be able to do that because they don't have the skill set or the training. Wow, nice eye-opener. I like that Very well. If someone's interested in franchising but doesn't have a lot of money up front, let's go back to the money part.

Speaker 1:Okay.

Speaker 2:Are there franchising options available for them? Or, like you said, they should just get a plan and have that there to save up liquid capital?

Speaker 1:You should always do that first. You should not even consider this unless you have that $60,000 to $80,000 sitting around and maybe you own your home, so that worst case you can get a home equity line there. But the traditional route is to get an SBA loan. The government wants to support small business and that's what the SBA does, and if you're starting a franchise as a startup and you want to go to the bank and get money, that's going to be the only option is the Small Business Administration loans. The problem is right now interest rates are 10% on those loans and they do adjust quarterly. So as rates come down over the next four years, that's going to be great. So the traditional way is you get an SBA loan or you beg borrow. I was going to say beg borrow and steal. Hopefully you don't do that. Beg borrow from family and friends. You might borrow against your house $50,000. You might pull some money out of your retirement account.

Speaker 1:By the way, you can take money out of your retirement account income tax free under a particularly quirky segment of the IRS tax code segment of the IRS tax code and it's very structured. There's companies that only do this because you can't screw it up. It has to be done a certain way to be in compliance with ERISA. But probably 50% of my clients, when they hear about that option, do use that option. Meaning they have a 401k from a previous employer.

Speaker 1:Let's say it's got 400,000 in it. They decide they want to take 100,000 of that and fund the business. You can segregate out that 100 and fund the business with that. Pull the money out. There's no tax, there's no penalty and there's no loan. You're not paying anything back. So it allows you to cash flow much quicker because you don't have debt service. You are risking your $100,000 that was previously invested, let's say, in mutual funds. Now you're investing that $100,000 in your own business and banking on the fact that that business will succeed and one day, when you sell that business, the money goes back into the 401k, also tax-free. So that's an attractive option for a lot of people if you happen to have a old IRA or 401k. So it's home equity cash, friends, family, sba probably in that order, and then 401k.

Speaker 2:How hard is it to get an SBA loan?

Speaker 1:I mean, like you said, there's certain, it's not hard in franchising so it has to be an established franchise. It can't be a franchise where there's one or two out locations, so they have to have 10 or 15 locations open and operating. That the bank can see, especially if it's under 150, it's hard paperwork-wise. There's onerous paperwork you have to go through. I have the resources, but you have to go through an SBA lender that specializes in franchises. You'll pay a bunch of packaging fees, probably 2,500 bucks up front. You'll get the SBA loan but you have to provide all kinds of documentation.

Speaker 1:If it's under 150 that you're borrowing, you do not need to put up collateral. If it's over 150, you will be putting up your home as collateral and if you don't own your home it's almost a no-go unless you have other, like a big portfolio of stocks or something, because you have to put up collateral if it's over 150. But getting a little $75,000 loan relatively easy. There's equipment financing. You can go the hard money route, which is terrible, but if you have to you can go the credit cards. You know where they give you the bunch of credit cards and you move that money around that way. So there is a lot of options in the 50 to 150 space.

Speaker 2:Wow, yeah, and like I said just determined to save for yourself, to have that money, that liquid money. And I mean that goes without saying. That old way of saying it'sined to save for yourself, to have that money, that liquid money, and I mean that goes without saying. That old way of saying it's good to save your money still resonates today, Even as hard as it is for people to get their mind around it to do it. But it's actually somewhat easier if you budget your money right. But life happens. You know Life is always getting in the way, so you keep your dream happens. You know life is always getting in the way, so you keep your dream going. You know you keep, keep fighting and, and you never know, Keep optimistic. Like I said, that same grit that you need to save your money is the same grit you're going to need to probably run your business.

Speaker 1:So yeah that's good.

Speaker 2:So taking the leap into business ownership, you know, you got the funds, you got the know-how, you got the connections that we're talking to you and your help guiding them. Many truckers think about becoming owner-operators, but which is kind of like running a franchise. What would you say to those individuals if they wanted to take the first step in getting into something else, or even just going into having a fleet of trucks?

Speaker 1:I mean, I don't know anything about going independent in your business. I feel like every town of size has a SBCD or whatever it's called Small Business Development Council, and they have experts and volunteers through SCORE S-C-O-R-E that will help you. If you're going to want to be an independent owner operator of a trucking company, they'll help you with various aspects of that. You know, a franchise is really an option for somebody who wants to completely reinvent, I mean that's. You know the franchise route is traditionally for people who have never owned a business before, because if you have, you don't need a franchise. Right? You're an entrepreneur, you've done it. You own a business. You can start another business, right?

Speaker 1:People start with franchising as business 101. They don't know anything about owning a business. They wanna step into a plug and play situation with coaching. The format is there, the marketing is done, the CRM is done, the technology piece is done and they want a lot of guidance and they're willing to pay for that structure and guidance because you are going to pay a franchise fee to be part of this organization and you're going to give them a percentage of your sales every single month. They're going to grab their 6% 8% royalty right off of your top line sales. And people choose to do that because they want the structure, they want the support. They've never owned a business and for many people it's their first business. Most people it doesn't mean it'll be their last business. They'll start with a franchise.

Speaker 1:This is how a lot of money is made in franchising. You start with a home services franchise, let's just say, and you can start those for all in less than $150,000. So they start that window washing business, they start that roofing business, they start that whatever it is carpet cleaning business through the franchise route. Now they have their business and they're building it and eight years from now their revenue is $800,000. And an $800,000 revenue generating business is worth $600,000 when you go to sell it. So now they sell it and they take that $600,000 and maybe they do another franchise or maybe they do their own thing now that they've learned what they need to learn going the franchise route.

Speaker 1:So it's really a means to an end. It's not the end for a lot of people. It is for some people. I mean, I know guys personally that started with one, carl's Jr, and now own a portfolio of 500 fast food restaurants all over the country that they operate out of one corporate office with just a huge management team I know you were going to ask me about. Do you know somebody? I know somebody who started a little soccer business for kids, who I think it was the $40,000 soccer business that was his total investment and grew it to own all of Houston. Well, if you own all of Houston and that soccer business, that's a multimillion dollar revenue business.

Speaker 1:So you can build up a lot of net worth in franchising. You can grow it by either just doubling down and growing that business. You can grow it by adding side businesses that are, you know, similar but different, where you're serving the same clientele. So you start with a. There's a lot of umbrella organizations that are built for you to do. That Neighborly is one of them.

Speaker 1:You start with a glass business where you're replacing plate glass and then you add on their appliance repair business, mr Appliance, and then you add on Mr Electric and you just keep adding on these businesses. They don't cost a lot to add on. You can use your same technicians for the most part. They just get cross-trained. You're using the same software system and you can operate those oftentimes out of one solitary location and just scale it by adding more and more technicians and more and more trucks that you lease so you can build. There's a lot of ways to make a million dollars in franchising, but it's not for everybody the end all. A lot of people will get into a franchise, build it, sell it and get out and do something else. It's very common.

Speaker 2:Oh, it's very common. And then also, too, you got your franchisee and you have your franchisor, so they coexist within each other because you may learn how to do it, but then you can help other people do it like yourself. So would you be considered a franchisor Because you're also a business owner as well?

Speaker 1:Yeah, no, because my business is not a franchise. So the franchisee it's a good question. People are always confused around the language. If you buy a McDonald's, you're a franchisee in the McDonald's system. Mcdonald's is the franchisor. If you buy, you know, a Serta Pro painting business, you're a franchisee. You own your territory. Serta Pro corporate is the franchisor. So, yeah, and it's a symbiotic relationship, hopefully.

Speaker 1:Obviously there's things that go badly and you there's lawsuits and everything else which, oh, there's things that go badly and you there's lawsuits and everything else which I want to talk about this.

Speaker 1:So one cool thing about the franchise research is that the sale of franchises is regulated by the Federal Trade Commission and so if you are an interested buyer and you either go direct or you go through me, either way, hopefully through me, because then I'll teach you what you need to know to ask the right questions, because then I'll teach you what you need to know to ask the right questions.

Speaker 1:But anyway, there is a specific process that the franchise development team not me, their franchise salespeople have to take you through, and a part of that is they have to disclose to you in a 200-page document, a franchise disclosure document, and in it, ray, is the names and contact information of all the franchisees in the system, including all the franchisees that have left the system in the last three years.

Speaker 1:They have to disclose any and all lawsuits. They have to disclose any and all bankruptcies of their principles, which I don't get why that's so important, but it is, and so there is a lot of information to be found before you write a single check and sign on the dotted line. The actual contract that you're going to be signing if you move forward with the franchise is in that document so you can read the language and know what you're agreeing to. All the fees have to be disclosed. They can't charge a fee if it's not in the document. So there's a wealth of information, and lawsuits is one of the key things that is disclosed right up front and so you'll know if there's a lot of lawsuits. That's a red flag.

Speaker 2:Do you see that quite often.

Speaker 1:Not really, because my job is to screen those out. So my process is somebody comes to me with hey, I really want to go the franchise route, but I don't know what I want to do, you know specifically. But so I do some assessing. We talk about their strengths, their skill sets. Do they want employees, do they want no employees? Do they want to do things themselves or have a team, whatever, and how much money do they have?

Speaker 1:Then I go into my database of 800 franchises that I work, that I am privy to their documents, I see, you know. And then I start doing territory checks for the market that that person lives in. I work nationwide, in all the states. So I do start doing territory checks for the market that that person lives in. I work nationwide, in all the states. So I do start doing territory checks and I decide through my own pre-screening which eight or 10 or four franchises I want that person to consider, based on everything that we've decided is an important business attribute for them. It may be brick and mortar, it may be home-based, it may be service, it may be product, it may be that they want recurring revenue, it may be that they want something recession resistant, like disaster recovery, all kinds of stuff.

Speaker 1:So once I've determined those attributes that are important to my person, then my job is to pre-screen out the crappy ones, obviously. So the first thing I do is download the disclosure documents which I have access to Most people don't and I run to the lawsuit section and I look and see what they are if they're trivial or if they're a normal range, it is a normal thing to have one or two. It is not a normal thing, if you only have 300 locations, to have 10 lawsuits. That's not good. So yeah, that's my job. That's not good. So yeah, that's my job.

Speaker 2:So the success rate? I mean you want them to be successful. Yeah, that makes your portfolio look great, Makes you look like you know. Hey, I can help other people, you can trust me. What do you, what do you do with that success rate? How do you let them know or help them feel secure about that?

Speaker 1:That's in the document. Yeah, so the document has a section People don't know how to read it, but I do and it talks about all the columns are there how many franchises were sold year by year last three years? How many closed, how many were terminated? That means the franchisor took your license away. That tells you how litigious the franchisor is or not. If there's one or two, okay, the guy wasn't performing, or they'll have an explanation. If there's a lot of them terminating your contract, something has occurred. Private equity has come in and taken over that franchise and got rid of a bunch of dead franchisees that weren't doing any business, or the franchisor is litigious and nasty or something that has to be investigated. There's another column that just has closures. There's another column that has transferred back to the franchisor because it's somewhat common in a franchise system.

Speaker 1:If somebody gets in trouble for a legitimate reason let's say they get sick the franchisor will often step in as a courtesy and run that business for the person. Step in as a courtesy and run that business for the person Because otherwise they're just going to close their doors and lose everything. So the franchisor will sometimes say why don't you let us run it for six months, see if you can get back on your feet. And then that's a situation where eventually either the franchisor does take it back and tries to resell it to somebody. All these crazy things happen because life is life and people get into business and they're not prepared for it and they suck at it. I mean all kinds of things happen.

Speaker 2:That's an eye opener. I mean, people don't see all that until they get into it and like, wow, I mean I think about a lot of these Amazon drivers. They were owned by a contractor that has a relationship with Amazon. I think FedEx has trucks that are contracted for ground and those groups work together under that umbrella. They own those routes and they have to abide by those standards. And you know, maybe somebody is thinking about that. Hey, I see the FedEx ground or you see the Amazon truck and you're like I could do that, but then there's so much more behind it. That's what goes on, Like you said, the franchise, or can be really hard on them. You know you, you mess up, they're going to take your route away. I've heard stories about that. I mean that's um, that's definitely eyeopening to know, also from the professional like yourself, that it does happen. It's not just a rumor. Thanks for sharing that. Yeah, how bad can some of them get? I mean, you got any uh, juicy stories.

Speaker 1:Yeah, I mean luckily not one of my clients, but there's uh, you know, one of the things that happens all the time is you know, if you own any franchise let's say it's a brick and mortar and your contracts you sign a contract for a period of time it's typically 10 years and in order to renew that contract, most people, if they're in a 10 years, they want to keep it, they want to pass it on, they want to keep it going. So the franchisor can require you to spend 50 or a hundred thousand completely updating your space to look the way their new stores look. That happens all the time. Famously, mcdonald's made a bunch of people do it and in that case it was hundreds of thousands of dollars and there was kind of a litigation around that. Let's see. So I know people that sold not sold but you know, helped their clients in a particular fitness franchise and originally it was a new franchise but owned by very experienced franchisors. But they had just started this new thing and it's a spin franchise and the build-out cost was a million three and you have to make a lot of money to earn back your million three build out cost and very quickly it fell apart and nobody who came in on that original model made any money and they either had to sell for pennies on the dollar or shut their doors.

Speaker 1:And then the franchisor learned and they rolled out a new model so they could keep going. That just was a much less expensive. Now it was only 500,000. Do you know what I mean? And those people who got in after that did fine. But it's very risky to be one of the first 10 franchisees. It really is, unless it's somebody so established, like you know, a very famous, let's just say a subway and then they launch some other franchise if it's somebody and that happens all the time, by the way, so Fast Signs has launched a computer business now. So that's different because now you have a very experienced franchisor launching and creating a new business based on their experience with the other franchise. But yeah, I mean, bad things happen all the time. Quiznos, very famous. All those people lost all their money and it's still talked about in business school for its failure.

Speaker 2:Yeah, I mean, we can learn from those failures. It's not something that we're particularly excited or happy about, but it's something you can learn from. You're like, hey, look at that, I don't want to do that, I want to do something different. What's one thing you would tell yourself if you were to go back in time and tell your younger version of yourself hey, you know, before you started, your franchise is waiting. What would that be?

Speaker 1:I guess I would say you're really going to love this business and you're uniquely cut out for it. It's all the things you love to do it's research, problem solving, helping people. You know, and I'm not somebody this is kind of a crazy thing to say, but I thank goodness I didn't choose to buy a franchise because I want to do it my way. I am not somebody who wants to do it the way you tell me to do it. I want to learn and figure it out and do it the way I know that it needs to be done. And so I do not have the personality to invest in a franchise. I have the personality for my business, which is to coach people through the process and teach them what they need to ask. Coach people through the process and teach them what they need to ask.

Speaker 1:So that's always interesting, because I always thought I wanted to buy a franchise. And then I started thinking about it and it's like well, I don't want employees, I don't want to deal with employees, I don't want to deal with HR, I don't want to deal with all those things. I want to be independent with all those things. I want to be independent, solopreneur, help people and be a consultant and that is exactly what I love to do and I can do it from anywhere. And I just got back from Mexico and there was three days that I was in Cabo and I worked for three hours, three of the days, while everyone else did whatever they did, and I can do this from anywhere, so it's right up my alley.

Speaker 2:Nice and you think about the future of business and the ownership. I mean that's a great story, your story is a success story, so thank you for sharing that. There's many ways that you can find success. Like you said, franchising is one of them Also, just like you said, just to have that entrepreneur mindset like yours and be a consultant in something that you're good at. Yeah, or get good at it, or a company.

Speaker 2:Right, yeah, all right, awesome. And so you know, the economy is always changing. Businesses shift. Trends are always popping up out of nowhere. And what trends do you see that when it comes to business ownership?

Speaker 1:that you see that's going on right now. Yeah, I think food is always going to be tricky for that reason, because we all know things that were just so hot when they first came out. You know frozen yogurt. No one eats frozen yogurt anymore, so I think food is particularly challenging. But the whole AI thing is going to change the way a lot of businesses operate. It's going to put certain businesses maybe out of business. Amazon people come to me and say I want a business that Amazon can't take over, that robotics can't take over and that people will always need. Well, that may not be the business of your dreams, but there's a lot of categories that fit that. You know. Restoration If your toilet floods, which the average home does four times a year some crazy statistic, you know or your ice maker, you're going to need those guys to come in with the blowers and rip out the walls and rip out the flooring, and I mean the number two business, they say, is really good.

Speaker 1:There's a lot of businesses like that.

Speaker 2:Yeah.

Speaker 1:And so you just have to you know, to be thinking what's it going to look like in 10 years and how long am I going to be in it? Maybe if it's over 20 years, you don't care, because, again, a lot of people start a franchise for not a lot of money, build it up and sell it in five to seven years.

Speaker 2:Nice. So if someone's listening right now it's on the fence about business ownership. What would you say to them to encourage them? I know you know they have to have that fortitude and the mindset, but what words of wisdom would you give them?

Speaker 1:I mean, I guess I would say ask your wife, ask your friends, what they think are the skills that you bring to the table as a business owner, what they think are the skills that you bring to the table as a business owner, because you might think that you have it and they might know otherwise, or maybe the other way. You might not feel confident that you could do that and they'll point out things. But look, remember when you had to figure out how to do this, you got online and you figured that out. So you're very resourceful. You're good with people. Make a list of the things that you're good at, and if you are good with people, you're going to need that. You're going to need that with your customers and you're going to need that with your employees, should you have employees. Are you a good problem solver? Are you somebody who gives up as soon as things get a little tough or get flustered? I actually have somewhere I should have had that so I could read off the things a self-efficacy. In fact, I just did a video on it for social media. It did quite well, where I talked about certain attributes that make you sort of good for business, and it was, you know problem solving, it's seeing numerous solutions for the same problem. So do some, do some self assessing and ask your friends and your spouse what they see as your top five traits and let's look at it. Reach out to me.

Speaker 1:I have an assessment that tells me if you're a good business owner or not, and it's a quick assessment and I'll offer it for all your listeners if they want to take it. It's called Zoracle. It's used in the franchise world not necessarily Zoracle, but things like it and it's on my website, anyway, so they can go to your franchise's wedding and complete that free assessment anytime. It's called Zoracle. It's interesting, it'll tell you. I mean, it's not the end, all be all, but I definitely get back reports from people where it says they're not really cut out for entrepreneurship and then I have to tell the person. You know here's why and you know maybe there's extenuating circumstances or maybe we find a business you know where they, where we can accommodate their strengths and their not so strengths. So it's, it's just a work around at times. At other times it's a no-go. You just really should try and find a job right, I mean, that's nothing wrong.

Speaker 2:With that too, you can find a lot of peace and, um, you can be, um you know, content with what you have, because now you know the truth as to where you lie, or you can just make that a personal goal to continue to better yourself.

Speaker 1:So yourself and find a partner you know. Maybe you have a brother-in-law who also wants to do this and he's got skills. You don't whatever you know or wife.

Speaker 2:Yeah, so awesome. Thank you, jane. You've been man. The amount of wealth of knowledge that you've put on us today is, I think, it's going to be huge for a lot of people that are trying to make decisions and trying to make changes in their life. Like you said, when you feel stuck and you feel bored, or you realize that you're that type of person that wants something different. After so many years of doing this, you want to do something else. Well, here's how you can do it Reach out to Jane. She's an incredible person, great to talk to, yeah, so I really appreciate you taking the time to come on the podcast and I hope that also, too, people reach out to you and find out like this, like that assessment. You know. Reach out about that. So you've given us a lot to consider. Where can people find you? If they want to learn more? Let you speak on that where they should plug into either your website or social media.

Speaker 1:Yeah, they can just look up. Your franchise is waiting. I think on YouTube it might be called find your franchise, but my name is always good, jane Stein. If you just Google it, I there's a million links that come up.

Speaker 2:Perfect, perfect, all right. So I'll get this packaged up ready to go for people to listen to and hope you guys benefit. So I appreciate you folks listening to the show, the episode of Das Delivered. If you have any questions or concerns, please feel free to reach out to us. We'd love to hear from you. Also, if you want to be on the show, we appreciate new guests and new insights as well. So from the trucking community, most people are about one degree away from a truck driver. So anything comes back to trucking, making sure people get, like I said, even those franchise they need. They need trucks delivering all their goods and stuff. So that's great. So until next time, we'll keep your ears peeled for new ideas that could be just right around the corner. Keep hustling, keep dreaming and always keep it delivered. See you next time, thank you thanks, ray.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

Channel 19 Experience Trucker Podcast

Channel 19 Experience

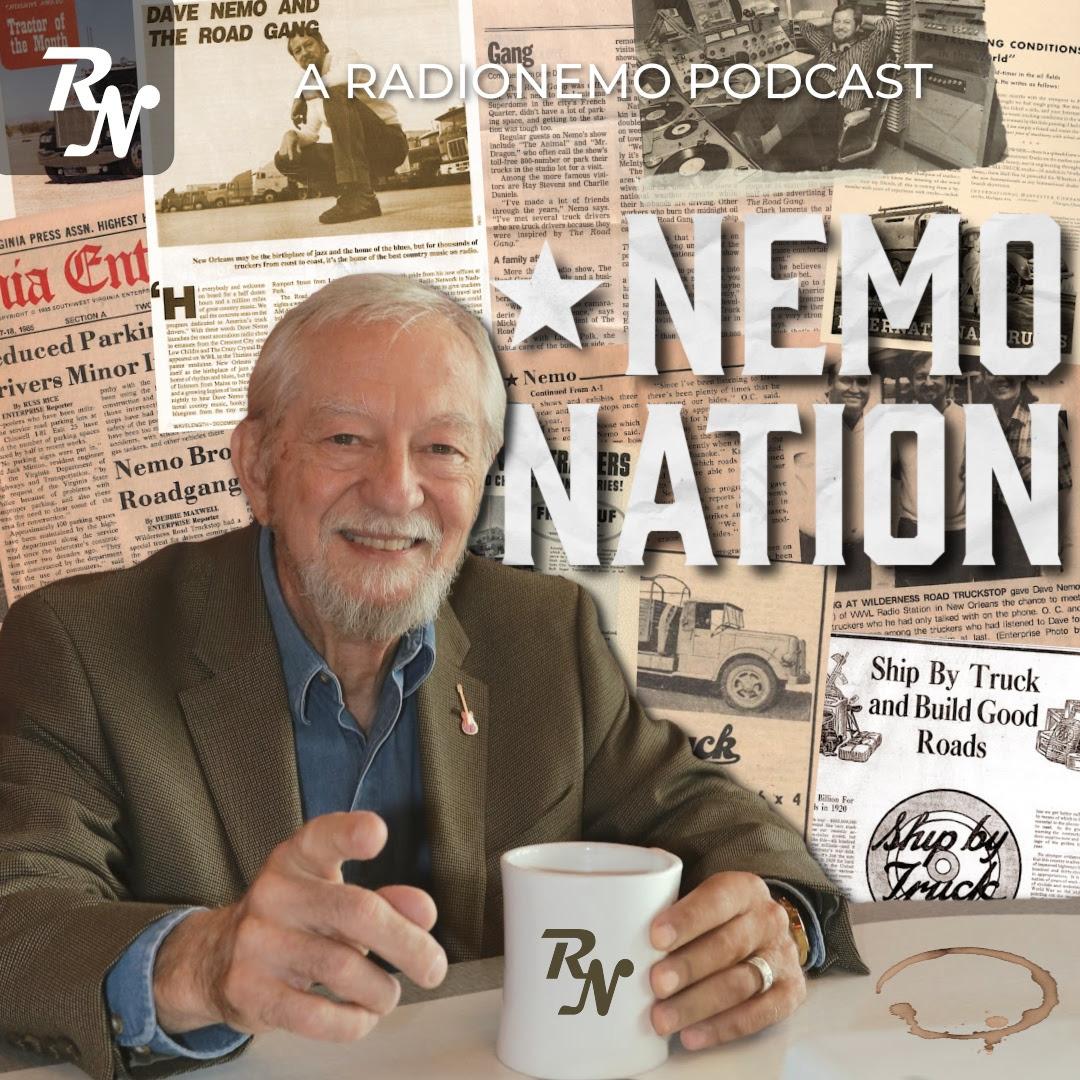

Nemo Nation

Nemo Nation